Motorola 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27 MOTOROLA, INC. AND SUBSIDIARIES

CONDENSED NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS

Foreign Currency Transactions: The effects of remeasuring the non-functional currency assets or liabilities into the

functional currency as well as gains and losses on hedges of existing assets or liabilities are marked-to-market, and

the result is recorded within selling, general and administrative expenses in the consolidated statements of operations.

Gains and losses on financial instruments that hedge firm future commitments are deferred until such time as the

underlying transactions are recognized or recorded immediately when the transaction is no longer expected to occur.

Foreign exchange financial instruments that hedge investments in foreign subsidiaries are marked-to-market, and the

results are included in stockholders’ equity. Other gains or losses on financial instruments that do not qualify as

hedges are recognized immediately as income or expense.

Use of Estimates: The preparation of financial statements in conformity with generally accepted accounting principles

requires management to make certain estimates and assumptions that affect the reported amounts of assets and lia-

bilities and disclosure of contingent assets and liabilities at the date of financial statements and the reported amounts

of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Reclassifications: Certain amounts in prior years’ financial statements and related notes have been reclassified to

conform to the 1999 presentation.

Recent Accounting Pronouncements: In June 1998, the Financial Accounting Standards Board (the FASB) issued

Statement of Financial Accounting Standards (SFAS) No. 133, “Accounting for Derivative Instruments and Hedging

Activities,” subsequently amended by SFAS No. 137, which the Company is required to adopt in the first quarter of

2001. The Company does not expect the adoption of SFAS 133 to materially affect its consolidated financial position,

liquidity or results of operations.

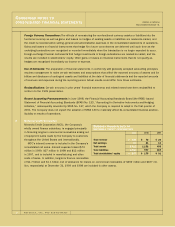

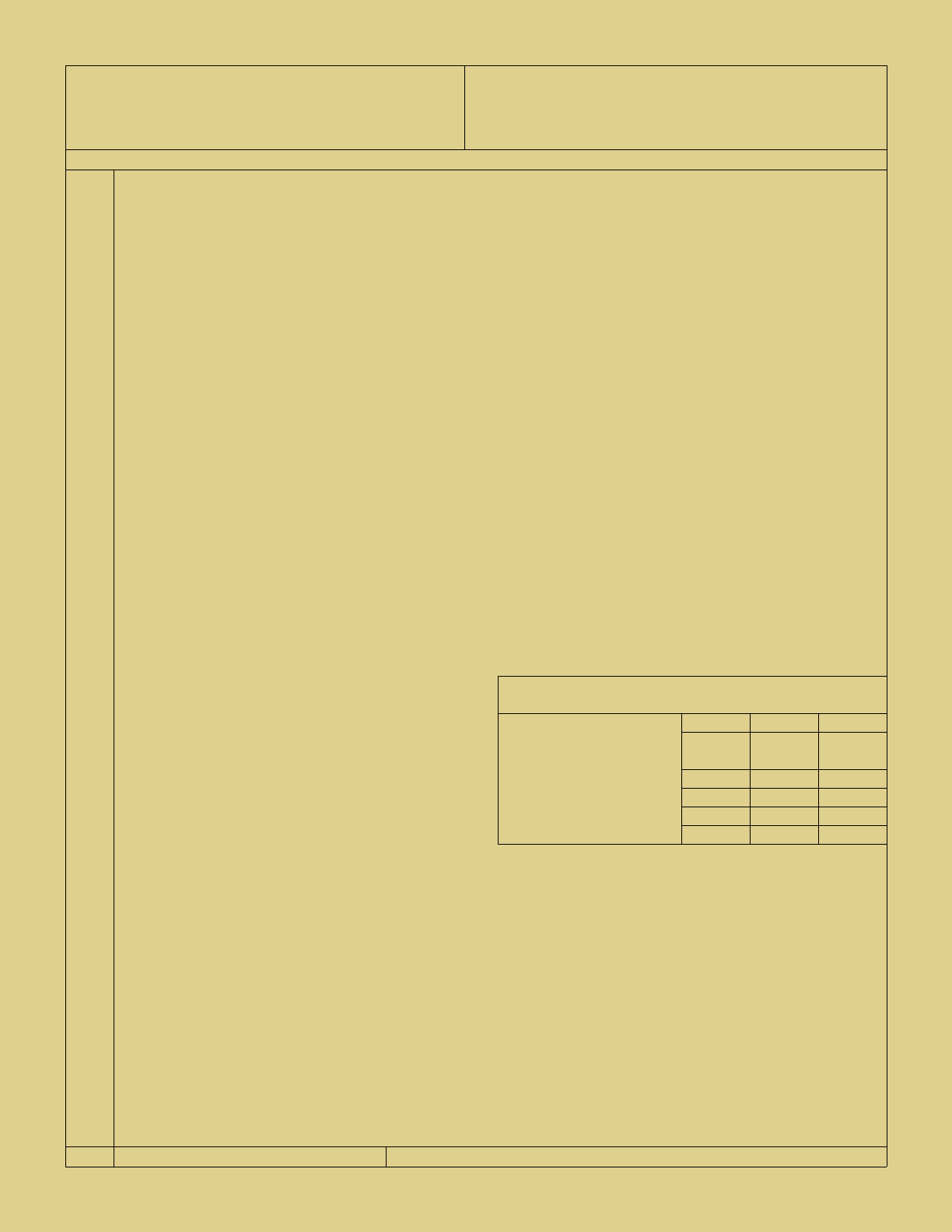

Motorola Credit Corporation

Motorola Credit Corporation (MCC), the Company’s

wholly owned finance subsidiary, is engaged principally

in financing long-term commercial receivables arising out

of equipment sales made by the Company to customers

throughout the United States and internationally.

MCC’s interest revenue is included in the Company’s

consolidated net sales. Interest expense totaled $72

million in 1999, $37 million in 1998 and $13 million

in 1997, and is included in manufacturing and other

costs of sales. In addition, long-term finance receivables

of $1.7 billion and $1.1 billion (net of allowance for losses on commercial receivables of $292 million and $167 mil-

lion, respectively) at December 31, 1999 and 1998 are included in other assets.

2.

SUMMARY FINANCIAL DATA OF

MOTOROLA CREDIT CORPORATION

1999 1998 1997

Total revenue $«÷159 $«÷««72 $««29

Net earnings ÷53 21 11

Total assets ÷2,015 1,152 458

Total liabilities ÷1,768 977 367

Total stockholders’ equity ÷$«««247 $«««175 $««91

(Dollars in millions)

Years Ended December 31