Memorex 2011 Annual Report Download - page 41

Download and view the complete annual report

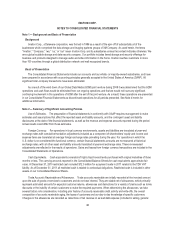

Please find page 41 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Accrued Liabilities. We also have other accrued liabilities, including uninsured claims and pensions. These

accruals are based on a variety of factors including past experience and various actuarial assumptions and, in many cases,

require estimates of events not yet reported to us. If future experience differs from these estimates, operating results in future

periods would be impacted.

We sponsor defined benefit pension plans in both U.S. and foreign entities. Expenses and liabilities for the pension

plans are actuarially calculated. These calculations are based on our assumptions related to the discount rate, expected

return on plan assets and mortality rates. The annual measurement date for these assumptions is December 31. See Note 9

to the Consolidated Financial Statements includes disclosures of these assumptions for both the U.S. and international plans.

The discount rate assumptions are tied to portfolios of long-term high quality bonds and are, therefore, subject to annual

fluctuations. A lower discount rate increases the present value of the pension obligations, which results in higher pension

expense. The discount rate used in calculating the benefit obligation in the United States was 3.75 percent at

December 31, 2011, as compared with 5.0 percent at December 31, 2010. A discount rate reduction of 0.25 percent

increases U.S. pension plan expense (pre-tax) by approximately $0.1 million.

The expected return on assets assumptions on the investment portfolios for the pension plans are based on the long-

term expected returns for the investment mix of assets currently in the respective portfolio. Because the rate of return is a

long-term assumption, it generally does not change each year. We use historic return trends of the asset portfolio combined

with recent market conditions to estimate the future rate of return.

The rate of return used in calculating the U.S. pension plan expense for 2011, 2010 and 2009 was 8.0 percent. A

reduction of 0.25 percent for the expected return on plan assets assumption will increase United States net pension plan

expense (pre-tax) by $0.2 million. Expected returns on asset assumptions for non-U.S. plans are determined in a manner

consistent with the United States plan.

The projected salary increase assumption is based on historic trends and comparisons to the external market. Higher

rates of increase result in higher pension expenses. In the United States, we used the rate of 4.75 percent for 2010 and 2009.

Beginning in 2011, the projected salary increase assumption was not applicable in the United States due to the elimination of

benefit accruals as of January 1, 2011. See Note 9 to the Consolidated Financial Statements for further information regarding

this change in benefits. Mortality assumptions were obtained from the IRS 2012 Static Mortality Table.

Recently Issued Accounting Standards

In September 2011, the Financial Accounting Standards Board (FASB) issued a revised standard intended to reduce the

cost and complexity of the annual goodwill impairment test by providing entities an option to perform a “qualitative”

assessment to determine whether further impairment testing is necessary. An entity has the option to first assess qualitative

factors to determine whether it is necessary to perform the current two-step test. If an entity believes, as a result of its

qualitative assessment, that it is more-likely-than-not that the fair value of a reporting unit is less than its carrying amount, the

quantitative impairment test is required. Otherwise, no further testing is required. The revised standard is effective for annual

and interim goodwill impairment tests performed for fiscal years beginning January 1, 2012. We do not expect the adoption of

this revised standard to have a material impact on our Consolidated Financial Statements.

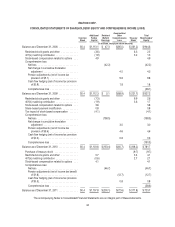

In June 2011, the FASB issued amended guidance to enhance comparability between entities that report under

generally accepted accounting principles in the United States (GAAP) and International Financial Reporting Standards (IFRS)

and to provide a more consistent method of presenting non-owner transactions that affect an entity’s equity. This guidance

eliminates the option to report other comprehensive income and its components in the statement of changes in shareholders’

equity and requires an entity to present the total of comprehensive income, the components of net income and the

components of other comprehensive income either in a single continuous statement or in two separate but consecutive

statements. Regardless of whether one or two statements are presented, an entity is required to show reclassification

adjustments on the face of the financial statements for items that are reclassified from other comprehensive income to net

income. On December 23, 2011, the FASB amended this guidance to indefinitely defer provisions which require entities to

38