JetBlue Airlines 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2015Annual Report50

PART II

ITEM 8Financial Statements and Supplementary Data

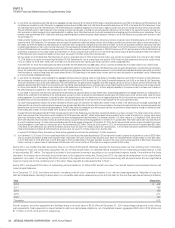

(5) In June 2009, we completed a public offering for an aggregate principal amount of $115 million of 6.75% Series A convertible debentures due 2039, or the Series A 6.75% Debentures. We

simultaneously completed a public offering for an aggregate principal amount of $86 million of 6.75% Series B convertible debentures due 2039, or the Series B 6.75% Debentures. These

are collectively known as the 6.75% Debentures. The 6.75% Debentures are general obligations and rank equal in right of payment with all of our existing and future senior unsecured debt.

They are effectively junior in right of payment to our existing and future secured debt, including our secured equipment debentures, to the extent of the value of the assets securing such

debt, and senior in right of payment to any subordinated debt. In addition, the 6.75% Debentures are structurally subordinated to all existing and future liabilities of our subsidiaries. The net

proceeds were approximately $197 million after deducting underwriting fees and other transaction related expenses. Interest on the 6.75% Debentures is payable semi-annually on April

15 and October 15.

Holders of either the Series A or Series B 6.75% Debentures may convert them into shares of our common stock at any time at a conversion rate of 204.6036 shares per $1,000 principal

amount of the 6.75% Debentures. The conversion rates are subject to adjustment should we declare common stock dividends or effect any common stock splits or similar transactions. If

the holders converted the Series A 6.75% Debentures in connection with a fundamental change that occurred prior to October 15, 2014, the applicable conversion rate would have been

increased depending on our then current common stock price. The same applies to the Series B 6.75% Debentures prior to October 15, 2016. The maximum number of shares into which all

of the 6.75% Debentures are convertible, including pursuant to this make-whole fundamental change provision, is 235.2941 shares per $1,000 principal amount of the 6.75% Debentures

outstanding, as adjusted, or 20.3 million shares as of December 31, 2015. During the fourth quarter of 2014, the remaining principal amount of approximately $76 million of the Series A

6.75% Debentures were converted by holders and as a result, we issued 15.5 million shares of our common stock.

We may redeem any of the Series B 6.75% Debentures for cash at a redemption price of 100% of their principal amount, plus accrued and unpaid interest at any time on or after October

15, 2016. Holders may require us to repurchase the Series B 6.75% Debentures for cash at a repurchase price equal to 100% of their principal amount plus accrued and unpaid interest,

if any, on October 15, 2016, 2021, 2026, 2031 and 2036; or at any time prior to their maturity upon the occurrence of a certain designated event.

As of December 31, 2015, the remaining principal balance of Series B 6.75% Debentures was $86 million, which is currently convertible into 20.3 million shares of our common stock.

We evaluated the various embedded derivatives within the supplemental indenture for bifurcation from the 6.75% Debentures under the applicable provisions, including the basic conversion

feature, the fundamental change make-whole provision and the put and call options. Based upon our detailed assessment, we concluded these embedded derivatives were either (i) excluded

from bifurcation as a result of being clearly and closely related to the 6.75% Debentures or are indexed to our common stock and would be classified in stockholders’ equity if freestanding

or (ii) are immaterial embedded derivatives.

(6) In June 2008, we completed a public offering for an aggregate principal amount of $100.6 million of 5.5% Series A convertible debentures due 2038, or the Series A 5.5% Debentures.

We simultaneously completed a public offering for an aggregate principal amount of $100.6 million for 5.5% Series B convertible debentures due 2038, or the Series B 5.5% Debentures.

These are collectively known as the 5.5% Debentures. The 5.5% Debentures are general senior obligations and were originally secured in part by an escrow account for each series. We

deposited approximately $32 million of the net proceeds from the offering, representing the first six scheduled semi-annual interest payments on the 5.5% Debentures, into escrow accounts

for the exclusive benefit of the holders of each series of the 5.5% Debentures. As of December 31, 2011, all funds originally deposited in the escrow account had been used. Interest on

the 5.5% Debentures is payable on a semi-annual basis on April 15 and October 15.

In June 2008, in conjunction with the public offering of the 5.5% Debentures described above, we also entered into a share lending agreement with Morgan Stanley & Co. Incorporated, an

affiliate of the underwriter of the offering, or the share borrower, pursuant to which we loaned the share borrower approximately 44.9 million shares of our common stock. Under the share

lending agreement, the share borrower is required to return the borrowed shares when the debentures are no longer outstanding. We did not receive any proceeds from the sale of the

borrowed shares by the share borrower, but we did receive a nominal lending fee of $0.01 per share from the share borrower for the use of borrowed shares.

Our share lending agreement requires the shares borrowed be returned upon the maturity of the related debt, October 2038, or earlier, if the debentures are no longer outstanding. We

determined the fair value of the share lending arrangement was approximately $5 million at the date of the issuance based on the value of the estimated fees the shares loaned would have

generated over the term of the share lending arrangement. The $5 million value was recognized as a debt issuance cost and was amortized to interest expense through the earliest put date

of the related debt, October 2013 and October 2015 for Series A and Series B, respectively.

During 2008 and 2009 approximately $79 million principal amount of the 5.5% Debentures was voluntarily converted by holders. As a result, we issued 17.5 million shares of our common

stock. Cash payments from the escrow accounts related to the 2008 conversions were $11 million and borrowed shares equivalent to the number of shares of our common stock issued

upon these conversions were returned to us pursuant to the share lending agreement described above. The borrower returned 10.0 million shares to us in September 2009, almost all of

which were voluntarily returned shares in excess of converted shares, pursuant to the share lending agreement. In October 2011, approximately 16.6 million shares were voluntarily returned

to us by the borrower, leaving 1.4 million shares outstanding under the share lending arrangement. At December 31, 2015, the fair value of similar common shares not subject to our share

lending arrangement, based upon our closing stock price, was approximately $32 million. During the fourth quarter of 2013, the remaining principal amount of approximately $55 million

of the Series A 5.5% Debentures was converted by holders and as a result, we issued 12.2 million shares of our common stock. In 2015, holders voluntarily converted the remaining $68

million principal balance of Series B 5.5% Debentures and as a result, we issued 15.2 million shares of our common stock.

In January 2016, Morgan Stanley terminated our share lending agreement and returned the outstanding 1.4 million shares to us.

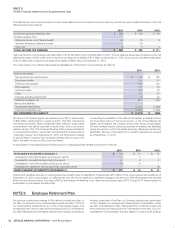

(7) As of December 31, 2015 and 2014, four capital leased Airbus A320 aircraft and two capital leased Airbus A321 aircraft were included in property and equipment at a cost of $253 million

with accumulated amortization of $48 million and $40 million, respectively. The future minimum lease payments under these non-cancelable leases are $23 million in 2016, $23 million

in 2017, $23 million in 2018, $23 million in 2019, $35 million in 2020 and $63 million in the years thereafter. Included in the future minimum lease payments is $35 million representing

interest, resulting in a present value of capital leases of $155 million with a current portion of $15 million and a long-term portion of $140 million.

During 2012, we modified the debt secured by three of our Airbus A320 aircraft, effectively lowering the borrowing rates over the remaining term of the loans.

In exchange for lower borrowing rates associated with two of these aircraft loans, we deposited funds equivalent to the outstanding principal balance, a total

of approximately $57 million. The deposit is included in the long-term investment securities on our consolidated balance sheets. If we withdraw the funds

deposited, the interest rate on the debt would revert back to the original borrowing rate. During June 2015, we executed an amendment to the original facility

agreement; as a result, the remaining $48 million principal of the deposit was returned to us by the borrower along with accrued interest and we negotiated a

lower borrowing rate for the remaining term of the loans. These deposits are discussed further in Note 1.

During 2015, we prepaid $100 million of outstanding principal related to 10 Airbus A320 aircraft, as a result, four aircraft became unencumbered and six had

lower principal balances.

As of December 31, 2015, we believe we were in compliance with all of our covenants in relation to our debt and lease agreements. Maturities of long-term

debt and capital leases, including the assumption our convertible debt will be redeemed upon the first put date, for the next five years are as follows (in millions):

Year Maturities

2016 $ 448

2017 189

2018 196

2019 217

2020 180

Thereafter 613

Aircraft, engines, and other equipment and facilities having a net book value of $2.95 billion at December 31, 2015 were pledged as security under various

loan agreements. Cash payments for interest related to debt and capital lease obligations, net of capitalized interest, aggregated $93 million, $102 million and

$117 million in 2015, 2014 and 2013, respectively.