Motorola 1999 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1999 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

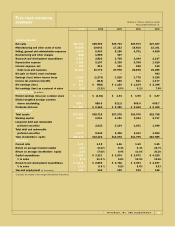

MOTOROLA, INC. AND SUBSIDIARIES 31

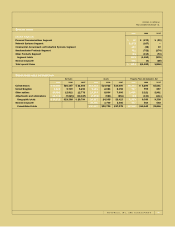

1999 1998 1997 1996 1995

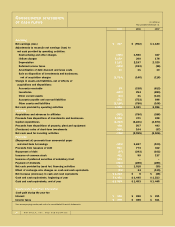

Operating Results

Net sales $30,931« $29,398« $29,794 $27,973 $27,037

Manufacturing and other costs of sales ÷19,169« 18,043« 17,283 16,610 15,361

Selling, general and administrative expenses ÷5,045« 5,443« 5,160 4,701 4,629

Restructuring and other charges ÷(226)« 1,980« 327 – –

Research and development expenditures ÷3,438« 2,893« 2,748 2,394 2,197

Depreciation expense ÷2,182« 2,197« 2,329 2,308 1,919

Interest expense, net ÷155« 216« 131 185 149

Total costs and expenses ÷29,763« 30,772« 27,978 26,198 24,255

Net gain on Nextel asset exchange ÷–« –« – – 443

Earnings (loss) before income taxes ÷1,168« (1,374)« 1,816 1,775 3,225

Income tax provision (benefit) ÷351« (412)« 636 621 1,177

Net earnings (loss) $««÷«817« $««÷(962)« $««1,180 $««1,154 $÷2,048

Net earnings (loss) as a percent of sales ÷2.6%« (3.3)«% 4.0% 4.1% 7.6%

Per Share Data (in dollars)

Diluted earnings (loss) per common share $««««1.31« $«««(1.61)« $««««1.94 $««««1.90 $÷÷3.37

Diluted weighted average common

shares outstanding ÷624.7« 598.6« 612.2 609.0 609.7

Dividends declared $««0.480« $««0.480« $««0.480 $««0.460 $««0.400

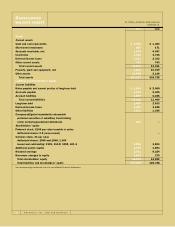

Balance Sheet

Total assets $37,327« $28,728« $27,278 $24,076 $22,738

Working capital ÷4,087« 2,091« 4,181 3,324 2,717

Long-term debt and redeemable

preferred securities ÷3,573« 2,633« 2,144 1,931 1,949

Total debt and redeemable

preferred securities ÷6,077« 5,542« 3,426 3,313 3,554

Total stockholders’ equity $16,344« $12,222« $13,272 $11,795 $10,985

Other Data

Current ratio ÷1.33« 1.18« 1.46 1.42 1.35

Return on average invested capital 5.5%« (6.2)«% 8.4% 8.4% 16.7%

Return on average stockholders’ equity ÷5.9%« (7.6)«% 9.4% 10.0% 20.2%

Capital expenditures $««2,684« $««3,221« $««2,874 $««2,973 $÷4,225

% to sales ÷8.7% 11.0«% 9.6% 10.6% 15.6%

Research and development expenditures $««3,438« $««2,893« $««2,748 $««2,394 $÷2,197

% to sales ÷11.1% ÷9.8«% 9.2% 8.6% 8.1%

Year-end employment (in thousands) ÷121« 133« 150 139 142

1Excludes the impact of the merger with General Instrument.

MOTOROLA, INC. AND SUBSIDIARIES 32

FIVE-YEAR FINANCIAL

SUMMARY(Dollars in millions, except as noted)

Years Ended December 31

1