Navy Federal Credit Union 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union34

NOTE 12: COMMITMENTS

In the normal course of business, Navy Federal enters into conditional commitments to extend credit

and makes financial guarantees to help meet the financing needs of its members. Unfunded loan

commitments are amounts that Navy Federal has agreed to lend a member generally as long as the

member remains in good standing on existing loans. Commitments generally have fixed expiration dates

or other termination clauses. Commitments are typically expected to expire without being drawn upon,

and therefore, do not necessarily represent future cash requirements. Navy Federal uses the same credit

policies in making commitments as it does for all loans to members and, accordingly, at December 31,

2014 and 2013, the credit risk related to these commitments was similar to that on its existing loans.

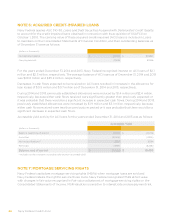

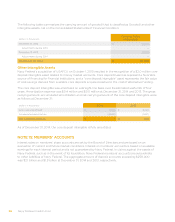

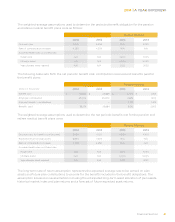

Unused commitment balances as of December 31, 2014 and 2013 were as follows:

(dollars in thousands) 2014 2013

Credit cards $ 11,647,058 $ 11,095,663

Home equity lines of credit 944,194 919,142

Checking lines of credit 892,784 831,196

Pre-approved auto loans 401,135 331,716

Utility deposit guarantee programs 1,583 1,706

Other (1) 10,378 8,915

Total $ 13,897,132 $ 13,188,338

(1)Includes Stand By Letters of Credit and Business Lines of Credit.

Navy Federal had an allowance of $16.9 million and $12.4 million at December 31, 2014 and 2013,

respectively, against unfunded credit card loan commitments and checking lines of credit loan

commitments. The total allowance for credit cards and checking lines of credit is derived at a product

level against the total credit line amounts, and the unfunded commitment liability portion is determined

by applying a ratio to that total allowance. The unfunded commitment liability ratio used is computed

based on historical data that identifies the volume of charge-os that exceeded the related outstanding

purchases over a 12-month period and its relation to the total respective portfolio charge-os. The

allowance for unfunded credit card commitments and checking lines of credit are included in Other

liabilities in the Consolidated Statements of Financial Condition. The osetting adjustments to the

allowance are included in the Provision for loan losses in the Consolidated Statements of Income.

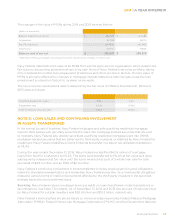

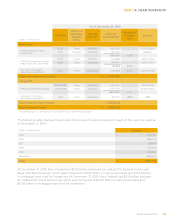

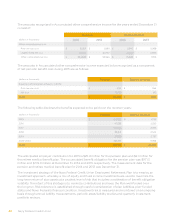

The net change in the allowance for unfunded loan commitments was as follows:

(dollars in thousands) 2014 2013

Balance, beginning of period $ 12,421 $ 9,109

Net change in allowance for unfunded loan commitments 4,482 3,312

Balance, end of period $ 16,903 $ 12,421