Navy Federal Credit Union 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

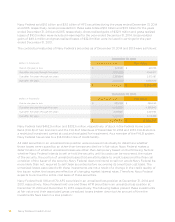

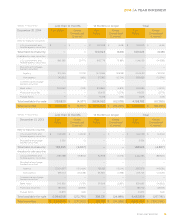

Navy Federal Credit Union20

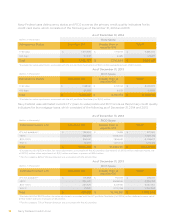

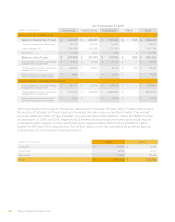

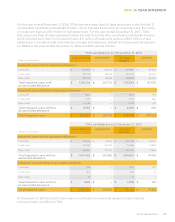

As of December 31, 2013

(dollars in thousands) Consumer Credit Cards Real Estate Other Total

Allowance for credit losses:

Balance, beginning of year $ 237,391 $ 224,187 $ 172,402 $ 247 $ 634,227

Provision charged to operations 193,737 224,241 50,041 — 468,019

Loans charged o (234,978) (209,022) (79,776) — (523,776)

Recoveries 41,208 12,041 7,518 2 60,769

Balance, end of year $ 237,358 $ 251,447 $ 150,185 $ 249 $ 639,239

Ending balance: loans individually

evaluated for impairment $ 62,167 $ 54,240 $ 100,175 $ — $ 216,582

Ending balance: loans collectively

evaluated for impairment $ 166,360 $ 197,207 $ 39,765 $ 249 $ 403,581

Ending balance: loans acquired

with deteriorated credit quality $ 8,831 $ — $ 10,245 $ — $ 19,076

Loan amount (excluding allowance):

Ending balance: loans individually

evaluated for impairment $ 352,477 $ 207,491 $ 499,016 $ — $ 1,058,984

Ending balance: loans collectively

evaluated for impairment $ 11,720,974 $ 7,919,993 $ 18,880,595 $ — $ 38,521,562

Ending balance: loans acquired

with deteriorated credit quality $ 6,587 $ — $ 45,529 $ — $ 52,116

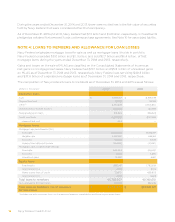

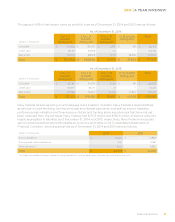

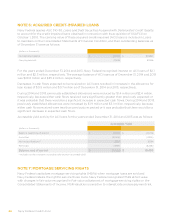

When payments of principal or interest are past due by more than 90 days, Navy Federal discontinues

the accrual of interest on those loans, and reverses the previously recognized interest. The unpaid

principal balances (UPB) of Navy Federal’s non-accrual loans totaled $304.5 million and $288.7 million

at December 31, 2014 and 2013, respectively. If interest on those loans had been accrued at original

contracted rates, interest income would have been approximately $30.3 million and $27.8 million

higher for 2014 and 2013, respectively. The UPB of loans on non-accrual status by portfolio type as

of December 31, 2014 and 2013 were as follows:

(dollars in thousands) 2014 2013

Consumer $ 92,977 $ 73,287

Credit Card 76,919 57,707

Real estate 134,622 157,656

Total $ 304,518 $ 288,650