Motorola 1999 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1999 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

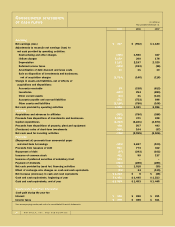

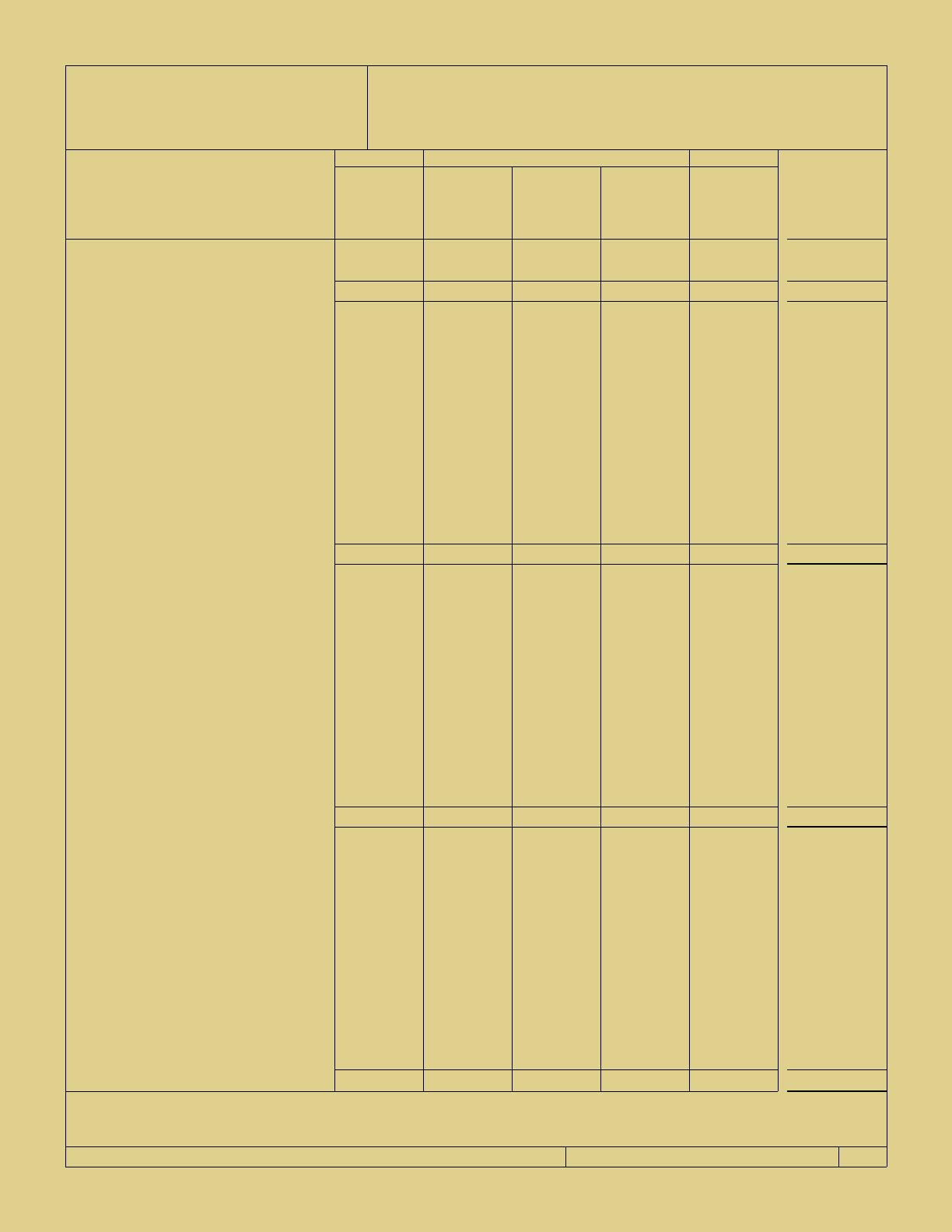

Non-owner Changes to Equity

Common Fair Value

Stock and Adjustment Foreign Minimum

Additional to Certain Currency Pension

Paid-in Cost-based Translation Liability Retained Comprehensive

Capital Investments Adjustments Adjustment Earnings Earnings (Loss)

Balances at January 1, 1997 $3,332 $÷«÷(26) $(121) $÷«– $8,610

Net earnings ÷ ÷ 1,180 1,180

Conversion of zero coupon notes 7 ÷

Fair value adjustment to certain

cost-based investments:

Reversal of prior period adjustment 26 26

Recognition of current period

unrecognized gain ÷ 533 ÷ 533

Change in foreign currency

translation adjustments ÷(119) ÷ (119)

Minimum pension liability adjustment ÷(38) (38)

Stock options and other 174

Dividends declared ($.48 per share) ÷(286)

Balances at December 31, 1997 $3,513 $÷«533 $(240) $(38) $9,504 $1,582

Net loss ÷÷ (962) (962)

Conversion of zero coupon notes ÷3 ÷

Fair value adjustment to certain

cost-based investments:

Reversal of prior period adjustment (533) (533)

Recognition of current period

unrecognized gain ÷ 476 ÷ 476

Change in foreign currency

translation adjustments ÷ 34 ÷ 34

Minimum pension liability adjustment ÷ 38 38

Stock options and other 182

Dividends declared ($.48 per share) ÷ (288)

Balances at December 31, 1998 $3,698 $÷«476 $(206) $÷«– $8,254 $««(947)

Net earnings ÷ ÷ 817 817

Conversion of zero coupon notes 9 ÷

Fair value adjustment to certain

cost-based investments:

Reversal of prior period adjustment (476) (476)

Recognition of current period

unrecognized gain ÷ 3,466 ÷ 3,466

Change in foreign currency

translation adjustments ÷ (33) ÷ (33)

Minimum pension liability adjustment ÷ (73) (73)

Stock options and other 703

Dividends declared ($.48 per share) ÷ (291)

Balances at December 31, 1999 $4,410 $3,466 $(239) $(73) $8,780 $3,701

See accompanying condensed notes to consolidated financial statements.

(In millions, except per share amounts)

CONSOLIDATED STATEMENTS

OF STOCKHOLDERS’ EQUITY

MOTOROLA, INC. AND SUBSIDIARIES 24