Lululemon 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

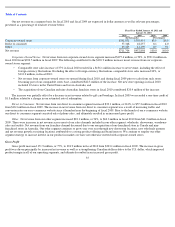

This discussion summarizes our consolidated operating results, financial condition and liquidity during the three-year period ending

January 29, 2012. Our fiscal year ends on the Sunday closest to January 31 of the following year, typically resulting in a 52 week year, but

occasionally giving rise to an additional week, resulting in a 53 week year. Fiscal 2011, 2010 and 2009 ended on January 29, 2012, January 30,

2011 and January 31, 2010, respectively. The following discussion and analysis should be read in conjunction with our consolidated financial

statements and the related notes included elsewhere in this Annual Report on Form 10-K.

This discussion and analysis contains forward-looking statements based on current expectations that involve risks, uncertainties and

assumptions, such as our plans, objectives, expectations and intentions set forth in the “Special Note Regarding Forward-Looking Statements.”

Our actual results and the timing of events may differ materially from those anticipated in these forward looking statements as a result of various

factors, including those set forth in the “Item 1A—Risk Factors” section and elsewhere in this Annual Report on Form 10-K.

Overview

Our results for fiscal 2011 demonstrate the ongoing success of our efforts to overcome the instability in the economy for the last three

fiscal years. At the end of last year, we set goals for fiscal 2011 which required continued investment in our stores and our people, making

infrastructure enhancements and funding working capital requirements, while remaining conscious of our discretionary spending. These goals

included growing revenue year-over-year while maintaining operating margins, as well as positioning the Company for long-term growth. We

continually assess the economic environment and market conditions when making decisions regarding timing of our investments.

Our investments in our stores and people were reflected in our comparable stores net revenue growth, which leveraged our fixed operating

costs and in turn led to increased operating margins. We increased our store base through execution of our real estate strategy, when and where

we saw opportunities for success. For example, we opened 41 new corporate-owned stores in North America, Australia, and New Zealand since

fiscal 2010, including our remaining four reacquired franchises. Where we find opportunities for growth through opening showrooms, or other

community presence efforts, we expect to expand our store base and therefore our business. 12 to 14 of our planned store openings in fiscal 2012

are expected to be in markets seeded by showrooms in fiscal 2012.

Throughout fiscal 2011, we were able to grow our e-commerce business which has further increased our brand awareness and has made

our product available in new markets, including those outside of North America. This sales channel offers a higher operating margin than our

other segments and accounted for 13.5% of total revenue in the fourth quarter of fiscal 2011 compared to 10.0% of total revenue in the same

period of the prior year. Continuing increases in traffic and conversion rates on our e-commerce website lead us to believe that there is potential

for our direct to consumer segment to become an increasingly substantial part of our business and we plan

to continue to commit a portion of our

resources to further developing this channel.

We believe that our brand is recognized as premium in our offerings of run and yoga assortment, as well as a leader in technical fabrics and

quality construction. This has made our product desirable to our consumers and has driven demand, which we are able to meet given our

increased product depth in stores compared to last year. In fiscal 2012, we plan on investing in new and legacy information technology systems

to gain further efficiencies in our vertical retail strategy. We also plan on investing in international expansion opportunities where we have

determined there is growth opportunity, including adding country-specific e-commerce websites and opening additional international

showrooms. We believe our strong cash flow generation, solid balance sheet and healthy liquidity provide us with the financial flexibility to

continue executing the initiatives which we believe will be beneficial for us.

25

ITEM 7.

MANAGEMENT

’

S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS