Hyundai 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

6. INSURED ASSETS

As of December 31, 2002, certain property, plant and equipment are insured for 9,585,558 million ($7,985,303 thousand)

and the Company and its certain subsidiaries carry general insurance for vehicles and workers' compensation and casualty

insurance for employees. In addition, the Company and Kia carry products and completed operations liability insurance

with a maximum coverage of 182,260 million ($151,833 thousand) thousand with Hyundai Marine & Fire Insurance Co.,

Ltd..

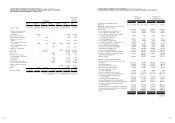

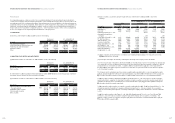

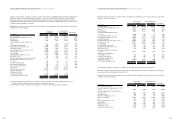

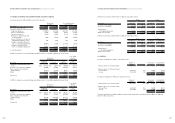

7. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment as of December 31, 2002 and 2001 consists of the following:

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

2002 2001 2002 2001

Buildings and structures 5,266,364 5,007,175

$

4,387,174

$

4,171,255

Machinery and equipment 8,270,212 8,103,729 6,889,547 6,750,857

Vehicles 142,681 111,248 118,861 92,676

Tools, Dies and molds 3,486,128 3,277,943 2,904,139 2,730,709

Other equipment 948,627 794,554 790,259 661,908

18,114,012 17,294,649 15,089,980 14,407,405

Less: Accumulated depreciation (6,415,241) (5,317,325) (5,344,253) (4,429,627)

11,698,771 11,977,324 9,745,727 9,977,778

Land 3,942,288 3,848,526 3,284,145 3,206,036

Construction in progress 1,104,179 1,079,647 919,843 899,406

16,745,238 16,905,497 $13,949,715 $14,083,220

As of December 31, 2002 and 2001, the value of the land, which the Company and its subsidiaries own domestically, totals

3,097,198 million ($2,580,138thousand) and 2,901,555 million ($2,417,157 thousand), respectively, in terms of land

prices officially announced by the Korean government.

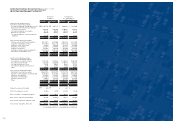

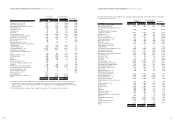

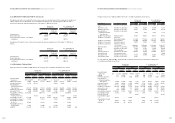

8. INTANGIBLES

Intangibles as of December 31, 2002 and 2001 consist of the following:

Korean won U. S. dollars (Note 2)

(in millions) (in thousands)

2002 2001 2002 2001

Accumulated

Acquisition Accumulated impairment

cost amortization loss Book value Book value Book value Book value

Goodwill 1,070,371 210,514 - 859,857 899,278

$

716,309

$

749,149

Negative goodwill (135,388) (22,719) - (112,669) (118,225) (93,860) (98,488)

Industrial property rights 30,021 10,624 - 19,397 19,298 16,159 16,076

Development costs 2,120,507 1,174,802 115,862 829,843 1,310,142 691,305 1,091,421

Other 109,625 27,943 - 81,682 40,742 68,046 33,940

3,195,136 1,401,164 115,862 1,678,110 2,151,235 $1,397,959 $1,792,098

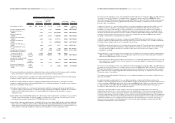

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

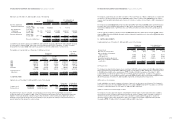

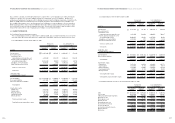

(*1) The equity securities of these affiliates were excluded from using the equity method since the Company believes the

changes in the investment value due to the changes in the net assets of the investee, whose individual beginning

balance of total assets or paid-in capital at the date of its establishment is less than 7,000 million ($5,831 thousand),

are not material.

(*2) Percentage ownership is calculated by combining the ownership of the Company and its subsidiaries.

Unlisted investment equity securities are stated at cost, except where an investee’s net equity value has declined and is

not expected to recover.

Total net equity value of unlisted investment equity securities, which the Company and its subsidiaries hold as of

December 31, 2002 and 2001, amounts to 223,369 million ($186,079 thousand) and 208,891 million ($174,018

thousand), respectively, based on the investees’ latest individual financial statements.

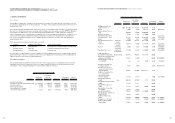

Debt securities as of December 31, 2002 and 2001 consist of the following:

Book value

Korean won Korean won U.S. dollars (Note 2)

(in millions) (in millions) (in thousands)

Historical cost 2002 2001 2002 2001

Securities finance bonds - - 228,937 $ - $ 190,717

Overseas debentures 167,293 163,962 181,976 136,589 151,596

Subordinated debt 237,450 210,371 101,458 175,251 84,520

Private bonds 68,110 49,950 15,329 41,611 12,770

Other 38,845 35,874 49,970 29,885 41,628

511,698 460,157 577,670 $383,336 $481,231

Investment equity securities of the Company and its domestic subsidiaries pledged as collateral for various borrowings

and payables as of December 31, 2002 are as follows:

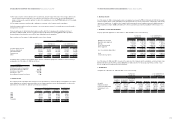

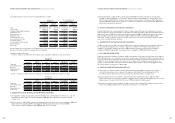

5. LEASED ASSETS

The Company and its subsidiaries have entered into lease agreements for certain machinery and equipment. The capital

lease obligations are included in long-term debt in the accompanying balance sheets. Annual payments on these lease

agreements as of December 31, 2002 are as follows (won in millions):

Financing leases Operating leases

Lease Interest Lease Lease

Payments Portion Obligation Payments

2003 97,765 15,214 82,551 39,963

2004 76,111 7,758 68,353 39,436

2005 62,521 6,571 55,950 18,260

2006 61,980 6,026 55,954 5,379

Thereafter 38,773 3,408 35,365 7,488

337,150 38,977 298,173 110,526

Company No. of shares pledged

Hyundai Corporation 1,514,841

Machinery Insurance Cooperative 150

Kisan Mutual Saving’s & Finance 306,160

Kia Motors Corporation 3,970,000

Kia Steel Co., Ltd. 175,100

Korea Defense Industry Association 1,500

72 73