Lululemon 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

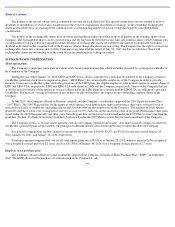

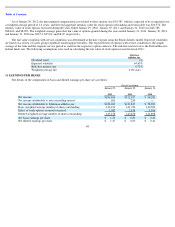

data about exercise patterns of employees in the retail industry as well as considering the probability of a liquidity event such as the sale of the

Company or an IPO and the potential impact of such an event on the exercise pattern. The risk-free interest rate approximates the yield on

benchmark Government of Canada bonds for terms similar to the contract life of the options.

The total fair value of awards under the stockholder sponsored plans that vested during the years ended January 29, 2012, January 30, 2011

and January 31, 2010 was $nil, $261, and $464 , respectively.

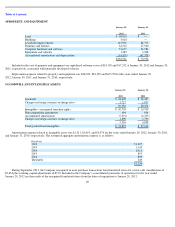

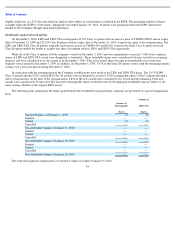

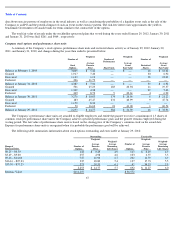

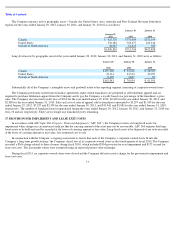

Company stock options and performance share units

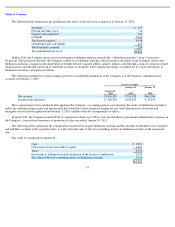

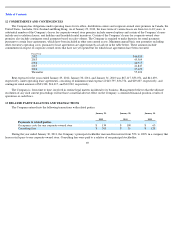

A summary of the Company’s stock options, performance share units and restricted shares activity as of January 29, 2012, January 30,

2011, and January 31, 2010, and changes during the years then ended is presented below:

The Company’s performance share units are awarded to eligible employees and entitle the grantee to receive a maximum of 1.5 shares of

common stock per performance share unit if the Company achieves specified performance goals and the grantee remains employed during the

vesting period. The fair value of performance share units is based on the closing price of the Company’s common stock on the award date.

Expense for performance share units is recognized when it is probable the performance goal will be achieved.

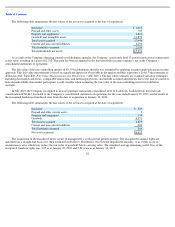

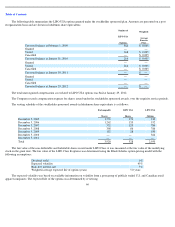

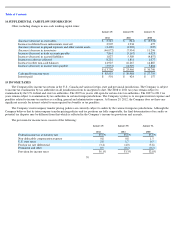

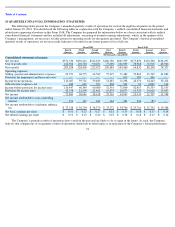

The following table summarizes information about stock options outstanding and exercisable at January 29, 2012:

67

Number of

Stock

Options

Weighted

-

Average

Exercise

Price

Number of

Performance

Share Units

Weighted

-

Average

Grant

Fair Value

Number of

Restricted

Shares

Weighted

-

Average

Grant

Fair Value

Balance at February 1, 2009

3,809

$

5.42

—

$

—

18

$

12.02

Granted

1,917

7.40

—

—

30

6.92

Exercised

1,113

1.12

—

—

18

12.02

Forfeited

226

11.79

—

—

—

—

Balance at January 31, 2010

4,387

$

7.04

—

$

—

30

$

6.92

Granted

501

25.23

183

20.94

11

19.37

Exercised

1,369

4.38

—

—

29

7.66

Forfeited

249

8.72

9

20.61

4

6.92

Balance at January 30, 2011

3,270

$

10.83

174

$

20.96

8

$

21.22

Granted

183

45.47

231

40.99

9

47.74

Exercised

1,150

8.36

—

—

—

—

Forfeited

50

16.62

21

41.00

1

60.54

Balance at January 29, 2012

2,253

$

14.77

384

$

31.90

16

$

33.96

Outstanding

Exercisable

Range of

Exercise Prices

Number of

Options

Weighted

-

Average

Exercise

Price

Weighted

-

Average

Remaining

Life (Years)

Number of

Options

Weighted

-

Average

Exercise

Price

Weighted

-

Average

Remaining

Life (Years)

$0.25 – $0.30

143

$

0.29

4.9

143

$

0.29

4.9

$3.49

–

$

9.00

655

4.98

4.6

103

6.55

5.5

$9.46

–

$

14.60

747

11.96

6.7

262

11.59

6.9

$16.16

–

$

25.23

335

18.80

5.4

137

17.73

5.5

$33.50

–

$

57.25

373

39.51

6.1

47

34.33

5.9

2,253

$

14.77

5.7

692

$

11.27

6.0

Intrinsic Value

$

111,207

$

36,572