Memorex 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

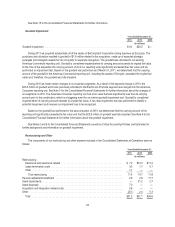

See Note 15 to the Consolidated Financial Statements for further information.

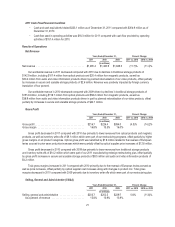

Goodwill Impairment

Years Ended December 31,

2011 2010 2009

(In millions)

Goodwill impairment ......................................................... $1.6 $23.5 $—

During 2011 we acquired substantially all of the assets of BeCompliant Corporation (doing business as Encryptx). The

purchase price allocation resulted in goodwill of $1.6 million related to this acquisition, made up of expected strategic

synergies and intangible assets that do not qualify for separate recognition. The goodwill was allocated to our existing

Americas-Commercial reporting unit. Goodwill is considered impaired when its carrying amount exceeds its implied fair value.

At the time of the acquisition the carrying amount of all of our reporting units significantly exceeded their fair value and we

performed an impairment test. Based on the goodwill test performed as of March 31, 2011, we determined that the carrying

amount of the goodwill in the Americas-Commercial reporting unit, including the assets of Encryptx, exceeded the implied fair

value and, therefore, the goodwill was fully impaired.

During 2010 we made certain changes to our business segments. As a result of the segment change in 2010, the

$23.5 million of goodwill which was previously allocated to the Electronics Products segment was merged into the Americas-

Consumer reporting unit. See Note 14 to the Consolidated Financial Statements for further information about the changes of

our segments in 2010. The Americas-Consumer reporting unit had a fair value that was significantly less than its carrying

amount prior to the combination, which is a triggering event for an interim goodwill impairment test. Goodwill is considered

impaired when its carrying amount exceeds its implied fair value. A two-step impairment test was performed to identify a

potential impairment and measure an impairment loss to be recognized.

Based on the goodwill test performed in the second quarter of 2010, we determined that the carrying amount of the

reporting unit significantly exceeded its fair value and that the $23.5 million of goodwill was fully impaired. See Note 6 to the

Consolidated Financial Statements for further information about the goodwill impairment.

See Notes 2 and 6 to the Consolidated Financial Statements as well as Critical Accounting Policies and Estimates for

further background and information on goodwill impairment.

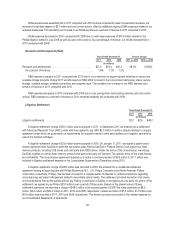

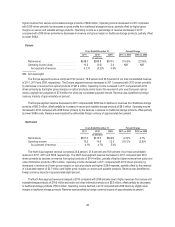

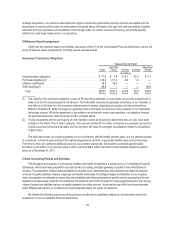

Restructuring and Other

The components of our restructuring and other expense included in the Consolidated Statements of Operations were as

follows:

Years Ended December 31,

2011 2010 2009

(In millions)

Restructuring

Severance and severance related ............................................. $ 7.0 $13.0 $11.2

Lease termination costs .................................................... 3.3 1.7 0.7

Other .................................................................. 1.1 — —

Total restructuring ...................................................... 11.4 14.7 11.9

Pension settlement/curtailment ................................................. 2.5 2.8 11.7

Asset impairments .......................................................... — 31.2 2.7

Asset disposals ............................................................ 7.0 — —

Acquisition and integration related costs .......................................... 2.6 — —

Other .................................................................... (2.0 ) 2.4 0.3

Total .................................................................. $21.5 $51.1 $26.6

23