Konica Minolta 1999 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1999 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OPERATING ENVIRONMENT

In fiscal 1999, ended March 31, 1999, weak consumer spending

and private-sector capital investment prevented the Japanese

economy from moving any closer to recovery.

ROverseas, while demand for Konica’s mainstay products in the

United States and Europe was solid, the economic downturn in

Asia continued to have a serious effect on sales in certain prod-

uct segments.

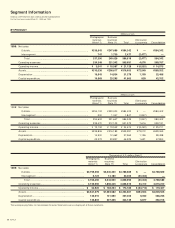

SALES

Consolidated net sales amounted to ¥584.3 billion (US$4,790

million), down ¥0.1 billion from the previous fiscal year. By seg-

ment, Photographic Materials and Photo-Related Industrial

Equipment declined 4.9% in fiscal 1999, to ¥336.6 billion

(US$2,759 million), with the stagnant economies in Japan and

elsewhere in Asia hampering sales of consumer products. Sales

in the Business Machines segment climbed 7.6%, to ¥247.7 billion

(US$2,030 million), with a strong performance by digital copiers

and other office equipment supporting revenue growth.

RBy geographic region, domestic sales declined 7.1%, to

¥328.6 billion (US$2,693 million), while overseas sales increased

10.9% billion, to ¥255.8 billion (US$2,096 million). As a percent-

age of net sales, overseas sales rose from 39.5% to 43.8%.

RExport sales increased 3.0%, to ¥330.1 billion (US$2,706 mil-

lion), and export sales as a percentage of net sales edged up

from 54.9% to 56.5%.

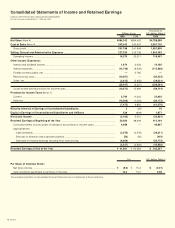

INCOME

Gross profit declined ¥0.2 billion, or 0.1%, to ¥241.8 billion

(US$1,982 million), and the gross profit ratio was 41.4%, the

same as in the previous fiscal year. This reflects the success

of measures to raise profit margins, in particular cost reduction

measures. Selling, general and administrative (SG&A) expenses

increased ¥10.5 billion, or 4.8%, to ¥227.2 billion (US$1,862 mil-

lion), due mainly to costs associated with sales and market net-

work rationalization activities and a sharp increase in the value

of the yen in the second half of the fiscal year. As a percentage

of net sales, SG&A expenses rose 1.8 percentage points, to

14 KONICA

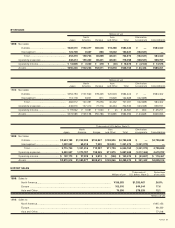

’95 ’96 ’97 ’98 ’99

Net Sales, Cost of

Sales, and Cost

of Sales Ratio

(Billions of Yen, %)

Net Sales

Cost of Sales

Cost of Sales Ratio (%)

518

505

578

584

584

311

298

345

342

343

59

60 60 59 59

’95 ’96 ’97 ’98 ’99

Net Sales by

Product Segment

(Billions of Yen)

Business Machines

Photographic Materials

518

505

578

584

584

’95 ’96 ’97 ’98 ’99

Net Sales,

Net Income, and

Return on Sales

(Billions of Yen, %)

Net Sales

Net Income

Return on Sales (ROS) (%)

518

505

578

584

584

3.8

2.1

4.5

5.5

Note: Net Income and ROS for

1999 were –¥3.2 billion and

–0.5%, respectively.

0.4

0.7

0.8

0.9

31.0

29.8

27.9

26.6

26.9

’95 ’96 ’97 ’98 ’99

Shareholders’

Equity Ratio and

Return on Equity

(%)

Shareholders’ Equity Ratio (%)

Return on Equity (ROE) (%)

2.7

3.3

1.3

2.3

Note: ROE for 1999 was –1.9%.

Financial Review

(Consolidated Financial Statements)