JetBlue Airlines 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2015Annual Report 53

PART II

ITEM 8Financial Statements and Supplementary Data

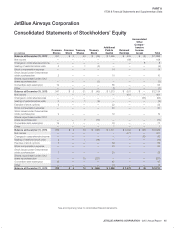

NOTE 5 Stockholders’ Equity

In September 2012, our Board of Directors authorized a share repurchase

program for up to 25 million shares of common stock over a five year

period. The repurchases may be commenced or suspended from time to

time without prior notice. During 2013, we repurchased approximately

0.5 million shares of our common stock for approximately $3 million. During

2014, we repurchased approximately 1.6 million shares of our common

stock for approximately $13 million.

On May 29, 2014, we entered into an accelerated share repurchase

agreement, or ASR, with JP Morgan, or the 2014 ASR, paying $60 million for

an initial delivery of approximately 5.1 million shares. The terms of the ASR

concluded on September 9, 2014 with JP Morgan delivering approximately

0.4 million additional shares to JetBlue. A total of approximately 5.5 million

shares was repurchased under the 2014 ASR, with an average price paid

per share of $10.90.

On June 16, 2015, we entered into an ASR with Goldman, Sachs & Co.,

or the 2015 ASR, paying $150 million for an initial delivery of approximately

6.1 million shares. The terms of the ASR concluded on September 15,

2015 with Goldman, Sachs & Co. delivering approximately 0.7 million

additional shares to JetBlue. A total of approximately 6.8 million shares

was repurchased under the 2015 ASR, with an average price paid per

share of $22.06.

The total shares purchased by JetBlue under the 2014 ASR and 2015 ASR

were based on the volume weighted average prices of JetBlue’s common

stock during the terms of the respective agreements.

In September 2015, JetBlue entered into an agreement for the repurchase

of up to 778,460 shares per day, structured pursuant to Rule 10b5-1

and 10b-18 under the Securities Exchange Act of 1934 as amended,

with a maximum of 3 million shares to be repurchased. The repurchases

commenced on October 30, 2015 and terminated on November 18,

2015 with 3 million shares repurchased for approximately $77 million. As

of December 31, 2015, 3.5 million shares remain available for repurchase

under the 2012 share repurchase program.

As of December 31, 2015, we had a total of 57.1 million shares of our

common stock reserved for issuance. These shares primarily related to

our equity incentive plans and our convertible debt. Refer to Note 7 for

further details on our share-based compensation.

As of December 31, 2015, we had a total of 69.6 million shares of treasury

stock, the majority of which relate to the return of borrowed shares

under our share lending agreement. Morgan Staley terminated our share

lending facility in January 2016 and returned the shares outstanding to

us. Refer to Note 2 for further details on the share lending agreement.

The treasury stock also includes shares that were repurchased under our

share repurchase program.

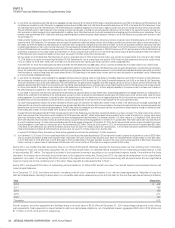

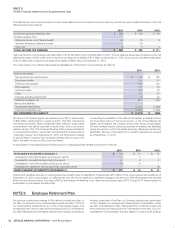

NOTE 6 Earnings Per Share

The following table shows how we computed basic and diluted earnings per common share for the years ended December 31 (dollars and share data

in millions):

2015 2014 2013

Numerator:

Net income $ 677 $ 401 $ 168

Effect of dilutive securities:

Interest on convertible debt, net of income taxes and profit sharing 4 7 9

Net income applicable to common stockholders after assumed conversions for diluted

earnings per share $ 681 $ 408 $ 177

Denominator:

Weighted average shares outstanding for basic earnings per share 315.1 294.7 282.8

Effect of dilutive securities:

Employee stock options and restricted stock units 2.8 2.4 2.1

Convertible debt 26.9 46.2 58.6

Adjusted weighted average shares outstanding and assumed conversions for diluted

earnings per share 344.8 343.3 343.5

Shares excluded from EPS calculation:

Shares issuable upon exercise of outstanding stock options or vesting of restricted stock

units as assumed exercise would be antidilutive — 6.9 13.8

As of December 31, 2015 and 2014, a total of approximately 1.4 million

shares of our common stock, which were lent to our share borrower

pursuant to the terms of our share lending agreement as described in

Note 2, were issued and outstanding for corporate law purposes, but

were returned during January 2016. Holders of the borrowed shares

had all the rights of a holder of our common stock. However, because

the share borrower had to return all borrowed shares to us, or identical

shares or, in certain circumstances of default by the counterparty, the

cash value thereof, the borrowed shares are not considered outstanding

for the purpose of computing and reporting basic or diluted earnings per

share. The fair value of similar common shares not subject to our share

lending arrangement based upon our closing stock price at December

31, 2015, was approximately $32 million.

As discussed in Note 2, during 2015 holders voluntarily converted

approximately $68 million in principal amount of the 5.5% Series B

convertible debentures. As a result, we issued 15.2 million shares of our

common stock.

As discussed in Note 5, JetBlue entered into the 2014 ASR and 2015

ASR and purchased approximately 5.5 million and 6.8 million shares,

respectively, for $60 million and $150 million, respectively based on the

volume weighted average prices of JetBlue’s common stock during the

term of the ASR agreements.

As discussed in Note 5, JetBlue repurchased 3 million shares pursuant

to Rule 10b5-1 and 10b-18 under the Securities Exchange Act of 1934

as amended, during the fourth quarter of 2015.