JetBlue Airlines 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2015Annual Report58

PART II

ITEM 8Financial Statements and Supplementary Data

standalone environmental liability insurance policy to help mitigate this

exposure. Our existing aviation hull and liability policy includes some limited

environmental coverage when a cleanup is part of an associated single

identifiable covered loss.

Under certain contracts, we indemnify specified parties against legal liability

arising out of actions by other parties. The terms of these contracts range

up to 25 years. Generally, we have liability insurance protecting ourselves

for the obligations we have undertaken relative to these indemnities.

Upon the sale of LiveTV to Thales in June 2014, refer to Note 16 for more

information, we transferred certain contingencies to Thales. These included

product warranties and LiveTV indemnities against any claims which may of

been brought against its customers. These indemnities related to allegations

of patent, trademark, copyright or license infringement as a result of the

use of the LiveTV system.

Under a certain number of our operating lease agreements we are required

to restore certain property or equipment to its original form upon expiration

of the related agreement. We have recorded the estimated fair value of these

retirement obligations of approximately $5 million as of December 31, 2015.

This liability may increase over time.

We are unable to estimate the potential amount of future payments under

the foregoing indemnities and agreements.

Legal Matters

Occasionally we are involved in various claims, lawsuits, regulatory examinations,

investigations and other legal matters arising, for the most part, in the ordinary

course of business. The outcome of litigation and other legal matters is always

uncertain. The Company believes it has valid defenses to the legal matters

currently pending against it, is defending itself vigorously and has recorded

accruals determined in accordance with U.S. GAAP, where appropriate.

In making a determination regarding accruals, using available information,

we evaluate the likelihood of an unfavorable outcome in legal or regulatory

proceedings to which we are a party to and record a loss contingency when

it is probable a liability has been incurred and the amount of the loss can be

reasonably estimated. These subjective determinations are based on the

status of such legal or regulatory proceedings, the merits of our defenses

and consultation with legal counsel. Actual outcomes of these legal and

regulatory proceedings may materially differ from our current estimates. It is

possible that resolution of one or more of the legal matters currently pending

or threatened could result in losses material to our consolidated results of

operations, liquidity or financial condition.

To date, none of these types of litigation matters, most of which are typically

covered by insurance, has had a material impact on our operations or

financial condition. We have insured and continue to insure against most of

these types of claims. A judgment on any claim not covered by, or in excess

of, our insurance coverage could materially adversely affect our financial

condition or results of operations.

Employment Agreement Dispute. In or around March 2010, attorneys

representing a group of current and former pilots (the “Claimants”) filed a

Request for Mediation with the American Arbitration Association (the “AAA”)

concerning a dispute over the interpretation of a provision of their individual

JetBlue Airways Corporation Employment Agreement for Pilots (“Employment

Agreement”). In early July 2014, the AAA issued the arbitrator’s Final Award,

awarding 318 of the 972 Claimants a total of approximately $4.4 million,

including interest, from which applicable tax withholdings must be further

deducted. In January 2015, the New York State Supreme Court justice

confirmed the arbitrator’s Final Award and denied Claimants’ motion to

vacate the award. During the fourth quarter of 2015, JetBlue made payment

of the Final Award confirmed by the Court.

Litigation Recovery. During 2015, JetBlue reached an agreement with

respect to the settlement of a dispute. JetBlue recorded a benefit of $6.4

million related to this matter.

NOTE 12 Financial Derivative Instruments and Risk Management

As part of our risk management techniques, we periodically purchase over

the counter energy derivative instruments and enter into fixed forward price

agreements, or FFPs, to manage our exposure to the effect of changes in the

price of aircraft fuel. Prices for the underlying commodities have historically

been highly correlated to aircraft fuel, making derivatives of them effective at

providing short-term protection against volatility in average fuel prices. We also

periodically enter into jet fuel basis swaps for the differential between heating

oil and jet fuel to further limit the variability in fuel prices at various locations.

To manage the variability of the cash flows associated with our variable

rate debt, we have also entered into interest rate swaps. We do not hold

or issue any derivative financial instruments for trading purposes.

Aircraft fuel derivatives

We attempt to obtain cash flow hedge accounting treatment for each

aircraft fuel derivative that we enter into. This treatment is provided for

under the Derivatives and Hedging topic of the Codification. It allows

for gains and losses on the effective portion of qualifying hedges to be

deferred until the underlying planned jet fuel consumption occurs, rather

than recognizing the gains and losses on these instruments into earnings

during each period they are outstanding. The effective portion of realized

aircraft fuel hedging derivative gains and losses is recognized in aircraft

fuel expense in the period the underlying fuel is consumed.

Ineffectiveness can occur in certain circumstances, when the change in the

total fair value of the derivative instrument differs from the change in the

value of our expected future cash outlays for the purchase of aircraft fuel

and is recognized immediately in interest income and other. Likewise, if a

hedge does not qualify for hedge accounting, the periodic changes in its

fair value are recognized in the period of the change in interest income and

other. When aircraft fuel is consumed and the related derivative contract

settles, any gain or loss previously recorded in other comprehensive income

is recognized in aircraft fuel expense. All cash flows related to our fuel

hedging derivatives are classified as operating cash flows.

Our current approach to fuel hedging is to enter into hedges on a

discretionary basis without a specific target of hedge percentage needs.

We view our hedge portfolio as a form of insurance to help mitigate the

impact of price volatility and protect us against severe spikes in oil prices,

when possible.

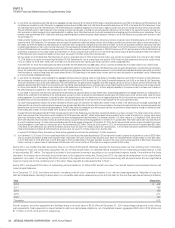

The following table illustrates the approximate hedged percentages of our projected fuel usage by quarter as of December 31, 2015, related to our

outstanding fuel hedging contracts that were designated as cash flow hedges for accounting purposes.

Jet fuel swap

agreements

Jet fuel

collar agreements

Heating oil collar

agreements Total

First Quarter 2016 —% —% —% —%

Second Quarter 2016 —% —% —% —%

Third Quarter 2016 10% —% —% 10%

Fourth Quarter 2016 10% —% —% 10%