Lululemon 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

securities trades should not be considered to contain a market, performance or service condition. Therefore, an entity should not classify such an

award as a liability if it otherwise qualifies for classification in equity. This guidance is effective for interim and annual periods beginning on or

after December 15, 2010 and is to be applied prospectively. The Company adopted the amendment in the first quarter of fiscal 2011 with no

material impact on the Company’s consolidated financial statements.

In May 2011, the FASB amended ASC Topic 820 Fair Value Measurement (“ASC 820”) to clarify requirements for how to measure fair

value and for disclosing information about fair value measurements common to US GAAP and International Financial Reporting Standards. This

guidance is effective for interim and annual periods beginning on or after December 15, 2011. The Company will adopt the amendment in the

first quarter of fiscal 2012 and expects no material impact on the Company’s consolidated financial statements.

In June 2011, the FASB amended ASC Topic 220 Comprehensive Income (“ASC 220”) to require (i) that all non-owner changes in

stockholders’ equity be presented either in a single continuous statement of comprehensive income or in two separate but consecutive

statements, and (ii) presentation of reclassification adjustments from other comprehensive income (“OCI”) to net income on the face of the

financial statements. This guidance eliminates the option to present the components of OCI as part of the statement of changes in stockholders’

equity, but does not change the items that must be reported in OCI or when an item of OCI must be reclassified to net income. This guidance is

effective for years, and interim periods within those years, beginning after December 15, 2011. The Company will adopt the amendment in fiscal

2012 and expects no material impact on the Company’s consolidated financial statements.

In September 2011, the FASB amended ASC Topic 350 Intangibles—Goodwill and Other (“ASC 350”) to allow a company to first assess

qualitative factors to determine whether it is necessary to perform the two-step quantitative goodwill impairment test. Under this amendment, a

company would not be required to calculate the fair value of a reporting unit unless the company determines, based on a qualitative assessment,

that it is more likely than not that its fair value is less than its carrying amount. The amendment includes a number of events and circumstances

for a company to consider in conducting the qualitative assessment. This guidance is effective for annual periods beginning on or after

December 15, 2011. The Company will adopt the amendment in the first quarter of fiscal 2012 and expects no material impact on the Company’

s

consolidated financial statements.

Reclassifications

Certain prior year amounts have been reclassified to conform to fiscal 2011 presentation.

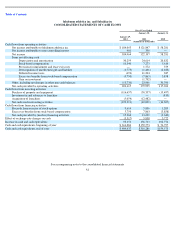

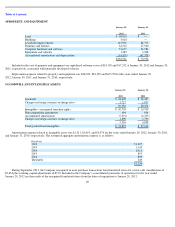

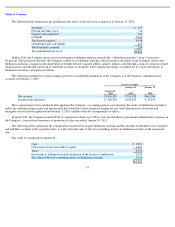

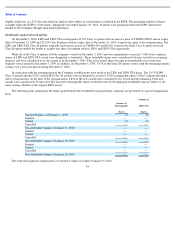

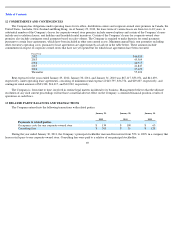

3 INVENTORIES

59

January 29,

2012

January 30,

2011

Finished goods

$

105,462

$

59,138

Raw materials

2,531

1,913

Provision for obsolescence and shrink

(3,896

)

(3,582

)

$

104,097

$

57,469