Navy Federal Credit Union 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 5

2014 | A YEAR IN REVIEW

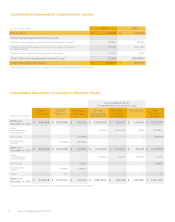

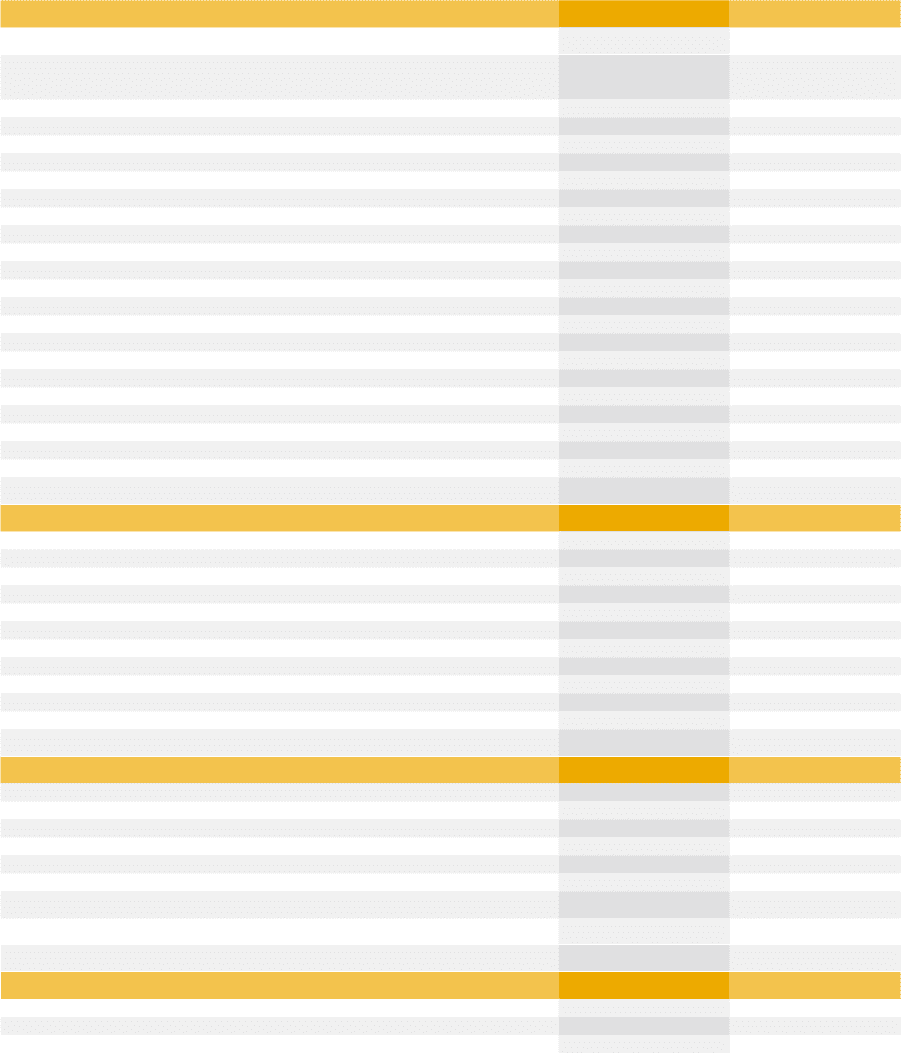

Consolidated Statements of Cash Flows

(dollars in thousands) For the Year Ended December 31,

Cash flows from operating activities 2014 2013

Net income $ 718,830 $ 695,838

Adjustments to reconcile net income to net cash provided

by operating activities:

Provision for loan losses 668,279 468,019

Depreciation and amortization of property, plant and equipment 123,818 104,888

Losses on disposal of property, plant and equipment 234 765

Gains on sale of investments (22,657) (16,855)

Amortization of loan origination fees and costs 6,452 5,016

Losses/(gains) valuation on mortgage servicing rights 34,841 (22,774)

Mortgage loans originated for sale (2,740,896) (5,560,055)

Gains on sale of mortgages (86,386) (38,728)

Mortgage loan sales proceeds 2,774,377 5,940,454

Accretion and amortization of AFS investment securities 47,509 74,308

Accretion and amortization of HTM investment securities 15 335

Increase in mortgage servicing rights (34,063) (63,788)

Increase in accrued interest receivable (16,141) (1,940)

Increase in prepaid expenses (10,508) (6,710)

Increase in accounts receivable (500,314) (64,927)

Decrease in other intangible assets 383 509

Increase in other assets (25,203) (2,019)

(Decrease)/increase in drafts payable (2,227) 27,059

Increase in accrued expenses and accounts payable 106,738 85,278

Increase in accrued interest payable 1,033 702

Increase in other liabilities 7,683 34,706

Net cash provided by operating activities 1,051,797 1,660,081

Cash flows from investing activities

Net decrease in short-term and interest-bearing deposits 60,964 1,470,200

Purchase of AFS investment securities (3,385,490) (4,615,162)

Purchase of HTM investment securities (149,711) —

Proceeds from maturities, paydowns, calls and sales of AFS investment securities 2,529,195 5,298,641

Proceeds from maturities, paydowns, and calls of HTM investment securities 157,646 92,383

Net (purchases)/redemptions of FHLB stock (130,246) 71,166

Proceeds from loans sold originated for investment 43,906 —

Net increase in loans to members (7,215,632) (6,270,359)

Purchases and sales of property, plant and equipment (248,465) (156,697)

Increase in deposit to NCUSIF (34,126) (33,385)

Proceeds from REO sales 30,491 35,982

Net cash used in investing activities (8,341,468) (4,107,231)

Cash flows from financing activities

Net increase in members’ accounts from savings, checking and IRA accounts 3,229,882 2,605,533

Net increase in members’ accounts from issuance and maturity of CDs 886,491 36,732

Net increase in members’ accounts from borrowers’ escrow 13,785 16,346

Net increase in securities sold under repurchase agreements 65,203 1,354,299

Proceeds from borrowings 6,300,000 2,165,002

Repayments of notes payable (3,281,635) (3,595,352)

Net cash provided by financing activities 7,213,726 2,582,560

Net (decrease)/increase in cash (75,945) 135,410

Cash at beginning of year 501,906 366,496

Cash at end of year $ 425,961 $ 501,906

Supplemental cash flow information:

Interest paid $ 625,450 $ 636,274

Transfers from loans to other real estate 28,866 33,146

The accompanying notes are an integral part of these consolidated financial statements.