Memorex 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

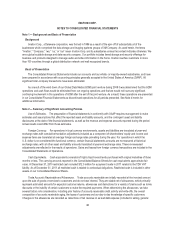

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Note 4 — Acquisitions and Divestiture

2011 Acquisitions

IronKey Systems, Inc.

On October 4, 2011 we acquired the secure data storage hardware assets of IronKey Systems Inc. (IronKey). The

purchase price consisted of a cash payment of $19.0 million. We also entered into a strategic partnership whereby we

received a license from IronKey for its secure storage management software and service as well as an exclusive license to

use the IronKey brand for secure storage products including online cloud-based security service.

The purchase price allocation resulted in goodwill of $9.4 million, consisting of expected strategic synergies and

intangible assets that do not qualify for separate recognition. IronKey is included in our existing Americas operating segment

and is included in the Mobile Security reporting unit for the purposes of goodwill impairment testing. This goodwill is deductible

for tax purposes. See Note 6 here for more information regarding goodwill.

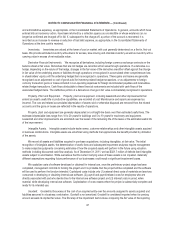

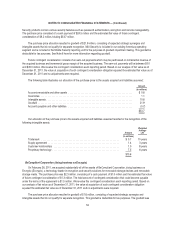

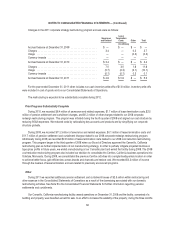

The following table illustrates our allocation of the purchase price to the assets acquired and liabilities assumed:

Amount

(In millions)

Accounts receivable and other assets ............................................... $ 3.5

Inventories ................................................................... 2.1

Intangible assets ............................................................... 7.8

Goodwill ..................................................................... 9.4

Accounts payable and other liabilities ............................................... (3.8)

$19.0

Our allocation of the purchase price to the assets acquired and liabilities assumed resulted in the recognition of the

following intangible assets:

Amount

Weighted

Average

Life

(In millions)

Trade name ......................................................... $0.8 2 years

License ............................................................ 1.9 7years

Customer relationships ................................................. 0.4 7years

Distributor relationships ................................................ 0.9 9years

Proprietary technology ................................................. 3.8 4years

$7.8

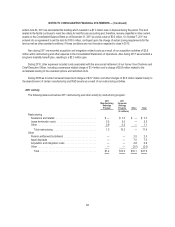

ProStor Systems, Inc.

On August 29, 2011, we acquired certain assets of ProStor Systems, Inc. (ProStor), including the InfiniVault tiered

storage system and other related technologies. The purchase price consisted of a cash payment of $0.5 million and resulted

in no goodwill.

Memory Experts International Inc. (MXI Security)

On June 4, 2011, we acquired the assets of MXI Security, a leader in high-security and privacy technologies, from

Memory Experts International Inc. MXI Security sells encrypted and biometric USB drives (MXI Stealth Key), encrypted and

biometric hard disk drives (MXI Stealth HD), secure portable desktop solutions (Stealth Zone), and software solutions. MXI

53