Memorex 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

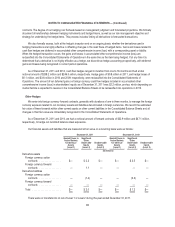

Tax laws require certain items to be included in our tax returns at different times than the items are reflected in our

results of operations. Some of these items are temporary differences that will reverse over time. We record the tax effect of

temporary differences as deferred tax assets and deferred tax liabilities in our Consolidated Balance Sheets.

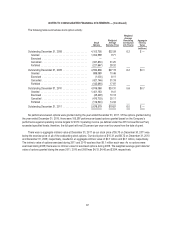

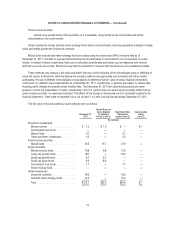

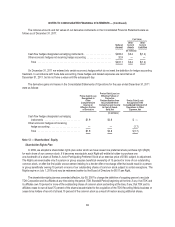

The components of net deferred tax assets and liabilities were as follows:

As of December 31,

2011 2010

(In millions)

Accounts receivable allowances ............................................ $ 5.6 $ 8.1

Inventories ............................................................ 12.3 13.0

Compensation and employee benefits ........................................ 9.7 10.9

Tax credit carryforwards .................................................. 35.0 20.4

Net operating loss carryforwards ............................................ 49.5 54.2

Accrued liabilities and other reserves ........................................ 16.3 19.1

Pension .............................................................. 8.7 6.0

Property, plant and equipment ............................................. 14.0 3.2

Intangible assets ........................................................ 5.6 5.4

Other, net ............................................................. 5.5 5.0

Gross deferred tax assets ............................................... 162.2 145.3

Valuation allowance ..................................................... (141.1) (127.4)

Deferred tax assets ................................................... 21.1 17.9

Deferred tax liabilities .................................................. — —

Net deferred tax assets ............................................... $ 21.1 $ 17.9

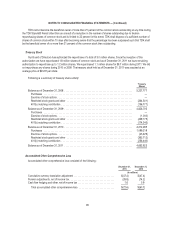

We regularly assess the likelihood that our deferred tax assets will be recovered in the future. A valuation allowance is

recorded to the extent we conclude a deferred tax asset is not considered to be more-likely-than-not to be realized. We

consider all positive and negative evidence related to the realization of the deferred tax assets in assessing the need for a

valuation allowance. If we determine we will not realize all or part of our deferred tax assets, an adjustment to the deferred tax

asset will be charged to earnings in the period such determination is made.

During the fourth quarter of 2010, we recognized significant restructuring charges related to our U.S. operations. Due to

these charges and cumulative losses incurred in recent years, we were no longer able to conclude that it was more-likely-

than-not that our U.S. deferred tax assets would be fully realized. Therefore, during 2010, we recorded a charge to establish a

valuation allowance of $105.6 million related to our U.S. deferred tax assets, of which $53.3 million related to beginning of the

year U.S. deferred tax assets. The valuation allowance charge is included in income tax provision on our Consolidated

Statement of Operations.

Our accounting for deferred tax consequences represents our best estimate of future events. A valuation allowance

established or revised as a result of our assessment is recorded through income tax provision (benefit) in our Consolidated

Statements of Operations. Changes in our current estimates due to unanticipated events, or other factors, could have a

material effect on our financial condition and results of operations.

The valuation allowance was $141.1 million, $127.4 million, and $22.9 million as of December 31, 2011, 2010 and 2009,

respectively. During 2011, the valuation allowance increased due to $13.4 million of additional federal tax credits related to

the repatriation of cash to the U.S., $3.8 million of additional U.S. net operating losses and $1.5 million of other items, offset

by a $5.0 million benefit from the reversal of a foreign net operating loss valuation allowance.

The increase in 2010, as compared to 2009, was due to the establishment of a valuation allowance against our

U.S. deferred tax assets in the amount of $105.6 million as discussed above, offset by expirations and releases of foreign

valuation allowances in the amount of $1.1 million.

77