Hyundai 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2003 _7271_Hyundai Motor Company Annual Report 2003

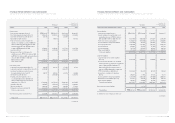

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

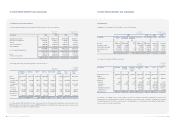

Restructuring of Receivables and Payables

If principal, interest rate or repayment period of receivables is changed unfavourably for the Company by the court imposition

such as commencement of reorganization or by mutual agreements and the difference between nominal value and present

value is material, such difference is recorded in other expense as provision for doubtful accounts. The difference is amortized

using the effective interest method, with the amortization included in interest income or interest expense.

Discount on Debentures

Discount on debentures is the difference between the issued amount and the face value of debentures. It is presented as a

deduction from to the face value of debentures and amortized over the redemption period of the debentures using the

effective interest rate method. Amortization of discount is recognized as interest expense on the debenture.

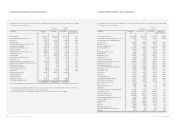

Accrued Severance Benefits

Employees and directors of the Company and its subsidiaries are entitled to receive a lump-sum payment upon termination of

their service based on the applicable severance plan of each company. The accrued severance benefits that would be payable

assuming all eligible employees of the Company and its domestic subsidiaries terminated their employment amount to

2,777,405 million ($2,318,755 thousand) and 2,592,509 million ($2,164,392 thousand) as of December 31, 2003 and 2002,

respectively.

Accrued severance benefits are funded through an individual severance insurance plan. Individual severance insurance

deposits, of which a beneficiary is a respective employee, are presented as deduction from accrued severance benefits. Actual

payments of severance benefits amounted to 406,840 million ($339,656 thousand) and 308,575 million ($257,618

thousand) in 2003 and 2002, respectively.

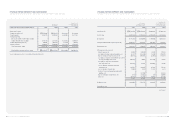

Accrued Warranties and Product Liabilities

The Company and its subsidiaries generally provide a warranty to the ultimate consumer with each product and accrue

warranty expense at the time of sale based on actual claims history. Also, the Company accrues potential expenses, which may

occur due to product liabilities suits, pending voluntary recall campaign and other obligation as of the balance sheet date.

Actual costs incurred are charged against the accrual when paid.

Stock Options

The Company and its subsidiaries compute total compensation expense to stock options, which are granted to employees and

directors, by the fair value method using the option-pricing model. The compensation expense has been accounted for as a

charge to current operations and a credit to capital adjustments from the grant date using the straight-line method.

Derivative Instruments

All derivative instruments are accounted for at fair value with the valuation gain or loss recorded as an asset or liability. If the

derivative instrument is not part of a transaction qualifying as a hedge, the adjustment to fair value is reflected in current

operations. The accounting for derivative transactions that are part of a qualified hedge based both on the purpose of the

transaction and on meeting the specified criteria for hedge accounting differs depending on whether the transaction is a fair

value hedge or a cash flow hedge. Fair value hedge accounting is applied to a derivative instrument designated as hedging

the exposure to changes in the fair value of an asset or a liability or a firm commitment (hedged item) that is attributable to a

particular risk. The gain or loss both on the hedging derivative instruments and on the hedged item attributable to the hedged

risk is reflected in current operations. Cash flow hedge accounting is applied to a derivative instrument designated as hedging

the exposure to variability in expected future cash flows of an asset or a liability or a forecast transaction that is attributable to

a particular risk. The effective portion of gain or loss on a derivative instrument designated as a cash flow hedge is recorded

as a capital adjustment and the ineffective portion is recorded in current operations. The effective portion of gain or loss

recorded as a capital adjustment is reclassified to current earnings in the same period during which the hedged forecasted

transaction affects earnings. If the hedged transaction results in the acquisition of an asset or the incurrence of a liability, the

gain or loss in capital adjustment is added to or deducted from the asset or the liability.

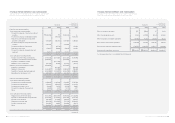

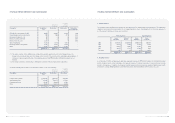

The Company and its domestic subsidiaries entered into derivative instrument contracts including forwards, options and

swaps to hedge the exposure to changes in foreign exchange rate. As of December 31, 2003 and 2002, the Company and its

domestic subsidiaries deferred the loss of 83,863 million (US$70,014 thousand) and gain of 22,900 million (US$19,118

thousand), respectively, on valuation of the effective portion of derivative instruments for cash flow hedging purposes from

forecasted exports as capital adjustments. The Company and its subsidiaries recognized loss on valuation of the ineffective

portion of such derivative instruments and the other derivative instruments in current operations.

The Company entered into derivative instrument contracts with the settlement for the difference between the fair value and

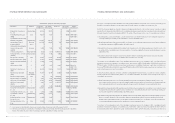

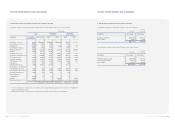

the contracted initial price of Kia Motors Corporation shares as follows:

(*) The Company has the position of seller.

The gain or loss on valuation of these derivatives related to the fair value of Kia shares is recognized in current operations. As

of December 31, 2003, all premiums to be paid by the Company are recorded as long-term other accounts payable in

long-term liabilities of 89,864 million (US$75,024 thousand) and accounts payable – other of 27,706 million (US$ 23,131

thousand), after deducting the present value discount of 20,959 million (US$17,498 thousand). Also, as of December 31,

2003, all premiums to be received by the Company are recorded as long-term other accounts receivable of 14,745 million

(US$12,310 thousand) and accounts receivable-other of 4,547 million (US$3,796 thousand), after deducting the present

value discount of 3,441 million (US$2,873 thousand). The present value discount will be amortized using the effective

interest method.

In 2003 and 2002, the Company and its subsidiaries recognized the net loss of 39,548 million (US$33,017 thousand) and the

net gain of 30,653million (US$25,591 thousand), respectively, on valuation of the ineffective portion of such instruments and

the other derivative instruments in current operations.

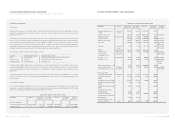

The Company and its domestic subsidiaries recorded total gain on valuation of outstanding derivatives and present value of

premiums of 162,722 million (US$135,851 thousand) and 51,622 million (US$43,097 thousand) in other assets as of

Contract Parties Derivatives Period Number of Initial Price

Kia shares

Credit Suisse First Boston International Equity swap September 17, 2003 ~

September 8, 2008 12,145,598 US$ 8.2611

Credit Suisse First Boston International Call option (*) " 12,145,598 US$ 11.5300

Credit Suisse First Boston International Equity swap " 21,862,076 US$ 8.2611

JP Morgan Chase Bank, London Branch Equity swap " 14,574,717 US$ 7.8811