Lululemon 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

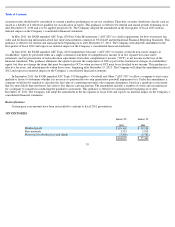

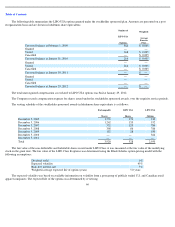

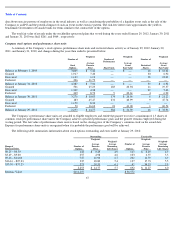

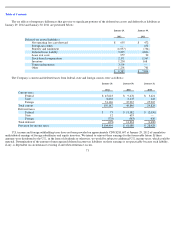

The following table summarizes the preliminary fair values of the net assets acquired as of January 29, 2012:

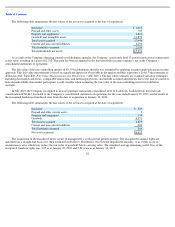

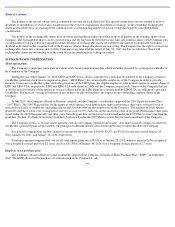

In May 2010, the Company increased its investment in lululemon athletica australia Pty (“lululemon australia”) from 13 percent to

80 percent. The transaction provides the Company control over lululemon australia, which became a subsidiary of the Company on this date.

lululemon australia is engaged in the distribution of healthy lifestyle inspired athletic apparel, which is sold through a chain of corporate-owned

retail locations and through a network of wholesale accounts, in Australia. The Company previously accounted for its 13 percent interest in

lululemon australia as an equity investment.

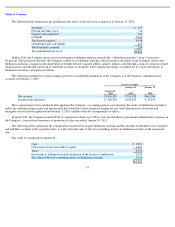

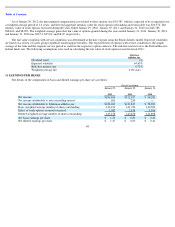

The following unaudited pro forma summary presents consolidated information of the Company as if the business combination had

occurred on February 1, 2009:

These amounts have been calculated after applying the Company’s accounting policies and adjusting the results of lululemon australia to

reflect the additional depreciation and amortization that would have been charged assuming the fair value adjustments to inventory and

intangible assets had been applied from February 1, 2010, together with the consequential tax effects.

In fiscal 2010, the Company incurred $181 of acquisition-related costs. These costs are included in general and administrative expenses in

the Company’s consolidated statements of operations for the year ended January 30, 2011.

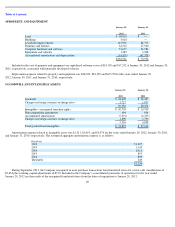

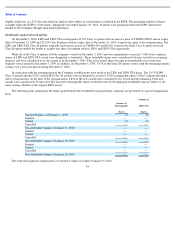

The following tables summarize the consideration transferred to acquire lululemon australia and the amounts of identified assets acquired

and liabilities assumed at the acquisition date, as well as the fair value of the non-controlling interest in lululemon australia at the acquisition

date:

Fair value of consideration transferred :

61

Inventory

$

617

Prepaid and other assets

24

Property and equipment

239

Goodwill

5,168

Total assets acquired

6,048

Unredeemed gift card liability

224

Total liabilities assumed

224

Total identifiable net assets

$

5,824

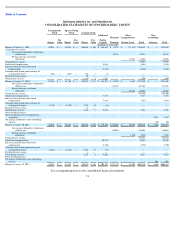

Fiscal Year Ended

January 29,

2012

January 30,

2011

January 31,

2010

Net revenue

$

1,000,839

$

716,328

$

463,506

Income from operations

$

286,958

$

180,832

$

85,854

Cash

$

5,872

Conversion of note receivable to equity

3,481

Total

9,353

Investment in lululemon australia held prior to the business combination

2,345

Fair value of the non

-

controlling interest in lululemon australia

3,554

$

15,252