Navy Federal Credit Union 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 19

2014 | A YEAR IN REVIEW

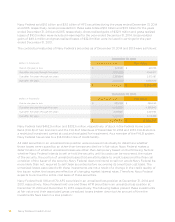

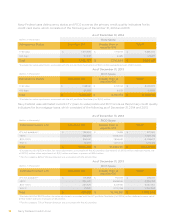

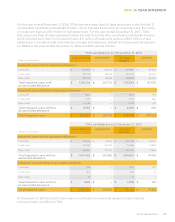

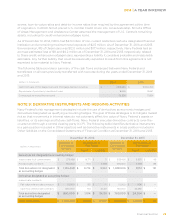

Navy Federal uses delinquency status and FICO score as the primary credit quality indicators for its

equity loans, which consisted of the following as of December 31, 2014 and 2013:

As of December 31, 2014

(dollars in thousands) FICO Score

Delinquency Status Less than 610 Greater than or

equal to 610

Total(1)

Performing $ 232,832 $ 2,144,443 $ 2,377,275

60+ days & foreclosure 30,039 12,326 42,365

Total $ 262,871 $ 2,156,769 $ 2,419,640

(1)Excludes fair value adjustments associated with the ACI portfolio (See Note 6) of $(12.7) million, deferred costs of $12.4 million, other

adjustments of $(0.6) million and loans in process of $0.7 million.

As of December 31, 2013

(dollars in thousands) FICO Score

Delinquency Status Less than 610 Greater than or

equal to 610

Total(1)

Performing $ 280,741 $ 2,114,887 $ 2,395,628

60+ days & foreclosure 40,606 15,156 55,762

Total $ 321,347 $ 2,130,043 $ 2,451,390

(1)Excludes fair value adjustments associated with the ACI portfolio (See Note 6) of $(14.5) million, deferred costs of $8.6 million and loans in

process of $1.4 million.

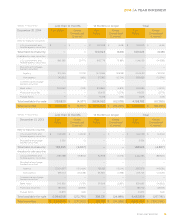

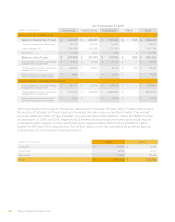

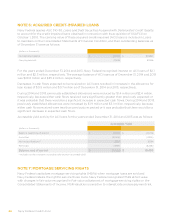

Changes in the allowance for loan losses during the years ended December 31, 2014 and 2013 were

as follows:

As of December 31, 2014

(dollars in thousands) Consumer Credit Cards Real Estate Other Total

Allowance for credit losses:

Balance, beginning of year $ 237,358 $ 251,447 $ 150,185 $ 249 $ 639,239

Provision charged to operations 315,269 336,197 12,580 (249) 663,797

Loans charged o (298,997) (270,096) (48,816) — (617,909)

Recoveries 44,002 17,795 5,911 — 67,708

Balance, end of year $ 297,632 $ 335,343 $ 119,860 $ — $ 752,835

Ending balance: loans individually

evaluated for impairment $ 56,454 $ 68,674 $ 82,582 $ — $ 207,710

Ending balance: loans collectively

evaluated for impairment $ 231,572 $ 266,669 $ 26,479 $ — $ 524,720

Ending balance: loans acquired

with deteriorated credit quality $ 9,606 $ — $ 10,799 $ — $ 20,405

Loan amount (excluding allowance):

Ending balance: loans individually

evaluated for impairment $ 404,495 $ 259,620 $ 570,262 $ — $ 1,234,377

Ending balance: loans collectively

evaluated for impairment $ 13,705,515 $ 9,248,205 $ 21,980,661 $ — $ 44,934,381

Ending balance: loans acquired

with deteriorated credit quality $ 4,398 $ — $ 41,231 $ — $ 45,629