Konica Minolta 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4Konica 2002

yielded significant results. While the trend toward digital

networking is progressing even faster than expected, the busi-

ness environment has become increasingly severe and compa-

nies lacking technological capabilities, cost competitiveness,

and the ability to reform their management and business oper-

ations, have been forced from the market. Amid this environ-

ment, under SAN Plan 2005, Konica will also focus on such

basic goals as progressing with business portfolio management,

strengthening and utilizing its core technologies, and imple-

menting a system for separate companies for each business

segment as well as a holding company.

BUSINESS DOMAINS AND VISION

Before explaining the strategies we will implement

to achieve our goals, I will clarify Konica’s busi-

ness domains and talk about Konica’s vision.

Recent years have witnessed breathtaking ad-

vances in information systems propelled by the estab-

lishment of high-speed communications infrastructure

and progress in developing new types of information terminals.

The revolution in imaging technologies, which has supported

advances in communications networks, is likely to significantly

alter all of Konica’s business fields. As these trends unfold,

Konica’s vision is to be an

“

Imaging Solutions Company,” and

the Company will focus on this field as a business domain

where it will pursue growth by vigorously reforming its busi-

nesses in tandem with an emphasis on digitization of input and

output devices. In output imaging, we will cultivate and

strengthen our inkjet technologies as a third technology plat-

form along with our existing

silver halide and copier tech-

nologies as we undertake revo-

lutionary new businesses. We

will also proactively pursue

new business opportunities in

hard output and display fields.

In input-imaging fields, we

foresee plentiful opportunities

in such upstream sectors as

optical units and key devices

for input devices, and will

focus on the development of this business.

COMPANYWIDE BUSINESS PORTFOLIO MANAGEMENT

In accordance with this vision, Konica will adopt management

policies that include 1) implementing Companywide business

portfolio management, 2) progressing further with digital net-

working, 3) enhancing management efficiency, 4) upgrading

quality, and 5) implementing environmental accounting. In

undertaking our Companywide business portfolio manage-

ment, we have designated our optics and EM technology and

inkjet technology businesses as strategic business fields

and our office document business as our growth

business. Accordingly, we will concentrate the

allocation of management resources on these sec-

tors as well as strengthen our ability to offer

appealing products and bolster our marketing in

these fields. We will energetically pursue both

internal and external strategic alliances that utilize

each partner’s strengths, offer revolutionary new products

and services drawing on our streamlined core technologies, and

raise the value of our corporate brand. As an additional mea-

sure, we will introduce Konica Value Added (KVA), which

focuses on the profitability of a project, as a new management

indicator. With the aim of achieving returns in excess of capital

costs, the Company will select and concentrate on those busi-

ness segments that fulfill the criteria of KVA.

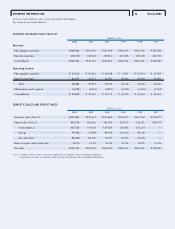

FURTHER PROMOTING DIGITAL NETWORKS

Determined to take advantage of the rapid expansion in digital

networks, Konica will significantly shift its management

resources toward digital business segments. Sales of digital

products as a percentage of our net sales are rapidly growing.

In fiscal 2000, digital products accounted for just 31% of total

sales but surged to 60% of total sales in fiscal 2002. This trend

is expected to gain momentum, and our goal is to increase

digital-related products as a percentage of total company sales

to 79% in fiscal 2006. Accordingly, we will raise the propor-

tion of total investments allocated to digital products 14 per-

centage points from fiscal 2002 to 83% in fiscal 2006. At the

same time, as it accelerates the introduction of new products

and develops its businesses, the Company will vigorously

(Billions of yen)

CHANGE IN DIGITAL SALES RATIO

’00

31%

175

’01

45%

244

’02

60%

324

’03

68%

388

69%

385 55%

229 40%

216 32%

182

(Target)

Digital Analog