Navy Federal Credit Union 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 25

2014 | A YEAR IN REVIEW

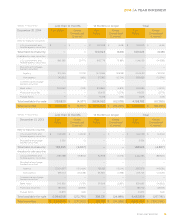

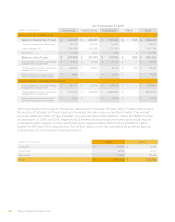

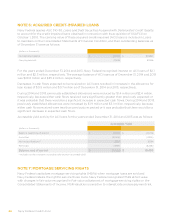

The changes in fair value of MSRs during 2014 and 2013 were as follows:

(dollars in thousands) 2014 2013

Balance, beginning of period $ 236,579 $ 144,089

Originations 34,063 69,716

Payos/maturities (24,464) (40,349)

Gain/(loss)(1) (10,377) 63,123

Balance, end of period $ 235,801 $ 236,579

(1)Represents MSR value changes resulting primarily from market-driven changes in interest rates.

Navy Federal obtains the fair value of its MSRs from a third-party service organization, which determines

fair value by discounting projected net servicing cash flows of Navy Federal’s servicing portfolio, taking

into consideration market loan prepayment predictions and other economic factors. The fair value of

MSRs is primarily aected by changes in mortgage interest rates since rate changes cause the loan

prepayment acceleration factors to increase or decrease.

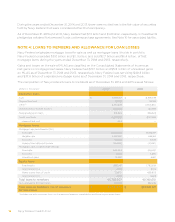

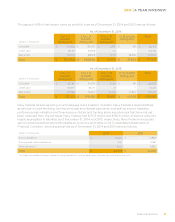

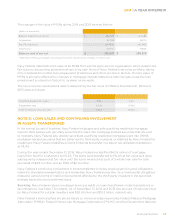

The key economic assumptions used in determining the fair value of MSRs at December 31, 2014 and

2013 were as follows:

2014 2013

Weighted-average life (years) 5.90 6.40

Prepayment rate 12.63% 11.94%

Yield-to-maturity discount rate 9.84% 10.34%

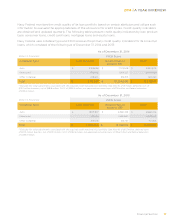

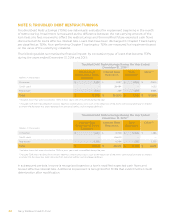

NOTE 8: LOAN SALES AND CONTINUING INVOLVEMENT

IN ASSETS TRANSFERRED

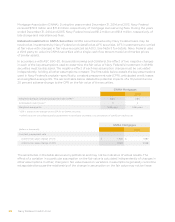

In the normal course of business, Navy Federal originates and sells qualifying residential mortgage

loans to third parties who generally securitize the loans into mortgage-backed securities that are sold

to investors. Navy Federal also directly securitizes qualifying residential mortgage loans into GNMA

mortgage-backed securities that are either sold to third-party investors, or retained by Navy Federal for

investment. Navy Federal classifies all loans it intends to transfer in a sale or securitization transaction

as MLAS.

During the year ended December 31, 2014, Navy Federal reclassified $43.8 million of mortgage

loans from held for investment to MLAS. The loans were transferred to MLAS at fair value and were

subsequently measured at fair value until the loans were sold as part of a whole loan sale for cash

proceeds of $44.0 million and an MSR of $0.4 million.

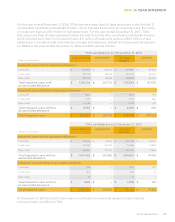

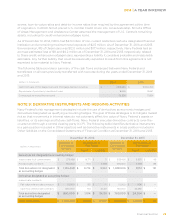

Navy Federal’s continuing involvement in loans transferred includes ongoing servicing and obligations

related to standard representations and warranties. Navy Federal may also incur incremental obligations

related to various forms of credit enhancements aorded to the third-party investors in the securities

partially backed by the transferred loans.

Servicing: Navy Federal retains mortgage servicing rights on loans transferred in sale transactions or

securitizations. See Note 7 for details. As of December 31, 2014 and 2013, the amount of loans serviced

by Navy Federal for outside investors was $20.0 billion and $19.3 billion, respectively.

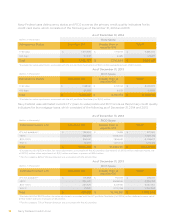

Navy Federal’s servicing fees are priced based on minimum rates required by Federal National Mortgage

Association (FNMA), Federal Home Loan Mortgage Corporation (FHLMC) and the Government National