Motorola 1999 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1999 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31 MOTOROLA, INC. AND SUBSIDIARIES

CONDENSED NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share amounts)

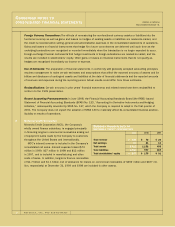

Merger with General Instrument Corporation

On January 5, 2000, the Company and General Instrument Corporation completed their previously announced merger.

The merger positions the Company as a leader in the convergence of voice, video and data technologies. The new

Broadband Communications Sector will focus on solutions that deliver interactive television, the Internet and telephone

services over wired networks. The new sector combines the operations of General Instrument with the cable modem

and cable telephony businesses of the Company’s Internet and Networking Group. Through the merger the Company

also acquired a majority ownership in Next Level Communications, Inc., which completed an initial public offering in

the fourth quarter of 1999. The Company issued 100.6 million shares to effect the merger and will account for the

merger under the pooling-of-interests method of accounting. The following tables present capsule combined operating

results for the three years ending December 31, 1999, 1998 and 1997 and capsule combined balance sheets as of

December 31, 1999 and 1998 as if the merger had occurred on January 1, 1997. The Company will record a charge

in the first quarter of 2000 for costs associated with the merger and expected integration costs. Full-line combined

operating results and balance sheets are included in the appendix to the Company’s proxy statement for the 2000

Annual Meeting of Stockholders.

4.

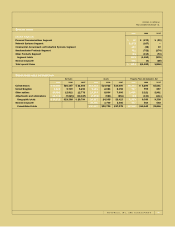

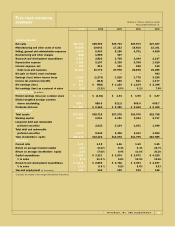

CAPSULE COMBINED BALANCE SHEETS (UNAUDITED)

1999 1998

Assets

Total current assets $17,579 $14,421

Property, plant and equipment, net 9,591 10,286

Other assets 13,313 6,244

Total assets $40,483 $30,951

Liabilities and Stockholders’ Equity

Total current liabilities ÷ ÷ 12,891 11,889

Long-term debt and other liabilities ÷ 8,406 5,149

Total liabilities 21,297 17,038

Company-obligated mandatorily redeemable

preferred securities of subsidiary trust holding

solely company-guaranteed debentures 484 –

Total stockholders’ equity ÷ 18,702 13,913

Total liabilities and stockholders’ equity ÷ $40,483 $30,951

CAPSULE COMBINED OPERATING RESULTS (UNAUDITED)

1999 1998 1997

Net sales $33,075 $31,340 $31,498

Earnings (loss) before income taxes 1,298 (1,280) 1,806

Net earnings (loss) $«««««900 $««««(907) $««1,164

Basic earnings (loss) per common share $««««1.27 $«««(1.31) $««««1.71

Diluted earnings (loss) per common share $««««1.23 $«««(1.31) $««««1.67

Basic weighted average common shares outstanding 706.5 690.3 680.3

Diluted weighted average common shares outstanding 734.0 690.3 697.6

Years Ended December 31

December 31