Konica Minolta 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA 15

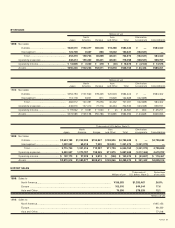

Six-Year Summary

KONICA CORPORATION AND CONSOLIDATED SUBSIDIARIES

For the fiscal years ended March 31

Millions of yen

1999 1998 1997 1996 1995 1994

For the Year:

Net sales.......................................................................................... ¥584,342 ¥584,402 ¥578,081 ¥505,349 ¥517,601 ¥492,947

Operating income............................................................................ 14,575 25,211 26,165 19,075 18,453 12,185

(Loss) income before provision for income taxes............................ (10,872) 15,984 16,205 9,530 8,214 5,007

Net (loss) income............................................................................. (3,166) 5,501 4,541 2,119 3,843 4,214

At Year-End:

Total assets ..................................................................................... ¥589,201 ¥629,063 ¥592,997 ¥552,009 ¥544,740 ¥531,570

Total shareholders’ equity ............................................................... 158,742 167,145 165,269 164,304 168,958 172,459

Interest-bearing debt....................................................................... 247,882 234,292 213,314 191,279 169,569 176,269

Per Share of Common Stock (Yen):

Net (loss) income............................................................................. ¥ (8.9) ¥ 15.4 ¥ 12.7 ¥ 5.9 ¥ 10.8 ¥ 11.8

Cash dividends applicable to earnings of the year ......................... 10.0 10.0 10.0 10.0 10.0 10.0

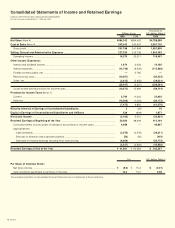

38.9%. As a result, operating income fell ¥10.6 billion, or 42.2%,

to ¥14.6 billion (US$119 million).

ROther expenses totaled ¥25.4 billion (US$209 million), com-

pared with ¥9.2 billion in the previous fiscal year. The high costs

associated with business restructuring activities were the primary

reason for this downturn. Consequently, Konica recorded a net

loss of ¥3.2 billion (US$26 million).

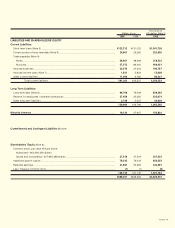

FINANCIAL POSITION

At March 31, 1999, total current assets stood at ¥349.2 billion

(US$2,863 million), down ¥43.6 billion, or 11.1%, from the previ-

ous fiscal year-end. This decline was due mainly to falls in trade

receivables of ¥10.0 billion and inventories of ¥20.3 billion, reflect-

ing lower sales activity and efforts to reduce inventory levels.

RNet property, plant and equipment increased ¥1.7 billion, or

1.0%, to ¥161.5 billion (US$1,324 million), while investments and

other assets advanced ¥8.1 billion, or 12.7%, to ¥71.5 billion

(US$586 million).

RTotal current liabilities fell ¥42.9 billion, or 13.2%, to

¥281.4 billion (US$2,306 million), primarily as a result of a

¥41.5 billion fall in trade payables, which declined amid the

slack economic environment, and an ¥8.8 billion decline in

short-term loans. Consequently, the current ratio increased

from 1.21 to 1.24.

RLong-term liabilities increased ¥20.2 billion, or 18.4%, to

¥130.0 billion (US$1,065 million).

RTotal shareholders’ equity fell ¥8.4 billion, to ¥158.7 billion

(US$1,301 million), mainly as a result of the use of monies in

the legal reserve. The shareholders’ equity ratio increased

from 26.6% to 26.9%.