Motorola 1999 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1999 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

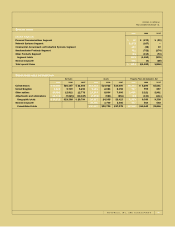

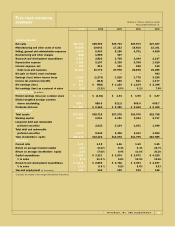

MOTOROLA, INC. AND SUBSIDIARIES 26

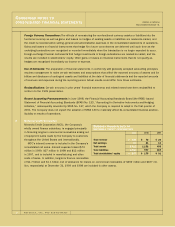

CONDENSED NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies

Consolidation and Investments: The consolidated financial statements include the accounts of Motorola, Inc. and all

majority-owned subsidiaries (the Company) in which it has control. The Company’s investments in non-controlled entities

in which it has the ability to exercise significant influence over operating and financial policies are accounted for by the

equity method. The Company’s investments in other entities are carried at their historical cost. Certain of these cost-

based investments are marked-to-market at the balance sheet date to reflect their fair value with the unrealized gains

and losses, net of tax, included in a separate component of stockholders’ equity.

Cash Equivalents: The Company considers all highly liquid investments purchased with an original maturity of three

months or less to be cash equivalents.

Revenue Recognition: The Company uses the percentage-of-completion method to recognize revenues and costs asso-

ciated with most long-term contracts. For contracts involving certain new technologies, revenues and profits or par ts

thereof are deferred until technological feasibility is established, customer acceptance is obtained and other contract-

specific factors have been completed. For other product sales, revenue is recognized at the time of shipment, and

reserves are established for price protection and cooperative marketing programs with distributors.

Advertising and Sales Promotion Costs: Advertising and sales promotion costs are expensed as incurred and are

included in selling, general and administrative expenses in the consolidated statements of operations.

Inventories: Inventories are valued at the lower of average cost (which approximates computation on a first-in, first-out

basis) or market (net realizable value or replacement cost).

Property, Plant and Equipment: Property, plant and equipment are stated at cost less accumulated depreciation.

Depreciation is recorded principally using the declining-balance method, based on the estimated useful lives of the

assets (buildings and building equipment, 5-40 years; machinery and equipment, 2-12 years).

Intangible Assets: Goodwill and other intangible assets are recorded at cost and amortized on a straight-line basis

over periods ranging from 3 to 10 years.

Long-Lived Assets: Long-lived assets held and used by the Company are reviewed for impairment whenever events or

changes in circumstances indicate that the carrying amount of assets may not be recoverable. The Company evaluates

recoverability of assets to be held and used by comparing the amount of an asset to future net undiscounted cash

flows to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized

is measured by the amount by which the carr ying amount of the assets exceeds the fair value of the assets. Assets

to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell.

Fair Values of Financial Instruments: The fair values of financial instruments are determined based on quoted market

prices and market interest rates as of the end of the reporting period.

Foreign Currency Translation: The Company’s European and Japanese operations and cer tain non-consolidated affiliates

use the respective local currencies as the functional currency. For all other operations, the Company uses the U.S. dollar

as the functional currency. The effects of translating the financial position and results of operations of local functional

currency operations into U.S. dollars are included in a separate component of stockholders’ equity.