Hyundai 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2003 _5857_Hyundai Motor Company Annual Report 2003

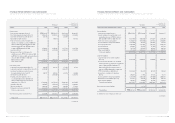

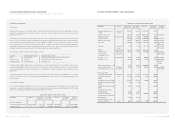

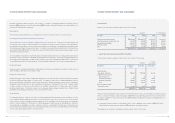

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (CONTINUED)

FOR THE YEARS ENDED DECEMBER 31, 2003 AND 2002

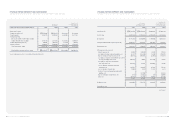

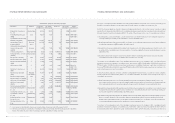

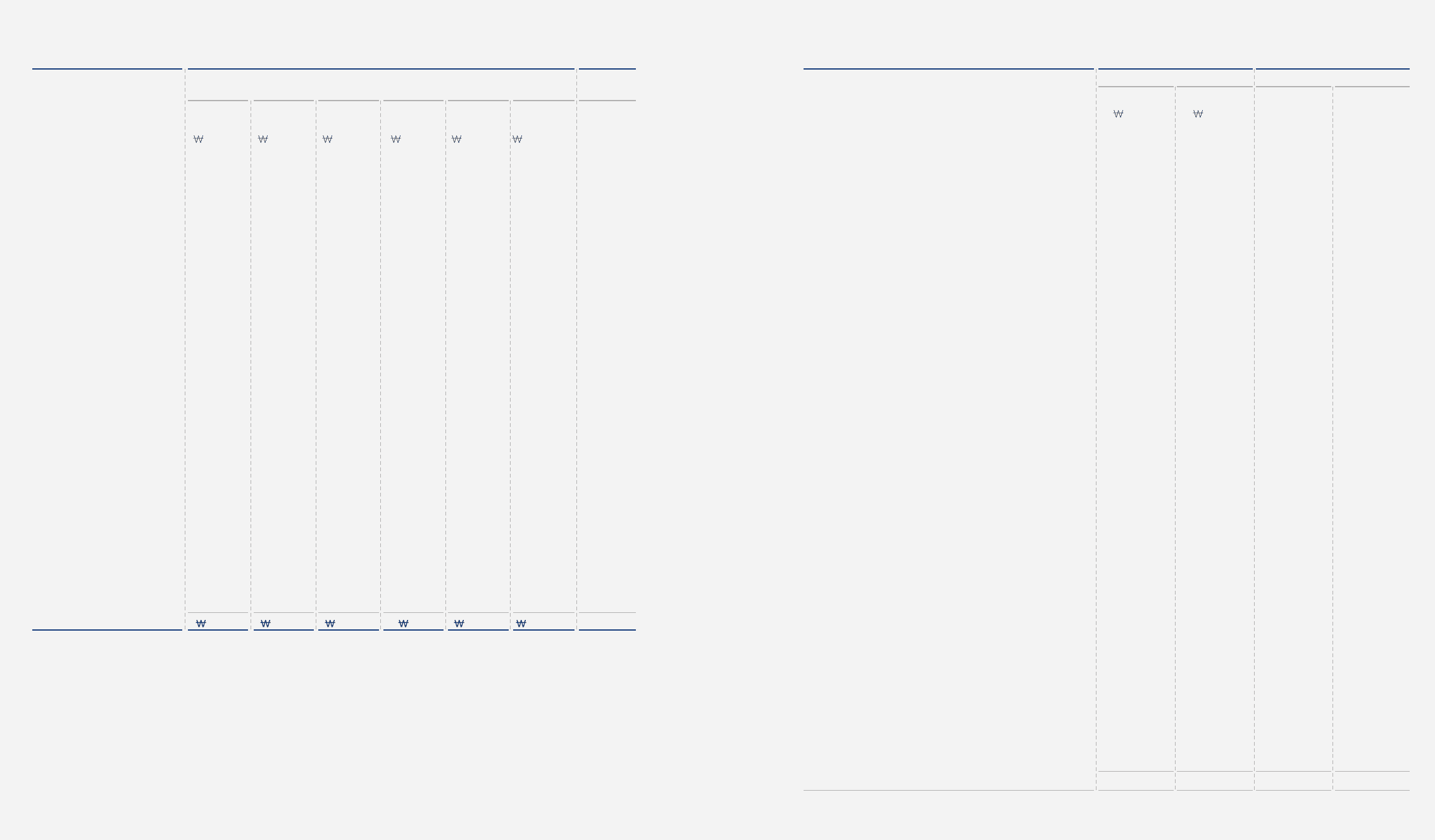

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2003 AND 2002

Capital Capital Retained Capital Minority Total Total

stock surplus earnings adjustments interests amount amount

January 1, 2003 1,476,454 5,286,061 3,677,983 (106,417) 3,104,001 13,438,082 $11,218,970

Additional investment in

subsidiaries - (124,104) - - 46,168 (77,936) (65,066)

Disposal of subsidiaries’ stock - 138,579 (1) - - 138,578 115,694

Extinguishment of treasury

stock by surplus - - (58,367) 9,172 (49,878) (99,073) (82,712)

Application of the equity

method - - 20,741 - - 20,741 17,316

Effect of change in the scope

of consolidation - (17,159) (45,326) - 131,065 68,580 57,255

Effect of change in the scope

of equity method - - (44,149) - - (44,149) (36,858)

Payment of cash dividends

(Note 19) - - (243,079) - (48,096) (291,175) (243,092)

Net income - - 1,775,481 - - 1,775,481 1,482,285

Treasury stock - 15,220 - (15,848) - (628) (524)

Discount on stock issuance - - (171) (2,641) - (2,812) (2,348)

Gain on valuation of

available-for-sale securities - - - 550,328 - 550,328 459,449

Gain on valuation of

investment equity securities - - - 11,380 - 11,380 9,501

Stock options 2,149 - - 3,061 - 5,210 4,350

Cumulative effect of foreign

currency translation - - - 38,420 - 38,420 32,075

Loss on transaction of

derivatives - - - (106,763) - (106,763) (89,133)

Effect of change in the

minority interests - - - - 241,128 241,128 201,309

Others - 30,178 64,663 - 494,469 589,310 491,993

December 31, 2003 1,478,603 5,328,775 5,147,775 380,692 3,918,857 16,254,702 $13,570,464

See accompanying notes to consolidated financial statements.

Korean won

(in millions)

Translation into

U.S. dollars (Note 2)

(in thousands)

2003 2002 2003 2002

Cash flows from operating activities:

Net income 1,775,481 1,434,395 $1,482,285 $1,197,525

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation 1,437,823 1,537,250 1,200,387 1,283,395

Loss (gain) on foreign currency translation, net 65,305 (131,965) 54,521 (110,173)

Loss (gain) on disposal of investments, net (127,567) 63,971 (106,501) 53,407

Loss (gain) on valuation of investments accounted

for using the equity method, net (169,161) 70,065 (141,226) 58,495

Loss on disposal of property, plant and equipment, net 273,696 206,424 228,498 172,336

Loss on valuation of inventories 15,001 5,331 12,524 4,451

Loss (gain) on redemption of debentures, net 115 (37,022) 96 (30,908)

Loss on impairment of investments 45,590 40,850 38,061 34,104

Loss on disposal of trade receivables 77,926 88,006 65,058 73,473

Amortization of discount on debentures 41,193 68,157 34,391 56,902

Amortization of intangibles, net 488,954 830,727 408,210 693,544

Provision for severance benefits 591,737 753,464 494,020 629,040

Provision for warranties and product liability 1,463,308 1,765,807 1,221,662 1,474,209

Provision for doubtful accounts 1,533,664 592,345 1,280,401 494,527

Amortization of present value discount accounts (107,948) (13,245) (90,122) (11,059)

Net income (loss) on minority interests (4,793) 464,058 (4,002) 387,425

Changes in operating assets and liabilities:

Increase in trade notes and accounts

receivable (1,631,248) (1,076,727) (1,361,870) (898,921)

Decrease in advances 136,828 158,826 114,233 132,598

Increase in inventories (1,412,848) (310,670) (1,179,536) (259,367)

Decrease (increase) in other current assets (94,041) 63,411 (78,512) 52,940

Decrease in long-term notes and accounts receivables 4,346 10,906 3,628 9,105

Increase in deferred income tax assets (1,158,341) (32,119) (967,057) (26,815)

Increase in other financial business assets (1,666,097) (4,114,688) (1,390,964) (3,435,205)

Increase (decrease) in trade notes and accounts payable (464,741) 1,630,804 (387,995) 1,361,500

Increase (decrease) in accounts payable-other (385,383) 846,440 (321,742) 706,662

Increase (decrease) in other current liabilities 487,079 (239,565) 406,645 (200,004)

Increase in individual severance insurance deposits (19,526) (266,017) (16,302) (222,088)

Decrease in accrued warranties and accrued

product liabilities (129,315) (143,349) (107,960) (119,677)

Decrease in accrued loss on valuation of derivatives (961) (38,318) (802) (31,990)

Increase in cumulative translation debits, net (70,830) (1,282) (59,134) (1,070)

Increase (decrease) in deferred income tax liabilities 786,795 (103,728) 656,867 (86,599)

Payment of severance benefits (406,840) (308,575) (339,656) (257,618)

Others (96,439) (86,229) (80,514) (71,990)

1,278,762 3,727,738 1,067,592 3,112,154

(continued)

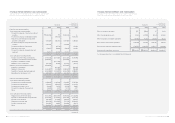

Korean won

(in millions)

Translation into

U. S. dollars (Note 2)

(in thousands)