Navy Federal Credit Union 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Navy Federal Credit Union12

additional disclosures surrounding the mortgage loans that are in the process of foreclosure. This ASU is

not expected to significantly impact Navy Federal’s consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606),

eective for annual reporting periods beginning after December 15, 2017. This ASU requires an entity

to recognize revenue to depict the transfer of promised goods or services to customers in an amount

that reflects the consideration to which the company expects to be entitled in exchange for those

goods or services. The guidance should be applied either retrospectively to each prior reporting period

presented or retrospectively with the cumulative eect of initially applying this guidance recognized at

the date of initial application. Navy Federal is currently assessing the impact on its future consolidated

financial statements.

In June 2014, the FASB issued ASU 2014-11, Transfers and Servicing (Topic 860): Repurchase-to-

Maturity Transactions, Repurchase Financings, and Disclosure, eective for annual reporting periods

beginning after December 15, 2014. This ASU requires repurchase-to-maturity transactions to be

accounted for as secured borrowings and requires separate accounting for a transfer of a financial asset

executed contemporaneously with a repurchase agreement with the same counterparty. This ASU also

requires new and expanded disclosures for certain transactions accounted for as secured borrowings in

transactions that are economically similar to repurchase agreements and about the types of collateral

pledged in repurchase agreements and similar transactions accounted for as secured borrowings.

This ASU is not expected to significantly impact Navy Federal’s consolidated financial statements.

In August 2014, the FASB issued ASU 2014-14, Receivables—Troubled Debt Restructurings by Creditors

(Topic 310-40): Classification of Certain Government-Guaranteed Mortgage Loans upon Foreclosure,

eective for annual reporting periods ending after December 15, 2015. This ASU requires that mortgage

loans which are either fully or partially guaranteed under government programs be derecognized

and a separate other receivable be recognized upon foreclosure if certain conditions are met. If those

conditions are met and such a receivable is recognized, the receivable should be measured based on

the amount of principal and interest related to the loan expected to be recovered from the guarantor.

This ASU is not expected to significantly impact Navy Federal’s consolidated financial statements.

In August 2014, the FASB issued ASU 2014-15, Presentation of Financial Statements—Going Concern

(Topic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern,

eective for annual reporting periods ending after December 15, 2016. This ASU provides guidance

about management’s responsibility to evaluate whether there is substantial doubt about an entity’s

ability to continue as a going concern and to provide related footnote disclosures. This ASU is not

expected to significantly impact Navy Federal’s consolidated financial statements.

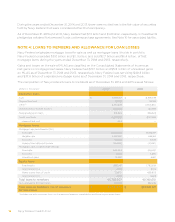

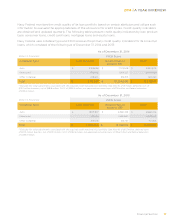

NOTE 2: RESTRICTIONS ON CASH

NFFG had $2.3 million and $2.8 million in restricted cash at December 31, 2014 and 2013, respectively,

as part of its original agreement with Charlie Mac, LLC. See Note 8 for details.

All restricted cash amounts are included in Other assets on the Consolidated Statements of

Financial Condition.