Konica Minolta 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 KONICA

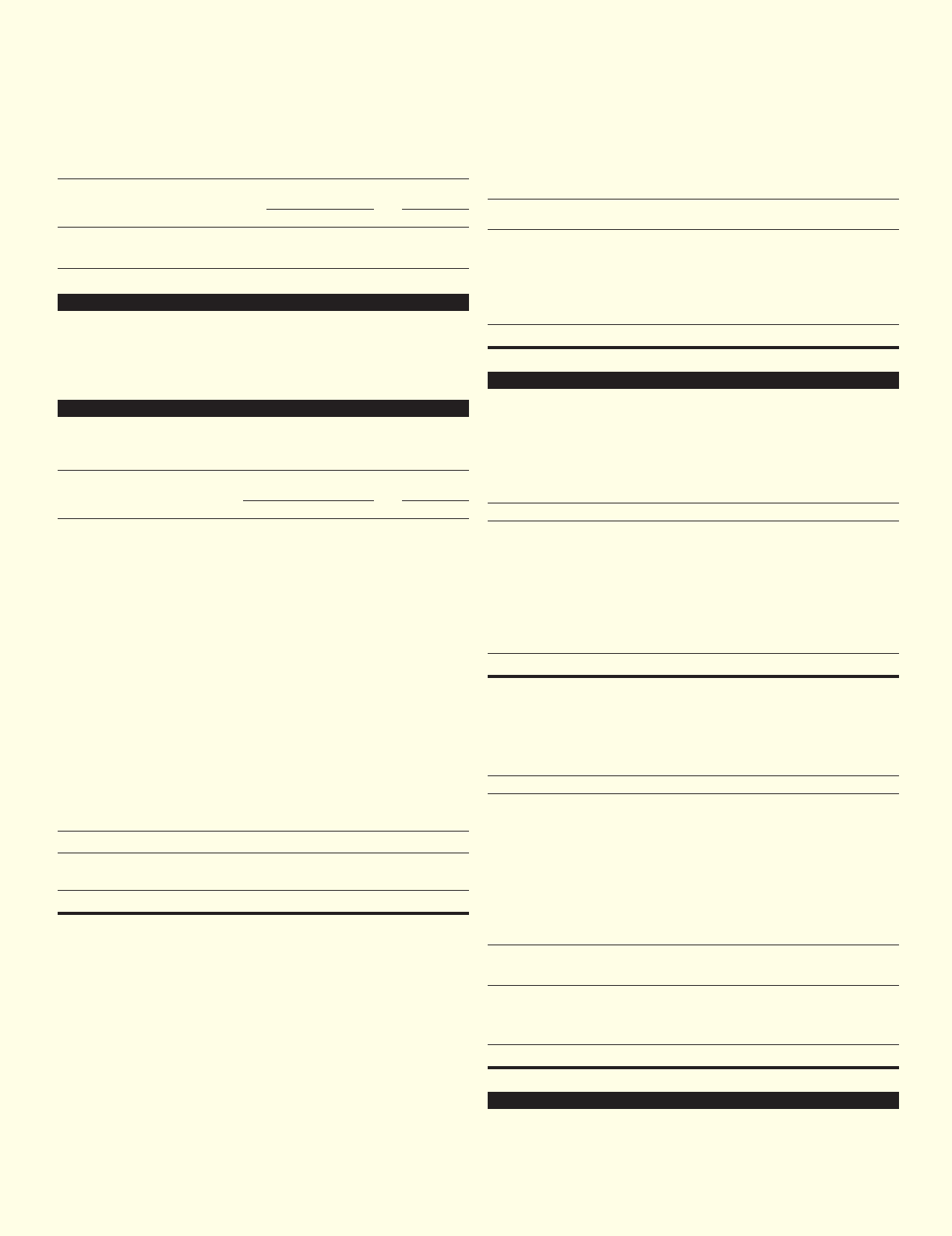

Transaction balances as of March 31, 1999 and 1998 are as follows:

Thousands of

Millions of yen U.S. dollars

1999 1998 1999

Trade receivables ....................... ¥6,019 ¥11,167 $49,336

Trade payables........................... 6,104 8,214 50,033

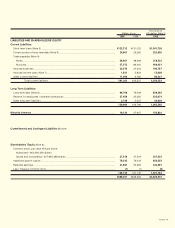

5. Short-Term Loans

Short-term loans consist principally of bank borrowings. The average

interest rates on these loans as of March 31, 1999 and 1998 were 4.2

per cent and 4.9 per cent per annum, respectively.

6. Long-Term Debt

Long-term debt as of March 31, 1999 and 1998 is summarized as

follows:

Thousands of

Millions of yen U.S. dollars

1999 1998 1999

1.6% to 3.2% Japanese yen

unsecured debentures,

due 1999 to 2008 ................. ¥ 57,750 ¥ 56,632 $ 473,361

1.0% to 5.7% mortgage

loans from banks,

due 1999 to 2005 ................. 2,920 2,390 23,934

6.6% to 7.8% mortgage

or secured loans from

government-sponsored

banks and agencies,

due 1999 to 2001 ................. 941 1,571 7,713

0.6% to 8.7% unsecured

loans from banks and

government-sponsored

banks and agencies,

due 1999 to 2008 ................. 57,036 37,296 467,508

Obligations under capital

leases, due 1999 to 2006..... 7,023 5,380 57,566

............................................... 125,670 103,269 1,030,082

Less: Current portion included

in current liabilities ............... (26,901) (24,260) (220,500

............................................... ¥ 98,769 ¥ 79,009 $ 809,582

At March 31, 1999, property, plant and equipment amounting to

¥5,695 million (US$46,680 thousand) at net book value was pledged

as collateral for long-term debt of ¥4,685 million (US$38,402 thousand).

As is customary in Japan, long-term and short-term bank loans are

made under general agreements which provide that additional security

and guarantees for present and future indebtedness will be given at

the request of the bank and that any collateral so furnished will be

applicable to all indebtedness due to that bank. In addition, the agree-

ments provide that the bank has the right to offset cash deposited

against any long-term or short-term debt that becomes due and, in

case of default and/or other specified events, against all other debt

payable to the bank.

The aggregate annual maturities of long-term debt as of March 31,

1999 are as follows:

Thousands of

Years ending March 31 Millions of yen U.S. dollars

1999........................................................ ¥ 26,902 $ 220,508

2000........................................................ 21,278 174,410

2001........................................................ 22,091 181,074

2002........................................................ 14,679 120,320

2003 and thereafter ................................ 40,720 333,770

................................................................ ¥125,670 $1,030,082

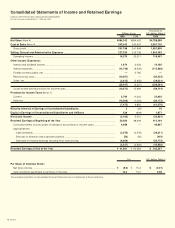

7. Income Taxes

The Company is subject to a number of different taxes in Japan,

based on income, which in the aggregate indicate statutory tax rates

of approximately 47.7 per cent and 51.4 per cent in 1999 and 1998,

respectively. The following is a reconciliation between the statutory

tax rate and the Company’s effective tax rate:

1999

Statutory tax rate .................................................................... 47.7%

Tax effect on loss of a consolidated subsidiary

previously not recognized................................................. 122.7

Valuation allowance............................................................ (16.1)

Effect of tax rate change..................................................... (40.8)

Inventories, etc. ................................................................. (35.5)

Other, net............................................................................ (7.8)

Effective tax rate..................................................................... 70.2

The components of deferred tax assets in the amount of ¥5,688 mil-

lion (US$46,623 thousand) included in “Current Assets” and ¥21,036

million (US$172,426 thousand) included in “Investments and Other

Assets” as of March 31, 1999 are as follows:

Millions of yen

Gross deferred tax assets:

Tax effect on loss of a consolidated subsidiary

previously not recognized .......................................... ¥12,814

Tax loss carryforward................................................... 7,668

Temporary difference carrying from restructuring........ 1,886

Reserve for employees’ retirement allowance ............. 3,036

Inventories, etc. ........................................................... 3,827

Other, net...................................................................... 5,704

Subtotal .................................................................... 34,935

Valuation allowance.......................................................... (6,413)

Deferred tax assets total .......................................... 28,522

Gross deferred tax liabilities.............................................

Deferral of taxes on profit of fixed assets......................... (1,798)

Net deferred tax assets .................................................... ¥26,724

8. Shareholders’ Equity

The Japanese Commercial Code provides that an amount equivalent

to at least 10 per cent of cash distributions (cash dividends and

bonuses to directors and corporate auditors) paid in a fiscal period

)