Navy Federal Credit Union 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 23

2014 | A YEAR IN REVIEW

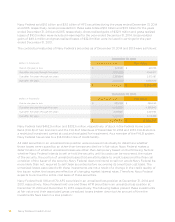

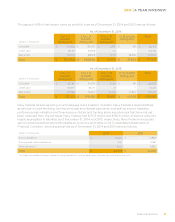

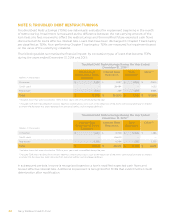

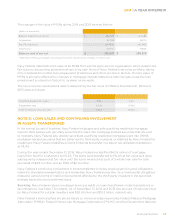

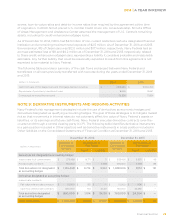

For the year ended December 31, 2014, TDRs that were more than 60 days delinquent within the first 12

months after modification totaled $5.8 million, which included $3.6 million of consumer loans, $1.1 million

of credit card loans and $1.1 million of real estate loans. For the year ended December 31, 2013, TDRs

that were more than 60 days delinquent within the first 12 months after modification totaled $5.4 million,

which included $4.0 million of consumer loans, $1.1 million of credit card loans and $0.3 million of real

estate loans. Cumulative total loan amounts, average loan balances, interest and impairment recognized

on TDRs for the years ended December 31, 2014 and 2013 were as follows:

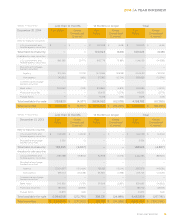

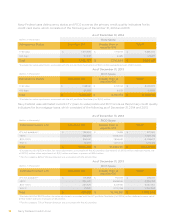

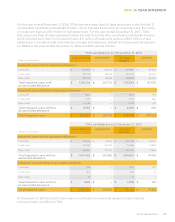

TDR Loan Balances as of December 31, 2014

(dollars in thousands)

Loan Amount Impairment Average

Balance

Interest

Impaired Loans with an associated allowance

Consumer $ 402,651 $ 56,454 $ 376,967 $ 39,035

Credit card 257,795 68,674 232,492 26,403

Real estate 557,778 82,582 528,385 22,097

Total Impaired Loans with

an associated allowance

$ 1,218,224 $ 207,710 $ 1,137,844 $ 87,535

Impaired Loans without an associated allowance

Consumer 1,844 — 1,520 199

Credit card 1,825 — 1,064 260

Real estate 12,484 — 6,255 451

Total Impaired Loans without

an associated allowance

$ 16,153 $ — $ 8,839 $ 910

Total Impaired Loans $ 1,234,377 $ 207,710 $ 1,146,683 $ 88,445

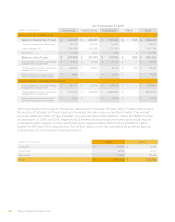

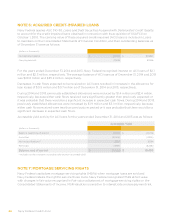

TDR Loan Balances as of December 31, 2013

(dollars in thousands)

Loan Amount Impairment Average

Balance

Interest

Impaired Loans with an associated allowance

Consumer $ 351,282 $ 62,167 $ 302,466 $ 35,140

Credit card 207,189 54,240 174,868 21,353

Real estate 498,991 100,175 482,466 17,646

Total Impaired Loans with an

associated allowance

$ 1,057,462 $ 216,582 $ 959,800 $ 74,139

Impaired Loans without an associated allowance

Consumer 1,195 — 1,029 120

Credit card 302 — 255 31

Real estate 25 — 24 1

Total Impaired Loans without

an associated allowance

$ 1,522 $ — $ 1,308 $ 152

Total Impaired Loans $ 1,058,984 $ 216,582 $ 961,108 $ 74,291

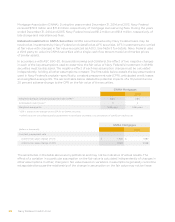

At December 31, 2014 and 2013, there were no unfunded commitments related to loans that had

previously been modified as TDRs.