Konica Minolta 1999 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1999 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA 23

(i) Income Taxes

In fiscal 1999, the Company and its domestic subsidiaries adopted

the deferred tax accounting method, which requires the adjustment

of previously deferred taxes using the liability method, where deferred

tax assets and liabilities are recognized for temporary differences

between the tax basis of assets and their reported amounts in the

financial statements. In accordance with generally accepted account-

ing standards for deferred tax accounting in Japan, the Company

reflected the cumulative effect of adopting deferred tax accounting at

the beginning of fiscal 1999 with a charge to retained earnings. Prior

years’ financial statements were not reclassified to conform to 1999

presentation.

In fiscal 1998, income taxes of the Company and its domestic sub-

sidiaries are provided for in an amount currently payable based on

the tax returns filed with the tax authority and adjusted for tax effects

of temporary differences arising from elimination entries reflected in

the consolidation procedures, such as the elimination of unrealized

intercompany profit and allowance for bad debts provided against

intercompany accounts receivable eliminated in consolidation.

Certain consolidated overseas subsidiaries account for income taxes

on the basis of interperiod allocation whereby tax effects on temporary

differences between tax and financial reporting are recognized.

(j) Research and Development Expenses

Expenses for research and development activities are charged to

income as incurred. Total amounts charged to income for the fiscal

years ended March 31, 1999 and 1998 were ¥27,944 million

(US$229,049 thousand) and ¥26,666 million, respectively.

(k) Legal Reserve

Due to the amendment to the Consolidated Financial Statements

Regulations, the presentations of the accounts in the consolidated

financial statements have been changed for the fiscal year ended

March 31, 1999.

“Legal Reserve,” which was previously reported as a separate

account within Shareholders’ Equity, is included in “Retained Earn-

ings.” Accordingly, the beginning balance, the movements during the

fiscal year, and the ending balance of the fiscal year of “Retained

Earnings” include “Legal Reserve.”

(l) Per Share Data

Net income per share of common stock has been computed based on

the weighted average number of shares outstanding during the year.

Cash dividends per share shown for each year in the accompany-

ing consolidated statements are dividends declared as applicable to

the respective years.

2. United States Dollar Amounts

Amounts in U.S. dollars are included solely for the convenience of

readers outside Japan. The rate of ¥122=US$1, the rate of exchange

on June 28, 1999, has been used in translation. The inclusion of such

amounts is not intended to imply that Japanese yen have been or

could be readily converted, realized or settled in U.S. dollars at this

rate or any other rate.

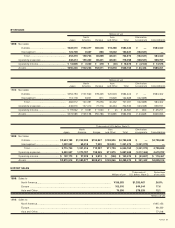

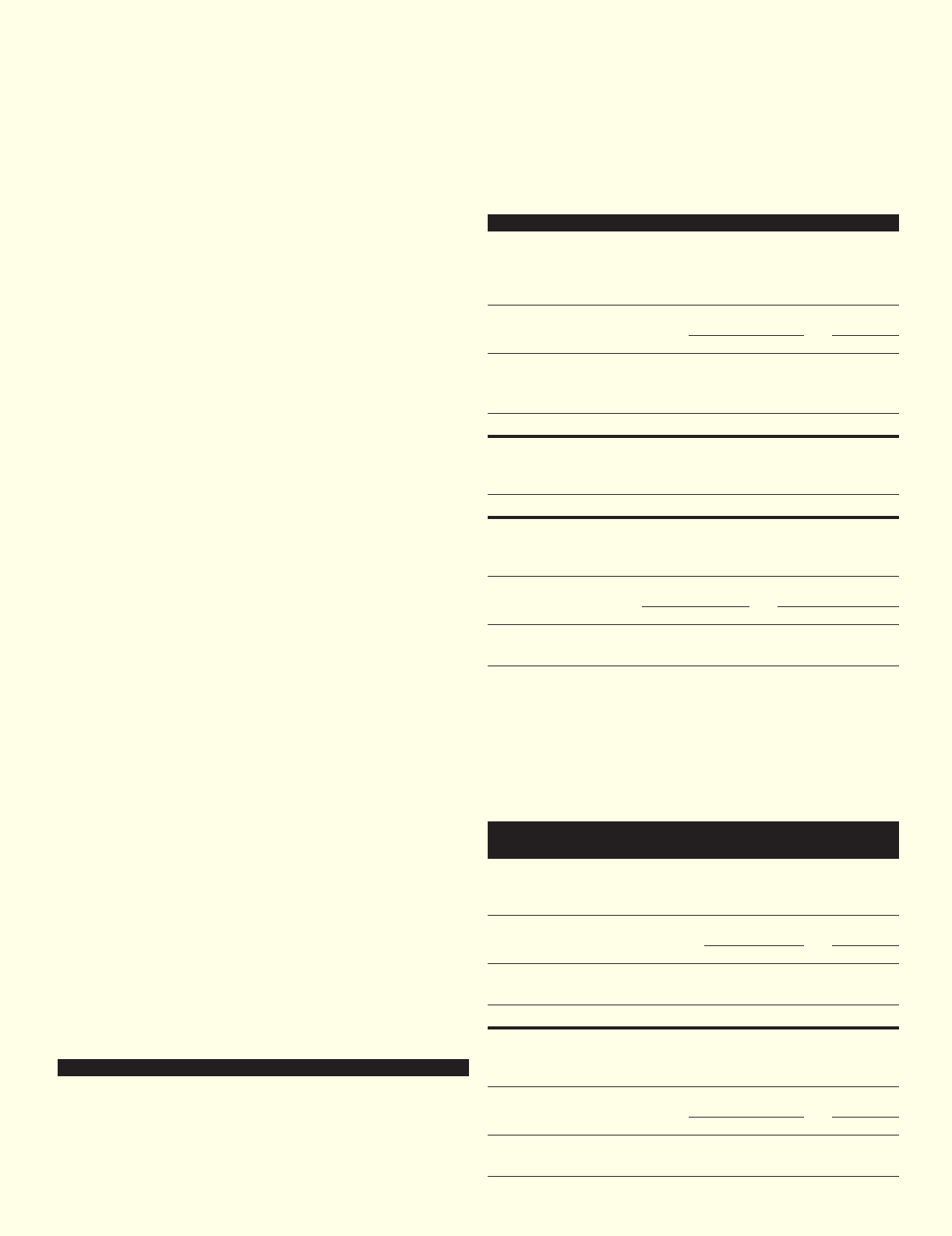

3. Marketable Securities

The aggregate book values and market values of current and non-

current marketable equity securities as of March 31, 1999 and 1998

are as follows:

Thousands of

Millions of yen U.S. dollars

1999 1998 1999

Book value:

Current.................................... ¥16,723 ¥17,868 $137,074

Non-current ............................ 13,943 14,135 114,287

.................................................... ¥30,666 ¥32,003 $251,361

Market value:

Current.................................... ¥17,861 ¥22,699 $146,402

Non-current ............................ 26,358 26,683 216,049

.................................................... ¥44,219 ¥49,382 $362,451

Gross unrealized gains and losses pertaining to marketable equity

securities as of March 31, 1999 are as follows:

Thousands of

Millions of yen U.S. dollars

Gains Losses Gains Losses

Current........................... ¥ 6,241 ¥5,103 $ 51,156 $41,828

Non-current ................... 13,291 876 108,943 7,180

The net realized gains on marketable equity securities for the fiscal

years ended March 31, 1999 and 1998 were ¥946 million (US$7,754 thou-

sand) and ¥33 million, respectively.

The net valuation loss on marketable equity securities for the fiscal

years ended March 31, 1999 and 1998 were ¥269 million (US$2,205

thousand) and ¥657 million, respectively.

4. Investments in and Loans to Unconsolidated

Subsidiaries and Affiliates

Investments in and loans to unconsolidated subsidiaries and affiliates

as of March 31, 1999 and 1998 are summarized as follows:

Thousands of

Millions of yen U.S. dollars

1999 1998 1999

Investments .................................... ¥3,205 ¥8,022 $26,270

Loans.............................................. 442 776 3,623

........................................................ ¥3,647 ¥8,798 $29,893

The transactions of the Company and its consolidated subsidiaries

with these unconsolidated subsidiaries and affiliates are as follows:

Thousands of

Millions of yen U.S. dollars

1999 1998 1999

Sales........................................... ¥18,256 ¥25,857 $149,639

Purchases................................... 21,739 26,411 178,189