Hyundai 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

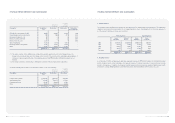

93_Hyundai Motor Company Annual Report 2003 Hyundai Motor Company Annual Report 2003 _94

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

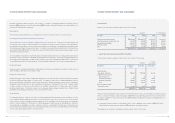

2003 2002 2003 2002

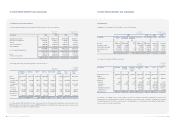

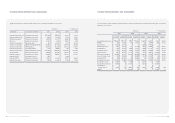

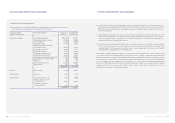

Salaries 1,728,168 1,636,321 $1,442,785 $1,366,105

Export related expenses 925,061 839,878 772,300 701,184

Sales promotion 2,320,814 2,159,849 1,937,564 1,803,180

Sales commission 403,840 405,419 337,151 338,470

Sales warranties 2,028,818 2,211,522 1,693,787 1,846,320

Taxes and dues 55,574 47,906 46,397 39,995

Communications 79,475 57,040 66,351 47,621

Utilities 46,065 41,350 38,458 34,522

Freight and warehousing 145,941 159,823 121,841 133,430

Rent 73,693 48,136 61,524 40,187

Travel 114,055 107,469 95,220 89,722

Service charges 539,698 345,069 450,574 288,086

Supplies 84,031 76,684 70,154 64,021

Research 478,197 313,865 399,229 262,035

Depreciation 219,658 180,301 183,385 150,527

Amortization 233,051 78,139 194,566 65,235

Provision for bad debt 1,532,102 598,448 1,279,097 499,623

Other 84,600 222,037 70,630 185,369

11,092,841 9,529,256 $9,261,013 $7,955,632

Korean won

(in millions)

U. S. dollars (Note 2)

(in thousands)

18. SELLING AND ADMINISTRATIVE EXPENSES

Selling and administrative expenses are as follows:

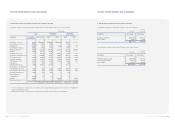

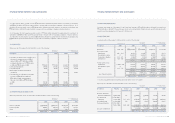

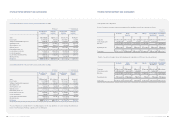

As of December 31, 2003, accumulated temporary differences of the Company and its subsidiaries amount to 4,287,892

million ($3,579,806 thousand) and net operating loss carry-forwards and tax exemption carry-forwards of subsidiaries amount

to 700,472 million ($584,799 thousand) and 135,998 million ($113,540 thousand), respectively. Some portion of the

temporary difference, net operating loss carry-forwards and tax exemption carry-forwards, which are more likely than not,

were not realized as deferred tax assets. Deferred tax assets was calculated using the expected tax rate (for 2004: 29.7%, from

2005 forward: 27.5%) with residual temporary differences. As of December 31, 2003 and 2002, deferred tax assets amount to

2,524,618 million ($2,107,712 thousand) and 1,366,637 million ($1,140,956 thousand), respectively and deferred tax liabilities

amount to 911,537 million ($761,009 thousand) and 124,295 million ($103,769 thousand), respectively.

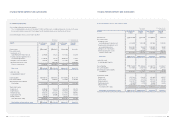

9. INCOME TAX EXPENSE AND DEFERRED INCOME TAX DEBITS (CREDITS)

Income tax expense in 2003 and 2002 consists of the following:

Description 2003 2002 2003 2002

Income tax currently payable 1,145,758 1,023,118 $956,552 $854,164

Changes in deferred income taxes due to:

Temporary differences (411,850) (247,882) (343,839) (206,948)

Tax loss carried forward (61,446) 95,899 (51,299) 80,063

Tax credit carried over (20,023) (6,159) (16,716) (5,142)

Deduction of capital surplus and

retained earnings - (480) - (401)

Excess of limitation on donation to

designated organization, others - 607 - 507

Changes in retained earnings

due to consolidation adjustments - (20,759) - (17,331)

(493,319) (178,774) (411,854) (149,252)

Income tax expense 652,439 844,344 $544,698 $704,912

Korean won

(in millions)

U. S. dollars (Note 2)

(in thousands)

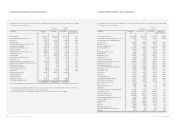

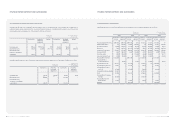

20. DIVIDENDS

The proposed dividends for 2003 are computed as follows:

Number of Dividend rate Korean won U.S. dollars

shares (in millions) (Note 2)

(in thousands)

Common shares, net of treasury shares 218,629,032 20% 218,629 $182,526

Preferred shares, net of treasury shares:

First and Third preferred shares 24,492,541 21% 25,717 21,470

Second preferred shares 37,571,005 22% 41,328 34,503

285,674 $238,499

The proposed dividends for 2002 were computed as follows:

Number of Dividend rate Korean won U.S. dollars

shares (in millions) (Note 2)

(in thousands)

Common shares, net of treasury shares 218,083,132 17% 185,371 $154,760

Preferred shares, net of treasury shares:

First and Third preferred shares 24,492,541 18% 22,043 18,403

Second preferred shares 37,542,305 19% 35,665 29,775

243,079 $202,938

The proposed dividends for 2003 and 2002 were approved at the shareholders’ meeting being held on March 12, 2004 and

March 14, 2003, respectively.