Lululemon 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

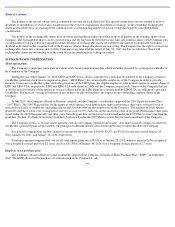

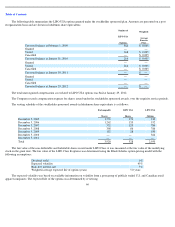

The holders of the special voting stock are entitled to one vote for each share held. The special voting shares are not entitled to receive

dividends or distributions or receive any consideration in the event of a liquidation, dissolution or wind-up. To the extent that exchangeable

shares as described below are exchanged for common stock, a corresponding number of special voting shares will be cancelled without

consideration.

The holders of the exchangeable shares have dividend and liquidation rights equivalent to those of holders of the common shares of the

Company. The exchangeable shares can be converted on a one for one basis by the holder at any time into common shares of the Company plus

a cash payment for any accrued and unpaid dividends. Holders of exchangeable shares are entitled to the same or economically equivalent

dividend as declared on the common stock of the Company. The exchangeable shares are non-voting. The Company has the right to convert the

exchangeable shares into common shares of the Company at any time after the earlier of July 26, 2047, the date on which less than 4,188

exchangeable shares are outstanding or in the event of certain events such as a change in control.

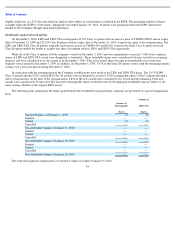

10 STOCK-BASED COMPENSATION

Share option plans

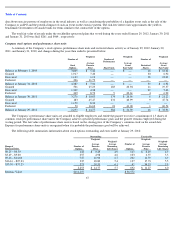

The Company’s employees participate in various stock-based compensation plans which are either provided by a principal stockholder of

the Company or the Company.

During the year ended January 31, 2006, LIPO and LIPO USA, entities controlled by a principal stockholder of the Company, created a

stockholder sponsored stock-based compensation plans (“LIPO Plans”) for certain eligible employees of the Company in order to provide

incentive to increase stockholder value. Under the provisions of the LIPO plans, the eligible employees were granted options to acquire shares of

LIPO and LIPO USA, respectively. LIPO and LIPO USA held shares in LACI and the Company, respectively. Shares of the Company that are

or will be issued to holders of the options or restricted shares under the LIPO Plans are currently held by LIPO USA, an affiliate of a principal

stockholder. The exercise, vesting or forfeiture of any of these awards will not have any impact on the outstanding common shares of the

Company.

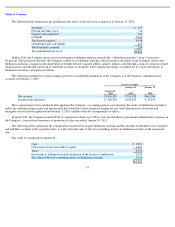

In July 2007, the Company’s Board of Directors adopted, and the Company’s stockholders approved the 2007 Equity Incentive Plan

(“2007 Plan”). The 2007 Plan provides for the grants of stock options, stock appreciation rights, performance share units, restricted stock or

restricted stock units to employees (including officers and directors who are also employees) of the Company. The majority of stock options

granted to date have a four-year vesting period and vest at a rate of 25% each year on the anniversary date of the grant. Performance share units

issued under the 2007 Plan generally vest three years from the grant date and restricted stock issued under the 2007 Plan vest one year from the

grant date. To date, 90 shares of restricted stock have been issued under the 2007 Plan to certain directors and consultants of the Company.

The Company’s policy is to issue shares upon the exercise of Company options from treasury. Any shares issued to employees related to

stockholder sponsored plans are provided by the principal stockholder and are not issued from treasury or repurchased by the Company.

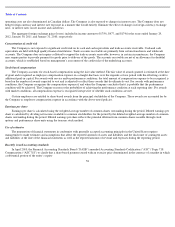

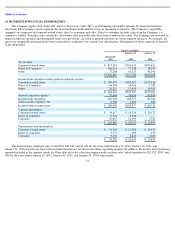

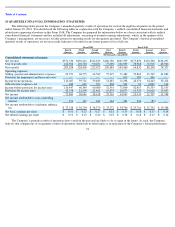

Stock-based compensation expense charged to income for the plans was $10,340, $7,273 and $5,616 for the years ended January 29,

2012, January 30, 2011, and January 31, 2010, respectively.

Total unrecognized compensation cost for all stock option plans was $18,619 as at January 29, 2012, which is expected to be recognized

over a weighted-average period of 2.2 years, and was $15,399 as at January 30, 2011 over a weighted-average period of 2.7 years.

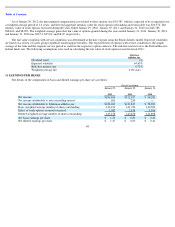

Employee stock purchase plan

The Company’s Board of Directors and stockholders approved the Company’s Employee Share Purchase Plan (“ESPP”) in September

2007. The ESPP allows for the purchase of common stock of the Company by all

64