Lululemon 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Opening new stores is an important part of our growth strategy. Accordingly, comparable store sales has limited utility for assessing the

success of our growth strategy insofar as comparable store sales do not reflect the performance of stores open less than 12 months.

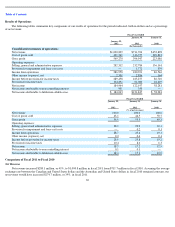

Cost of goods sold includes:

Cost of goods sold also may change as we open or close stores because of the resulting change in related occupancy costs. The primary

drivers of the costs of individual goods are the costs of raw materials and labor in the countries where we source our merchandise.

Selling, general and administrative expenses consist of all operating costs not otherwise included in cost of goods sold and provision for

impairment and lease exit costs. Our selling, general and administrative expenses include marketing costs, accounting costs, information

technology costs, human resource costs, professional fees, corporate facility costs, corporate and store-level payroll and benefits expenses, stock-

based compensation and occupancy, depreciation and amortization expense for all assets other than depreciation and amortization expenses

related to store-level capital expenditures and our distribution centers, each of which are included in cost of goods sold. We anticipate that our

selling, general and administrative expenses will increase in absolute dollars due to anticipated continued growth of our corporate support staff

and store-level employees.

Provision for impairment and lease exit costs

consists of asset impairments, lease exit and other related costs associated with the relocation

of our administrative offices and the closure of one Canadian corporate-owned store in fiscal 2010, as well as management’s evaluation of

corporate-owned locations. Also included in prior years are one US corporate-owned store in the first quarter of fiscal 2009 as well as an asset

impairment provision based on management’s ongoing evaluation of its portfolio of corporate-owned store locations. Long-lived assets are

reviewed at the store-level periodically for impairment or whenever events or changes in

28

•

competition;

•

changes in our merchandise mix;

•

pricing;

•

the timing of our releases of new merchandise and promotional events;

•

the effectiveness of our grassroots marketing efforts;

•

the level of customer service that we provide in our stores;

•

our ability to source and distribute products efficiently; and

•

the number of stores we open, close (including for temporary renovations) and expand in any period.

•

the cost of purchased merchandise, which includes acquisition and production costs including raw material and labor, as applicable;

•

the cost incurred to deliver inventory to our distribution centers including freight, non

-

refundable taxes, duty and other landing costs;

•

the cost of our distribution centers (such as labor, rent and utilities) and the depreciation and amortization related to our distribution

centers;

•

the cost of our production, merchandise and design departments including salaries, stock

-

based compensation and benefits, and

operating expenses;

•

the cost of occupancy related to store operations (such as rent and utilities) and the depreciation and amortization related to store

-

level capital expenditures;

•

hemming; and

•

shrink and valuation reserves.