Hyundai 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

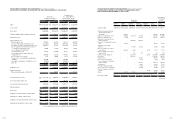

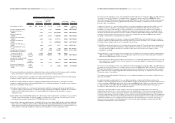

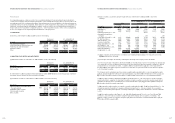

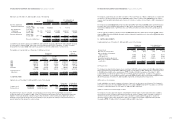

Capital stock as of December 31, 2002

U.S. dollars

Korean won (Note 2) Percentage Indirect

Business (in millions) (in thousands) Shares (*) Ownership (*) Ownership (*)

Kia Canada, Inc. (KCI) Sales 66,889 55,722 6,298 100.00 Kia82.5%,

KMA 17.5%

Kia Motors Belgium (KMB) 1,257 1,047 1,000,000 100.00 KME 100.00%

Kia Motors Czech s.r.o.

(KMCZ) 4,412 3,675 106,870,000 100.00 KME 100.00%

Kia Motors (UK) Ltd.

(KMUK) 33,489 27,898 17,000,000 100.00 KME 100.00%

Kia Motors Austria GmbH

(KMAS) 2,650 2,208 2,107,512 100.00 KME 100.00%

Kia Motors Hungary Kft

(KMH) 146 122 30,000,000 100.00 KME 100.00%

Kia Motors Polska Sp.z.o.o.

(KMP) 4,904 4,085 15,637 99.60 KMD 99.60%

Kia Heavy Industries U.S.A.,

Corp. 720 600 1,200 100.00 WIA 100.00%

Hyundai Pipe of America, Inc. 2,401 2,000 250,000 100.00 HYSCO 100%

Hyundai America Technical

Center Inc. (HATCI) R & D 12,004 10,000 1,000 100.00

Hyundai Motor Finance Financing 120,040 100,000 750 100.00 HMA 100.00%

Company (HMFC) service

Hyundai Auto Canada Captive

Insurance Incorporation Insurance 1,142 951 100 100.00 HMA 100.00%

(HACCII) service

Real Estate 1,399 1,165 4,088,071 100.00 HMA 100.00%

Sevenwood Property Inc. rent

Kia Motors Europe GmbH Holding 31 26 25,000 100.00 Kia 100.00%

(KME) company

(*) Shares and ownership are calculated by combining the shares and ownership, which the Company and its subsidiaries

hold as of December 31, 2002. Indirect ownership represents subsidiaries’ holding ownership.

Among the consolidated domestic subsidiaries, Kia and Hyundai HYSCO have been listed on the Korea Stock Exchange,

and Bontek is under composition with creditors according to the Composition Act.

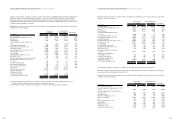

In 2002, the Company added two domestic companies including Daimler Hyundai Truck Co., Ltd. and ten overseas

companies including Hyundai Motor Europe GmbH (HME) to its consolidated subsidiaries. The details of these changes in

the scope of consolidation are as follows:

(1) DongFeng Yueda Kia Motor Co., Ltd. (formerly Hyundai-Kia-Yueda Motor Company) and Daimler Hyundai Truck Co.,

Ltd. whose equity securities had been accounted for using the equity method in 2001 are included in the consolidation

mainly due to the holding and acquisition of ownership enabling the Company and its subsidiaries to exercise

substantial control.

(2) Hyundai Motor Europe GmbH (HME) and Autoever, which had not been included in the consolidation nor accounted for

using the equity method in 2001, are included in 2002 consolidation since its individual total assets at the end of the

preceding year exceeded the required level of 7,000 million ($5,831 thousand).

(3) Hyundai Motor Manufacturing Alabama, LLC (HMMA), Kia Motors Europe GmbH (KME), Kia Motors Belgium (KMB), Kia

Motors Czech s.r.o. (KMCZ), Kia Motors (UK) Ltd. (KMUK), Kia Motors Austria GmbH (KMAS), Kia Motors Hungary Kft

(KMH) and Hyundai Auto Canada Captive Insurance Incorporation (HACCII) are included in the consolidation due to the

new acquisition of ownership enabling the Company and its subsidiaries to exercise substantial control.

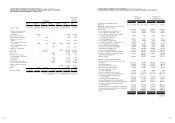

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

The inclusion of the individual accounts of the subsidiaries mentioned above in the Company’s 2002 consolidated financial

statements increased the Company’s consolidated assets, shareholders’ equity and revenues by 698,043 million

($581,509 thousand), 29,926 million ($24,930 thousand) and 1,094,755 million ($911,992 thousand), respectively and

decreased consolidated net income by 22,069 million ($18,385 thousand) [I2] as compared to the results using the

previous scope of consolidation.

In 2002, Korea Precision Co., Ltd, which was an indirect consolidated subsidiary through investment of WIA, one of the

Company’s domestic subsidiaries, was merged into Hyundai Dymos (formerly Korea Drive Train System), another

subsidiary. In accordance with financial accounting standards for consolidated financial statements in the Republic of

Korea, which state that when consolidated companies are merged together during a fiscal year, consolidated financial

statements would reflect this transaction as if the controlling company acquired additional interest rather than a merger

took place, the net income for Korea Precision Co., Ltd. as of the merger date, amounting to 4,864 million ($4,052

thousand), is reflected in the consolidated income statement.

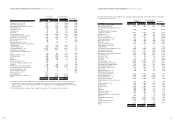

In 2001, the Company added seven domestic companies including ROTEM (formerly Korea Rolling Stock Co.) and four

overseas companies including Hyundai-Assan Otomotiv Sanayi Ve Ticaret Anonim Sirketi to its consolidated subsidiaries.

The details of these changes in the scope of consolidation are as follows:

(1) ROTEM (formerly Korea Rolling Stock Co.), Hyundai-Assan Otomotiv Sanayi Ve Ticaret Anonim Sirketi, Hyundai Pipe of

America, Inc. and Hyundai-Huy Hoang Pipe Company Limited whose equity securities had been accounted for using

the equity method in 2000 are included in consolidation mainly due to the increase in the Company’s and its

subsidiaries’ ownership.

(2) Cheju Dynasty Co., Ltd, which had not been included in the consolidation nor accounted for using the equity method in

2000, is included in 2001 consolidation since its individual total assets at the end of the preceding year exceeded the

required level of 7,000 million ($5,831 thousand).

(3) Hyundai Powertech, WIA Corporation, WISCO, Korea Precision Co., Ltd, Bontek and Kia Heavy Industries U.S.A., Corp.

are included in the consolidation due to the new acquisition of ownership enabling the Company and its subsidiaries to

exercise substantial control.

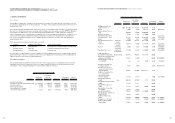

The inclusion of the individual accounts of the subsidiaries mentioned above in the Company’s 2001 consolidated financial

statements increased the Company’s consolidated assets and revenues by 2,426,041 million ($2,021,027 thousand) and

715,047 million ($595,674 thousand), respectively and decreased consolidated net income and shareholders’ equity by

6,275 million ($5,227 thousand) and 2,464 million ($2,053 thousand), respectively, as compared to the results using

the previous scope of consolidation.

The Company excluded Hyundai Motor Europe Pars in its consolidated subsidiaries as of December 31, 2001 due to the

disposal of investments.

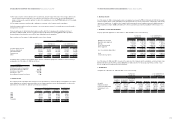

Goodwill and negative goodwill related to the consolidated subsidiaries computed as the difference between the

acquisition cost and the Company’s portion of the subsidiaries’ net equity at the date when the Company obtained control

over the subsidiaries is 340,288 million ($283,479 thousand) and 108,169 million ($90,111 thousand) as of December

31, 2002, respectively, and 343,704 million ($286,325 thousand) and 118,225 million ($98,488 thousand) as of

December 31, 2001, respectively, net of accumulated amortization.

In response to general unstable economic conditions, the Korean government and the private sector have been

implementing structural reforms to historical business practices. Implementation of these reforms is progressing slowly,

particularly in the areas of restructuring private enterprises and reforming the banking industry. The Korean government

continues to apply pressure to Korean companies to restructure into more efficient and profitable firms. The Company and

its subsidiaries may be either directly or indirectly affected by these general unstable economic conditions and the reform

program described above. The accompanying financial statements reflect management’s assessment of the impact to

date of the economic situation on the financial position of the Company and its subsidiaries. Actual results may differ

materially from management’s current assessment.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

58 59