Navy Federal Credit Union 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Navy Federal Credit Union8

Loan origination fees and certain direct origination costs are deferred and amortized over the life of the

loans using the interest method (eective yield) under ASC 310-20, Receivables—Non-refundable Fees

and Other Costs, for all products except for credit card loans, where fees and costs are deferred and

amortized on a straight-line basis annually.

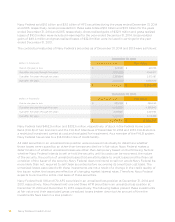

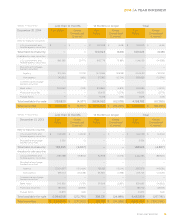

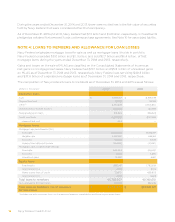

Allowance for Loan Losses

Navy Federal accrues estimated losses in accordance with ASC 450, Contingencies. The allowance for

loan losses is a reserve against Loans to members established through a provision for loan losses charged

to earnings. Loan losses are charged against the allowance when management believes the collectability

of the loan amount is unlikely. Recoveries on previously charged-o loans are credited to the allowance.

The allowance for loan losses is evaluated monthly by management and is based on management’s

periodic review of the collectability of the loans based on prior historical experience, changes in the value

of loans outstanding, overall delinquency and delinquencies by loan product, and current economic

conditions and trends that may adversely aect a borrower’s ability to pay. Loans that are not in

foreclosure or undergoing a modification or repayment plan are typically charged o to the allowance

at 180 days past due.

Navy Federal’s loan portfolio consists mainly of large groups of smaller-balance homogeneous loans that

are collectively evaluated for impairment. The allowance for loan losses is maintained at a level that, in

management’s judgment, is sucient to absorb losses inherent in the portfolio based on evaluations of

the collectability of loans and prior loan loss experience.

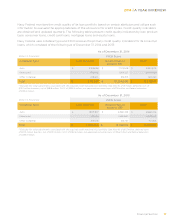

Acquired Credit-Impaired Loans

ASC 310-30, Loans and Debt Securities Acquired with Deteriorated Credit Quality, addresses

accounting for dierences, attributable to credit quality, between contractual cash flows and cash

flows expected to be collected from an investor’s initial investment in loans or debt securities acquired

in a transfer. Acquired loans are considered to be impaired if Navy Federal does not expect to receive

all contractually required cash flows and the loans have exhibited credit deterioration since origination.

Credit deterioration can be evidenced by lower FICO score or past-due status. Acquired credit-

impaired (ACI) loans are recorded at fair value at acquisition, determined by discounting expected

future principal and interest cash flows. The excess of the expected future cash flows on ACI loans

over the recorded investment is referred to as accretable yield, which is recognized as interest income

over the remaining life of the loan using an eective yield methodology. The dierence between

contractually required payments at acquisition date, considering the impact of prepayments and

credit losses expected over the life of the loan, and the cash flows expected to be collected is referred

to as the non-accretable dierence.

Each quarter, Navy Federal re-evaluates the performance and credit quality of its ACI loans by

aggregating individual loans that have common risk characteristics and estimating their expected future

cash flows. Decreases in expected or actual cash flows that are attributable, at least in part, to credit

quality are charged to the provision for loan losses resulting in an increase in the allowance for loan

losses. Conversely, increases in expected or actual cash flows are treated as a recovery of any previously

recorded allowance for loan losses, and to the extent applicable, are reclassified from non-accretable

dierence to accretable yield.

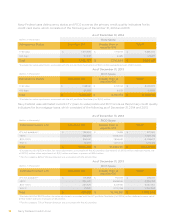

Navy Federal’s ACI loans are accounted for in pools. Loans deemed uncollectible on an individual basis

remain in the pool and are not reported as charge-os. Disposals of loans, whether through sale or

foreclosure, result in the loan’s removal from the pool at its carrying amount. See Note 6 for details.