Hyundai 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2003 _9089_Hyundai Motor Company Annual Report 2003

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

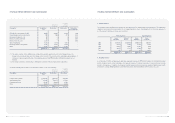

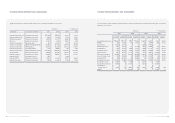

Convertible bonds with the carrying value of 300,000 million ($250,459 thousand) as of December 31, 2003 were issued by

Hyundai Card Co., Ltd, a subsidiary. In, 2003, convertible bonds with the face value of 54 million ($45 thousand) were

converted to 10,820 shares of common stock.

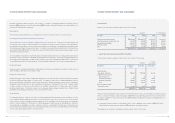

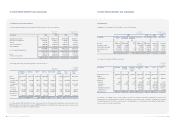

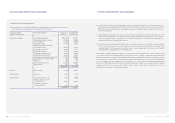

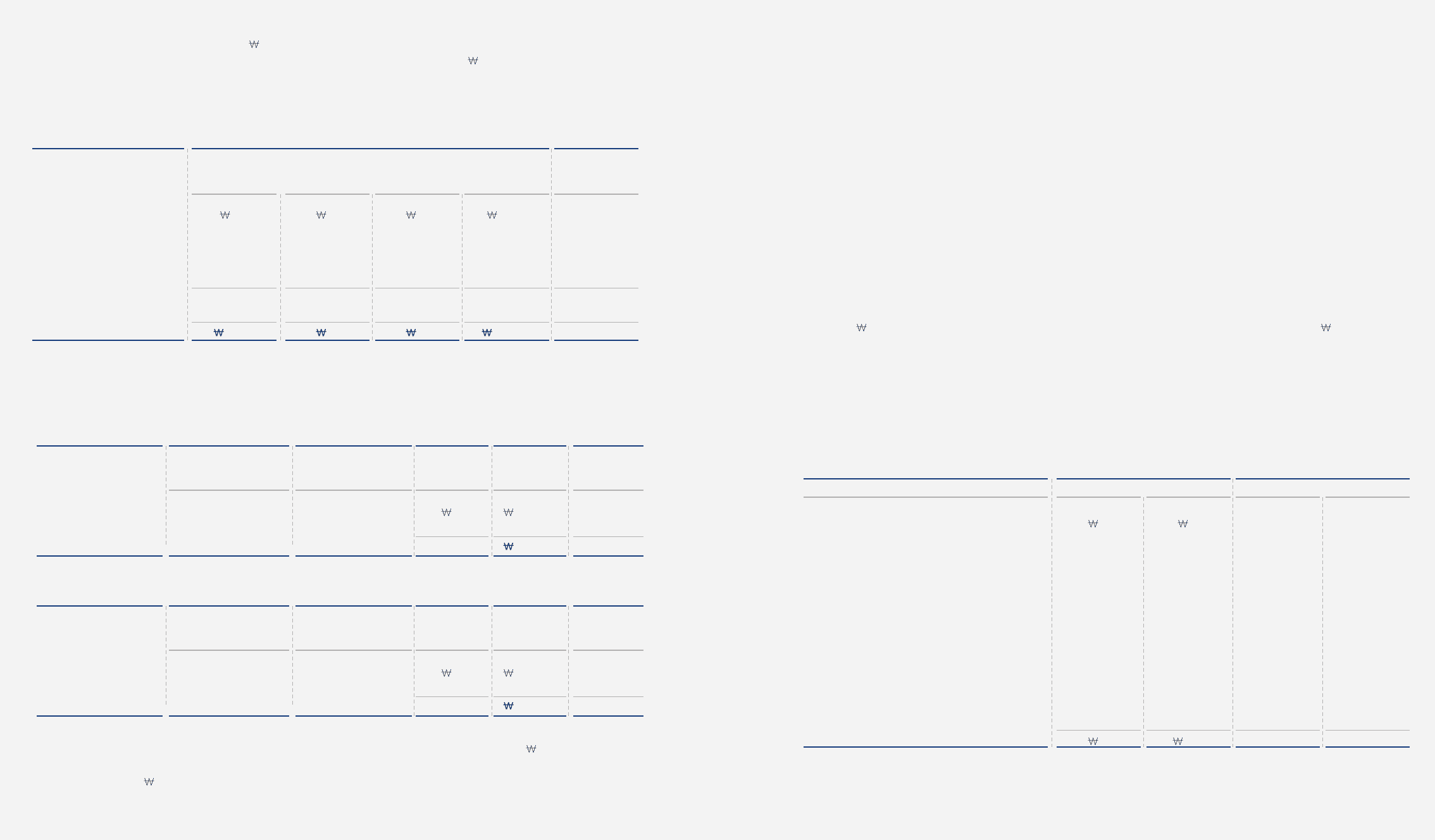

The maturity of long-term debt as of December 31, 2003 is as follows:

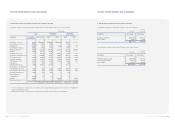

15. CAPITAL STOCK

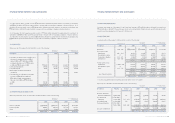

Capital stock as of December 31, 2003 consists of the following:

Debentures Local Foreign Total Total

currency currency

loans loans

2004 5,151,950 237,454 268,939 5,658,343 $4,723,946

2005 2,434,452 202,499 219,373 2,856,324 2,384,642

2006 1,631,585 142,105 75,922 1,849,612 1,544,174

2007 181,860 137,911 52,421 372,192 310,730

Thereafter 1,219,960 156,886 48,046 1,424,892 1,189,591

10,619,807 876,855 664,701 12,161,363 10,153,083

Less: Discount on debentures (75,913) - - (75,913) (63,376)

10,543,894 876,855 664,701 12,085,450 $10,089,707

Korean won

(in millions)

U. S. dollars (Note 2)

(in thousands)

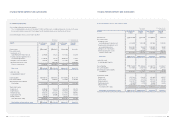

Authorized Issued Par value Korean won U.S. dollars

(in millions) (Note 2)

(in thousands)

Common stock 450,000,000 shares 219,518,502 shares 5,000 1,147,592 $958,083

Preferred stock 150,000,000 shares 65,202,146 shares 5,000 331,011 276,349

1,478,603 $1,234,432

Authorized Issued Par value Korean won U.S. dollars

(in millions) (Note 2)

(in thousands)

Common stock 450,000,000 shares 219,088,702 shares 5,000 1,145,443 $956,289

Preferred stock 150,000,000 shares 65,202,146 shares 5,000 331,011 276,349

1,476,454 $1,232,638

Capital stock as of December 31, 2002 consists of the following:

In 2003, a part of the stock options granted to the directors were exercised at an exercise price of 14,900 and the new

common stock of 429,800 shares were issued. This issue of new common stock resulted in the increase in paid-in capital in

excess of par value by 8,197 million (US $6,843 thousand).

The preferred shares are non-cumulative, participating and non-voting. Of the total preferred stock issued of 65,202,146

shares as of December 31, 2003, a total of 27,588,281 preferred shares (First and Third preferred shares) are eligible to receive

cash dividends, if declared, equal to that declared for common shares plus an additional 1 percent minimum increase while the

dividend rate for the remaining 37,613,865 preferred shares (Second preferred shares) is 2 percent higher than that declared

for common shares.

The Company acquired treasury stock after cancellation of Trust Cash Fund on March 2, 2001. In accordance with the decision

of the Board of Directors, on March 5, 2001, the Company retired 10,000,000 common shares in treasury and 1,000,000

second preferred shares in treasury, which had additional dividend rate of 2 percent to the rate of common stock, using the

retained earnings.

The Company issued 10,000,000 Global Depositary Receipts (GDRs) representing 5,000,000 shares of preferred stock in

November 1992, 4,675,324 GDRs representing 2,337,662 shares of preferred stock in June 1995 and 7,812,500 GDRs

representing 3,906,250 shares of preferred stock in June 1996, all of which have been listed on the Luxembourg Stock

Exchange.

In the second half of 1999, the Company issued 45,788,000 Global Depositary Shares representing 22,894,000 common

shares for 601,356 million (US$502,050 thousand), which include paid-in capital in excess of par value of 486,886 million

($406,484 thousand).

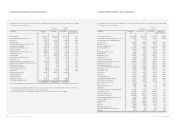

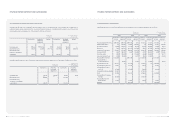

16. CAPITAL ADJUSTMENTS

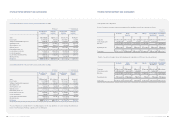

Capital adjustments as of December 31, 2003 and 2002 consist of the following:

Description 2003 2002 2003 2002

Treasury stock (93,191) (86,514) $(77,802) $(72,227)

Discounts on stock issuance (3,015) (374) (2,517) (312)

Gain on valuation of available-for- sale

securities(see Note 4) 565,217 - 471,879 -

Gain (Loss) on valuation of investment

securities accounted for using the equity

method 11,380 (104,232) 9,501 (87,020)

Gain on valuation of investment

securities - 119,121 - 99,450

Stock option cost 16,667 13,605 13,915 11,358

Cumulative translation adjustments (32,503) (70,923) (27,136) (59,211)

Gain (Loss) on valuation of derivatives

(see Note 2) (83,863) 22,900 (70,014) 19,119

380,692 (106,417) $317,826 $(88,843)

Korean won

(in millions)

U. S. dollars (Note 2)

(in thousands)