Hyundai 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2003 _5655_Hyundai Motor Company Annual Report 2003

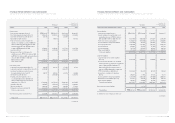

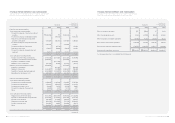

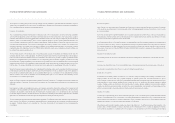

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (CONTINUED)

FOR THE YEARS ENDED DECEMBER 31, 2003 AND 2002

2003 2002 2003 2002

Income before income tax 2,669,048 2,742,797 $2,228,291 $2,289,862

Income tax expense (Note 19) 652,439 844,344 544,698 704,912

Income before minority interests 2,016,609 1,898,453 1,683,593 1,584,950

Minority interests (241,128) (464,058) (201,308) (387,425)

Net income 1,775,481 1,434,395 $1,482,285 $1,197,525

Ordinary income per ordinary common share 7,845 6,313 $6.55 $5.27

Earnings per ordinary common share 7,845 6,313 $6.55 $5.27

Ordinary income per fully diluted common share 7,820 6,290 $6.53 $5.25

Earnings per fully diluted common share 7,820 6,290 $6.53 $5.25

See accompanying notes to consolidated financial statements.

Korean won

(in millions, except

per share amounts)

Translation into

U. S. dollars (Note 2)

(in thousands, except

per share amounts)

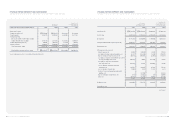

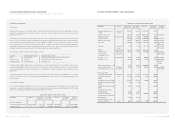

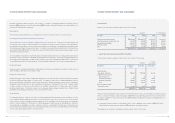

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2003 AND 2002

Capital Capital Retained Capital Minority Total Total

stock surplus earnings adjustments interests amount amount

January 1, 2002 1,476,454 5,306,332 2,473,940 (65,435) 2,512,837 11,704,128 $9,771,354

Additional investment in

subsidiaries - (24,222) - - - (24,222) (20,222)

Disposal of treasury stock - (18) - - - (18) (15)

Merger between subsidiaries - - 1,785 - - 1,785 1,490

Application of the equity

method - - (1,219) - - (1,219) (1,018)

Effect of change in the scope

of consolidation - (588) 590 1,906 52,300 54,208 45,256

Effect of change in the scope

of equity method - - - (3,182) - (3,182) (2,657)

Payment of cash dividends

(Note 19) - - (215,145) - (5,002) (220,147) (183,793)

Net income - - 1,434,395 - - 1,434,395 1,197,525

Treasury stock - - - (6,867) - (6,867) (5,733)

Discount on stock issuance - 1 - 248 - 249 208

Loss on valuation of

investment equity securities - - - (4,704) - (4,704) (3,927)

Stock options - - - (82) - (82) (68)

Cumulative translation debits - - - (67,578) - (67,578) (56,418)

Loss on transaction of

derivatives - - - 39,277 - 39,277 32,791

Effect of change

in the minority interests - - - - 543,866 543,866 454,054

Others - 4,556 (16,363) - - (11,807) (9,857)

December 31, 2002 1,476,454 5,286,061 3,677,983 (106,417) 3,104,001 13,438,082 $11,218,970

(continued)

Korean won

(in millions)

Translation into

U.S. dollars (Note 2)

(in thousands)