JetBlue Airlines 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.JETBLUE AIRWAYS CORPORATION-2015Annual Report38

PART II

ITEM 7AQuantitative and Qualitative Disclosures About Market Risk

ITEM 7A. Quantitative and Qualitative Disclosures

About Market Risk

The risk inherent in our market risk sensitive instruments and positions is

the potential loss arising from adverse changes to the price of fuel and

interest rates as discussed below. The sensitivity analyses presented do

not consider the effects such adverse changes may have on the overall

economic activity, nor do they consider additional actions we may take

to mitigate our exposure to such changes. Variable-rate leases are not

considered market sensitive financial instruments and, therefore, are not

included in the interest rate sensitivity analysis below. Actual results may

differ. See Notes 1, 2 and 13 to our consolidated financial statements for

accounting policies and additional information.

Aircraft fuel

Our results of operations are affected by changes in the price and availability

of aircraft fuel. Market risk is estimated as a hypothetical 10% increase in

the December31, 2015 cost per gallon of fuel. Based on projected 2016

fuel consumption, such an increase would result in an increase to aircraft

fuel expense of approximately $120 million in 2016. This is compared

to an estimated $175 million for 2015 measured as of December31,

2014. As of December31, 2015 we had hedged approximately 5% of

our projected 2016 fuel requirements. All hedge contracts existing as of

December31, 2015 settle by December 31, 2016.

The financial derivative instrument agreements we have with our

counterparties may require us to fund all, or a portion of, outstanding

loss positions related to these contracts prior to their scheduled maturities.

The amount of collateral posted, if any, is periodically adjusted based on

the fair value of the hedge contracts.

Interest

Our earnings are affected by changes in interest rates due to the impact

those changes have on interest expense from variable-rate debt instruments

and on interest income generated from our cash and investment balances.

The interest rate is fixed for $1.4 billion of our debt and capital lease

obligations, with the remaining $0.4 billion having floating interest rates. If

interest rates were on average 100 basis points higher in 2016 than they

were during 2015, our interest expense would increase by approximately

$4 million. This is determined by considering the impact of the hypothetical

change in interest rates on our variable rate debt.

If interest rates were an average 10% lower in 2016 than they were

during 2015, our interest income from cash and investment balances

would remain relatively constant. These amounts are determined by

considering the impact of the hypothetical interest rates on our cash and

cash equivalents and short term investment securities balances as of

December31, 2015 and 2014.

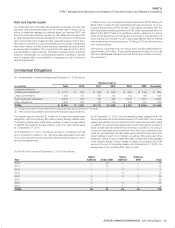

Convertible Debt

On December31, 2015, our $86 million aggregate principal amount of

convertible debt had a total estimated fair value of $405 million, based on

quoted market prices. If there was a 10% increase in our stock price, the fair

value of this debt would have been $446 million as of December31, 2015.