Memorex 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

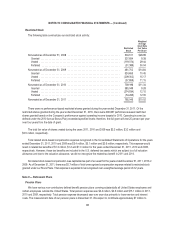

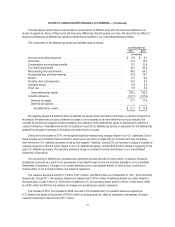

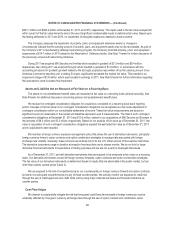

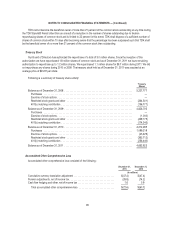

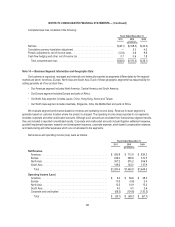

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Amount

(In millions)

Balance at December 31, 2008 .................................................... $10.5

Additions:

Tax positions of prior years ..................................................... 4.4

Reductions:

Tax positions of prior years ..................................................... (0.6)

Settlements with tax authorities .................................................. (0.2)

Lapse of statute of limitations ................................................... (0.3)

Balance at December 31, 2009 .................................................... $13.8

Additions:

Tax positions of current years ................................................... 0.3

Tax positions of prior years ..................................................... 1.3

Reductions:

Settlements with taxing authorities ............................................... (0.2)

Lapse of statute of limitations ................................................... (0.3)

Balance at December 31, 2010 .................................................... $14.9

Additions:

Tax positions of current year .................................................... 0.3

Tax positions of prior years ..................................................... 0.1

Reductions:

Settlements with taxing authorities ............................................... —

Lapse of statute of limitations ................................................... (0.2)

Balance at December 31, 2011 .................................................... $15.1

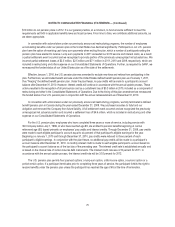

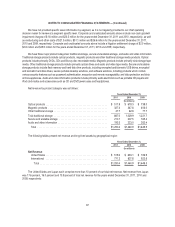

The total amount of unrecognized tax benefits as of December 31, 2011 was $15.1 million, excluding accrued interest

and penalties described below. If the unrecognized tax benefits were recognized in our consolidated financial statements,

$4.6 million would ultimately affect income tax expense and our related effective tax rate. The other $10.5 million of

unrecognized tax benefit would reduce income tax expense, but would be offset by an increase in valuation allowance against

deferred tax assets.

Interest and penalties recorded for uncertain tax positions are included in our income tax provision. During the years

ended December 31, 2011, 2010, and 2009, we recognized approximately $(0.2) million benefit, $0.5 million expense, and

$0.5 million expense, respectively, in interest and penalties. We had approximately $2.5 million, $2.6 million and $2.2 million

accrued, excluding the tax benefit of deductible interest, for the payment of interest and penalties at December 31, 2011,

2010 and 2009, respectively. The reversal of accrued interest and penalties would affect income tax expense and our related

effective tax rate.

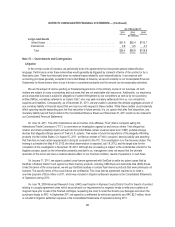

It is reasonably possible that our unrecognized tax benefits could increase or decrease significantly during the next

twelve months due to the resolution of certain U.S. and international tax uncertainties; however it is not possible to estimate

the potential change at this time.

Our federal income tax returns for 2004 through 2010 remain subject to examination by the Internal Revenue Service

(IRS). The IRS completed its field examination of our U.S. federal income tax returns for the years 2006 through 2008 in the

second quarter of 2010. The IRS completed its field examination for the 2009 tax year in the fourth quarter of 2011. We have

protested certain IRS positions in both audit cycles and the matters are currently pending in the IRS appeals process. With

79