Hyundai 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

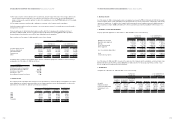

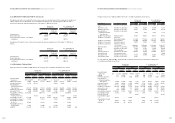

(4) Stock option cost

The Company granted stock options to 104 directors (grant date: March 10, 2000, beginning date for exercise: March 10,

2003, expiry date for exercise: March 9, 2008), at an exercise price of 14,900 ($12.41) as determined during the meeting

of the shareholders on March 10, 2000. These stock options require at least two-year continued service for exercise. If all

of the stock options as of December 31, 2002 and 2001 are exercised, 1,340,000 and 1,470,000 new shares or shares held

as treasury stock, respectively, will be granted according to the decision of the Board of Directors.

The Company calculates the total compensation expense using an option-pricing model. In the model, the risk-free rate

of 9.04 percent, an expected exercise period of 5.5 years and an expected variation rate of stock price of 71.1 percent are

used. Total compensation expense amounting to 12,291 million ($10,239 thousand) and 12,208 million ($10,170

thousand) in 2002 and 2001, respectively, has been accounted for as a charge to current operations and a credit to capital

adjustment over the required period of service (two years) from the grant date using the straight-line method.

In addition, Kia, a domestic subsidiary, granted stock options to 62 directors (grant date: March 17, 2000, beginning date

for exercise date: March 17, 2003, expiry date for exercise : March 18, 2008), at an exercise price of 5,500 ($4.58) as

determined during the meeting of the shareholders on March 17, 2000. If all of the stock options, which require at least

two-year continued service, are exercised, 950,000 new shares or shares held as treasury stock will be granted in

accordance with the decision of the Board of Directors. The Company calculates the total compensation expense using

an option-pricing model. In the model, the risk-free rate of 10.0 percent, an expected exercise period of 5.5 years and an

expected variation rate of stock price of 83.9 percent are used. Total compensation expense amounts to 3,735 million

($3,111 thousand) and to be accounted for as a charge to current operations and a credit to capital adjustment over the

required period of service from the grant date using the straight-line method.

(5) Cumulative translation adjustments

Cumulative translation debits of 70,923 million ($59,083 thousand) and 5,251 million ($4,374 thousand) as of

December 31, 2002 and 2001, respectively, which result from the translation of financial statements of overseas

subsidiaries and two branches located in the United States, is included in capital adjustments on the basis set forth in

Note 2.

(6) Gain (loss) on valuation of derivatives

The gain (loss) on valuation of the effective portion of derivative instruments for cash flow hedging purpose from

forecasted exports is included in capital adjustments on the basis set forth in Note 2. The Company recorded a gain of

22,900 million ($19,077 thousand) and a loss of 16,377 million ($13,643 thousand) as of December 31, 2002 and 2001,

respectively.

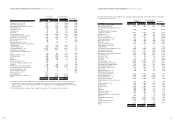

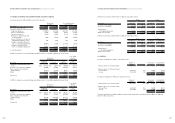

15. PLEDGED ASSETS, CHECKS AND NOTES

As of December 31, 2002, the following assets, checks and notes are pledged as collateral:

(1) The Company’s and its domestic subsidiaries' property, plant and equipment are pledged as collateral for various loans

to a maximum of 3,565 billion ($2,970 million).

(2) The Company’s and its domestic subsidiaries’ cash and cash equivalents of 33,405 million ($27,828 thousand),

financial instruments of 143,889 million ($119,868 thousand), marketable securities and investment securities (see

Note 4) are pledged as collateral for various borrowings, debentures, payables, lease agreements, guarantees of a

customer financing system and others.

(3) Certain overseas subsidiaries’ receivables, inventories and other financial business assets are pledged as collateral for

their borrowings.

(4) 130 blank checks, 275 blank promissory notes, 3 checks amounting to 6,742 million ($5,616 thousand) and6

promissory notes amounting to 7,478 million ($6,230 thousand) are pledged as collateral to financial institutions

and others.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

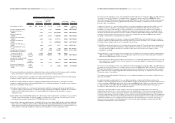

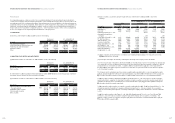

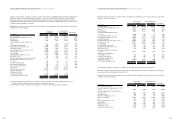

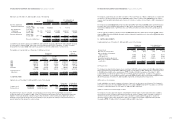

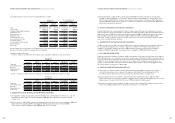

16. SELLING AND ADMINISTRATIVE EXPENSES

Selling and administrative expenses are as follows:

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

2002 2001 2002 2001

Salaries 1,636,321 1,406,531

$

1,363,146

$

1,171,719

Export related expenses 839,878 763,607 699,665 636,127

Sales promotion 2,159,849 1,862,237 1,799,275 1,551,347

Sales commission 405,419 363,607 337,737 302,905

Sales warranties 2,211,522 1,357,028 1,842,321 1,130,480

Taxes and dues 47,906 43,579 39,909 36,304

Communications 57,040 56,279 47,517 46,884

Utilities 41,350 38,364 34,447 31,959

Freight and warehousing 159,823 133,248 133,141 111,003

Rent 48,136 57,685 40,100 48,055

Travel 107,469 99,204 89,528 82,643

Service charges 345,069 281,814 287,462 234,767

Supplies 76,684 65,810 63,882 54,823

Research 313,865 108,006 261,467 89,975

Depreciation 180,301 201,389 150,201 167,768

Amortization 78,139 68,530 65,094 57,089

Provision for bad debt 598,448 452,755 498,540 377,170

Other 222,037 66,457 184,969 55,362

9,529,256 7,426,130 $7,938,401 $6,186,380

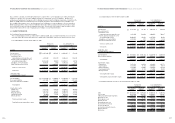

17. EXTRAORDINARY GAIN ON INCOME TAX BENEFITS

In 1999, Kia, one of the Company’s subsidiaries, and its transferor company, formerly Asia Motors, asked the Korean tax

authorities to reassess the accumulated tax loss carryforward totaling 4,573,584 million ($3,810,050 thousand) for the

loss on prior period error corrections that is attributable to events occurring from 1991 to 1997 and charged to the

operations in 1998. However, the tax authorities refused to reassess the tax loss carry forward and, instead, imposed on

May 1, 2000, a corporate tax assessment of 380,668 million ($317,118 thousand) pertaining to taxable year 1998.

Kia appealed the dismissal of its request for reassessment and the imposition of corporate tax by the tax authorities and

brought the case to the National Tax Tribunal. On January 31, 2001, the National Tax Tribunal accepted the Kia’s assertion

and issued its decision for the reassessment of Kia’s prior years’ taxable income. Pursuant to the decision of the National

Tax Tribunal, the tax authorities reassessed Kia’s tax loss carry forward and determined the deductible amount for tax loss

carry forward as 640,589 million ($533,646 thousand) as of January 1, 2001, after the utilization of 98,093 million

($81,717 thousand) of tax loss carryforward during 2000. In prior years, the future tax benefits from the tax loss

carryforward were not recorded by Kia as deferred income tax assets pending the outcome of the tax litigation.

Accordingly, in 2001, Kia recognized the tax benefits from the reassessed tax loss carryforward as an extraordinary gain in

the amount of 197,301 million ($164,363 thousand). Additionally, in 2001, as a result of the determination of the

deductible amount for tax loss carryforward, the asset revaluation tax amounting to 22,044 million ($18,364 thousand)

out of 34,256 million ($ 28,537 thousand) paid and recorded as other receivables in 2000 with respect to the asset

revaluation in 1999 was refunded to Kia.

78 79