JetBlue Airlines 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2015Annual Report 61

PART II

ITEM 8Financial Statements and Supplementary Data

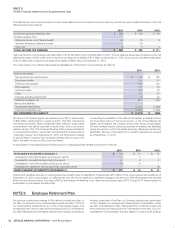

NOTE 14 Accumulated Other Comprehensive Income (Loss)

Comprehensive income (loss) includes changes in fair value of our aircraft

fuel derivatives and interest rate swap agreements, which qualify for hedge

accounting. A rollforward of the amounts included in accumulated other

comprehensive income (loss), net of taxes for the years ended December

31, 2015, 2014 and 2013 is as follows (in millions):

Aircraft Fuel

Derivatives(1)

Interest

Rate Swaps(2) Total

Balance of accumulated losses at December 31, 2012 (1) (7) (8)

Reclassifications into earnings (net of $7 of taxes) 6 5 11

Change in fair value (net of $(2) of taxes) (4) 1 (3)

Balance of accumulated income (losses), at December 31, 2013 1 (1) —

Reclassifications into earnings (net of $12 of taxes) 18 1 19

Change in fair value (net of $(52) of taxes) (82) — (82)

Balance of accumulated losses, at December 31, 2014 $ (63) $ — $ (63)

Reclassifications into earnings (net of $49 of taxes) 77 1 78

Change in fair value (net of $(11) of taxes) (18) — (18)

Balance of accumulated losses, at December 31, 2015 (4) 1 (3)

(1) Reclassified to aircraft fuel expense

(2) Reclassified to interest expense

NOTE 15 Geographic Information

Under the Segment Reporting topic of the Codification, disclosures are

required for operating segments that are regularly reviewed by chief operating

decision makers. Air transportation services accounted for substantially

all the Company’s operations in 2015, 2014 and 2013.

Operating revenues are allocated to geographic regions, as defined

by the DOT, based upon the origination and destination of each flight

segment. We currently serve 29 locations in the Caribbean and Latin

American region, or Latin America as defined by the DOT. However,

our management includes our three destinations in Puerto Rico and two

destinations in the U.S. Virgin Islands in our Caribbean and Latin America

allocation of revenues. Therefore, we have reflected these locations within

the Caribbean and Latin America region in the table below. Operating

revenues by geographic regions for the years ended December 31 are

summarized below (in millions):

2015 2014 2013

Domestic $ 4,521 $ 4,093 $ 3,886

Caribbean & Latin America 1,895 1,724 1,555

TOTAL $ 6,416 $ 5,817 $ 5,441

Our tangible assets primarily consist of our fleet of aircraft, which is deployed system wide, with no individual aircraft dedicated to any specific route or

region; therefore our assets do not require any allocation to a geographic area.

NOTE 16 LiveTV

LiveTV, LLC, formerly a wholly owned subsidiary of JetBlue, provides in-flight

entertainment and connectivity solutions for various commercial airlines

including JetBlue. On June 10, 2014, JetBlue entered into an amended

and restated purchase agreement with Thales Holding Corporation, or

Thales, replacing the original purchase agreement between the parties

dated as of March 13, 2014. Under the terms of the amended and

restated purchase agreement, JetBlue sold LiveTV to Thales for $399

million, subject to purchase adjustments based upon the amount of cash,

indebtedness, and working capital of LiveTV at the closing date of the

transaction relative to a target amount. Excluded from this sale was LiveTV

Satellite Communications, LLC, which was retained by JetBlue pending

receipt of the necessary regulatory approvals for the sale. On September

25, 2014, JetBlue received all necessary regulatory approvals and sold

LiveTV Satellite Communications, LLC, to Thales for approximately $1

million in cash.

The total cash proceeds of $393 million reflect the agreed upon purchase

price, net of purchase agreement adjustments including post-closing

purchase price adjustments, which were finalized during the third quarter

of 2014. The sale resulted in a pre-tax gain of approximately $241 million

and is net of approximately $19 million in transaction costs. The gain on

the sale has been reported as a separate line item in the consolidated

statement of operations for the year ended December 31, 2014.

The tax expense recorded in connection with this transaction totaled $72

million, net of a $19 million tax benefit related to the utilization of a capital

loss carryforward. The capital gain generated from the sale of LiveTV

resulted in the release of a valuation allowance related to the capital

loss deferred tax asset. This resulted in an after tax gain on the sale of

approximately $169 million.

Following the close of the sales on June 10, 2014, and on September 25,

2014, the applicable LiveTV operations are no longer being consolidated

as a subsidiary in JetBlue’s consolidated financial statements. The effect of

this reporting structure change is not material to the consolidated financial

statements presented. LiveTV third party revenues in 2014 up to the date

of sale were $30 million , compared to $72 million in 2013.

Deferred profit on hardware sales and advance deposits for future hardware

sales were included in other accrued liabilities and other long term liabilities

on our consolidated balance sheets depending on whether we expected