Hyundai 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

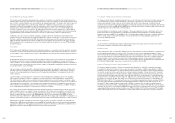

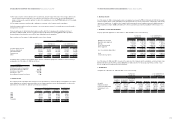

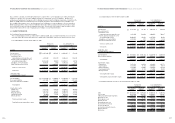

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

As of December 31, 2002 and 2001, significant balances related to the transactions between the Company and

consolidated subsidiaries are as follows:

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Subsidiaries Counterpart Subsidiaries 2002 2001 2002 2001

Kia Motors Corporation WIA Corporation 11,593 -

$

9,658

$

-

Kia Motors Corporation Hyundai Powertech - 119,927 - 99,906

Kia Motors Corporation Kia Motors America

Inc. and etc. 636,022 1,116,256 529,842 929,903

Kia Motors Corporation KIA Canada, Inc 100,956 104,021 84,102 86,655

Kia Motors Corporation Kia Motors

Deutschland GmbH. 211,704 166,049 176,361 138,328

KEFICO Corporation Kia Motors Corporation 7,606 10,077 6,336 8,395

Hyundai Dymos Kia Motors Corporation

(formerly Korea Drive

Train System) 2,413 3,042 2,010 2,534

Hyundai Capital Service Hyundai Powertech

Inc. 16,047 - 13,368 -

Wia Corporation Kia Motors Corporation 93,340 - 77,757 -

Hyundai Powertech Kia Motors Corporation 26,902 27,128 22,411 22,599

Hyundai HYSCO Kia Motors Corporation 16,788 18,929 13,985 15,769

Hyundai Translead(HT, HAOSVT

formerly Hyundai Preci-

Sion America Inc.) 30,245 - 25,196 -

Hyundai Motor Finance HAOSVT

Company - 10,609 - 8,838

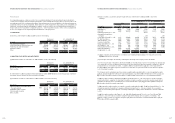

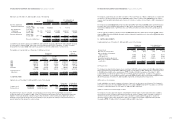

22. RELATED PARTY TRANSACTIONS

In 2002, significant transactions with related parties other than the consolidated subsidiaries are as follows :

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Companies Related Party Sales, Purchases, Sales, Purchases,

Revenues Expenses Revenues Expenses

Hyundai Motor Company Hyundai Mobis 304,130 864,982 $ 253,357 $ 720,578

Kia Motors Corporation Hyundai Mobis 861,712 1,101,049 717,854 917,235

In 2001, significant transactions with related parties other than the consolidated subsidiaries are as follows :

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Companies Related Party Sales, Purchases, Sales, Purchases,

Revenues Expenses Revenues Expenses

Hyundai Motor Company Hyundai Mobis 229,478 636,316 $ 191,168 $ 530,087

Kia Motors Corporation Hyundai Mobis 97,792 159,367 81,466 132,762

As of December 31, 2002, significant balances related to the transactions other than the consolidated subsidiaries are as

follows:

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Companies Related Party Receivables Payables Receivables Payables

Hyundai Motor Company Hyundai Mobis 26,497 96,838 $ 22,073 $ 80,671

Kia Motors Corporation Hyundai Mobis 111,345 137,978 92,757 114,943

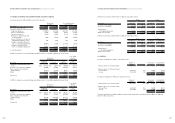

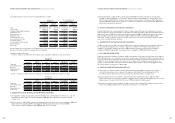

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

As of December 31, 2001, significant balances related to the transactions other than the consolidated subsidiaries are as

follows:

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Companies Related Party Sales, Purchases, Sales, Purchases,

Revenues Expenses Revenues Expenses

Hyundai Motor Company Hyundai Mobis 9,366 109,228 $ 7,802 $ 90,993

Kia Motors Corporation Hyundai Mobis 74,557 20,789 62,110 17,318

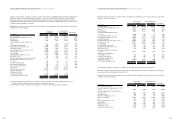

23. COMMITMENTS AND CONTINGENCIES

(1) The Company and its consolidated subsidiaries are contingently liable for guarantees of indebtedness of other

companies including subsidiaries as of December 31, 2002 as follows:

Company providing Company provided Korean won U.S. dollars(Note 2)

guarantee of indebtedness guarantee of indebtedness (in millions) (in thousands)

Hyundai Motor Company Hyundai Merchant Marine 411,444 $ 342,756

Hyundai Motor Finance

Company 204,068 170,000

Hyundai Translead 176,459 147,000

Hyundai Motor India 117,835 98,163

HAOSVT 86,742 72,261

Hyundai Motor Japan Co. 15,193 12,657

Hyundai Motor Amerida 132,706 110,551

Hyundai Motor Poland Sp.Zo.O 10,687 8,903

Hyundai Motor Europe GmbH 56,581 47,135

Other overseas 2,258 1,881

Other domestic 2,401 2,000

1,216,374 $1,013,307

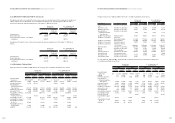

Company providing Company provided Korean won U.S. dollars(Note 2)

guarantee of indebtedness guarantee of indebtedness (in millions) (in thousands)

Kia Motors Corporation Kisan Corporation 2 2

Hyundai Dymos (formerly

Korea Drive Train System) Wia Corporation 112,003 93,305

WIA Corporation Hyundai Dymos (formerly Korea

Drive Train System) 7,831 6,524

Hyundai HYSCO Hyundai Pipe of America, Inc. 6,002 5,000

Hyundai-Huy Hoang Pipe

Company Limited 1,751 1,459

7,753 $6,459

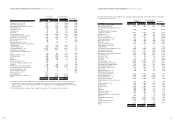

(2) As of December 31, 2002, the outstanding balance of accounts receivable discounted with recourse and transferred by

the Company and its consolidated subsidiaries amounts to 38,051 million ($31,699 thousand) except for short-term

borrowings of 2,479,563 million ($2,065,614 thousand) resulting from elimination of significant balances related to the

transactions between the consolidated subsidiaries.

(3) The Company and its consolidated subsidiaries have used a customer financing system related to a long-

terminstallment sales system and have provided guarantees to related banks amounting to 375,891 million ($313,138

thousand) as of December 31, 2002. These guarantees are all covered by insurance contracts, which specify the

customer and the Company and its subsidiaries as contractor and beneficiary, respectively.

(4) The Company accrues estimated product liabilities expenses and carries the products and completed operations

liability insurance (see Note 6) in order to cover the potential loss, which may occur due to the lawsuits related to its

operation such as product liabilities. The Company expects that the resolution of cases pending against the Company

as of December 31, 2002 will not have any material effect on its financial position.

84 85