Memorex 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

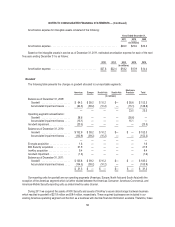

At December 31, 2011, our net deferred tax asset was $21.1 million, which relates to foreign jurisdictions. These

deferred tax assets are net of a valuation allowance of $141.1 million, primarily related to the deferred tax assets in the U.S.

Our income tax returns are subject to review by various U.S. and foreign taxing authorities. As such, we record accruals

for items that we believe may be challenged by these taxing authorities. The threshold for recognizing the benefit of a tax

return position in the financial statements is that the position must be more-likely-than-not to be sustained by the taxing

authorities based solely on the technical merits of the position. If the recognition threshold is met, the tax benefit is measured

and recognized as the largest amount of tax benefit that, in our judgment, is greater than 50 percent likely to be realized.

Interest and penalties recorded for uncertain tax positions are included in our income tax provision.

Treasury Stock. Our repurchases of shares of common stock are recorded as treasury stock and are presented as a

reduction of shareholders’ equity. When treasury shares are reissued, we use a last-in, first-out method and the difference

between repurchase cost and fair value at reissuance is treated as an adjustment to equity.

Stock-Based Compensation. Share-based compensation awards are measured at fair value at the date of grant and

expensed over their vesting or service periods.

The fair value of each option award is estimated on the date of grant using the Black-Scholes option valuation model.

Expected volatilities are based on historical volatility of our stock. The risk-free rate for the contractual life of the option is

based on the U.S. Treasury yield curve in effect at the time of grant. We use historical data to estimate option exercise and

employee termination activity within the valuation model. The expected term of stock options granted is based on historical

data and represents the period of time that stock options granted are expected to be outstanding. The dividend yield, if

applicable, is based on the latest dividend payments made on or announced by the date of the grant. Forfeitures are

estimated based on historical experience and current demographics. See Note 8 herein for further information regarding

stock-based compensation.

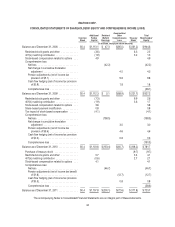

Comprehensive Income. Comprehensive income (loss) includes net income (loss), the effects of currency translation,

unrealized gains and losses on cash flow hedges and pension adjustments. Comprehensive income (loss) for all years

presented is included in the Consolidated Statements of Shareholders’ Equity and Comprehensive Income (Loss).

Weighted Average Basic and Diluted Shares Outstanding. Basic earnings per share is calculated using the weighted

average number of shares outstanding during the year. Diluted earnings per share is computed on the basis of the weighted

average basic shares outstanding plus the dilutive effect of our stock-based compensation plans using the “treasury stock” method.

See Note 3 herein for further information regarding the calculation of weighted average basic and diluted shares outstanding.

Recent Accounting Pronouncements

In September 2011, the Financial Accounting Standards Board (FASB) issued a revised standard intended to reduce the

cost and complexity of the annual goodwill impairment test by providing entities an option to perform a “qualitative”

assessment to determine whether further impairment testing is necessary. An entity has the option to first assess qualitative

factors to determine whether it is necessary to perform the current two-step test. If an entity believes, as a result of its

qualitative assessment, that it is more-likely-than-not that the fair value of a reporting unit is less than its carrying amount, the

quantitative impairment test is required. Otherwise, no further testing is required. The revised standard is effective for annual

and interim goodwill impairment tests performed for fiscal years beginning January 1, 2012. We do not expect the adoption of

this revised standard to have a material impact on our Consolidated Financial Statements.

In June 2011, the FASB issued amended guidance to enhance comparability between entities that report under GAAP

and International Financial Reporting Standards (IFRS) and to provide a more consistent method of presenting non-owner

transactions that affect an entity’s equity. This guidance eliminates the option to report other comprehensive income and its

components in the statement of changes in shareholders’ equity and requires an entity to present the total of comprehensive

income, the components of net income and the components of other comprehensive income either in a single continuous

51