Hyundai 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

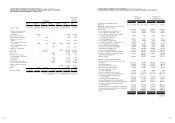

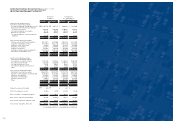

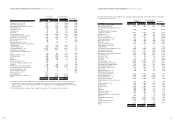

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

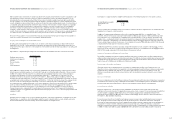

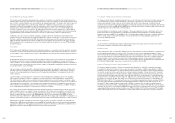

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2002 and 2001

Korean won

(in millions)

Capital Capital Retained Capital Minority Total Total

stock surplus earnings adjustments interest amount amount

January 1, 2001 1,476,454 5,354,390 1,708,256 (795,174) 2,417,595 10,161,521 $ 8,465,112

Difference between additional

investment and equity of

subsidiaries - (74,984) - - - (74,984) (62,466)

Disposal of subsidiaries’ stock - (75,004) (62,139) 49,264 - (87,879) (73,208)

Disposal of treasury stock - 15,380 - 213,342 - 228,722 190,538

Retirement of treasury stock by

retained earnings - - (168,694) 168,694 - -

Retirement of subsidiaries’ treasury

stock - 68,732 - - - 68,732 57,258

Application of the equity

method - - (1,649) (2,252) - (3,901) (3,250)

Effect of change in the scope of

consolidation - (43,854) (486) - 48,151 3,811 3,175

Effect of change in the scope of

equity method - - (33) 477 - 444 370

Payment of cash dividends - - (165,387) - (2,297) (167,684) (139,690)

Net income - - 1,152,136 - - 1,152,136 959,793

Treasury stock - - - 40,369 - 40,369 33,630

Discount on stock issuance - - - (573) (573) (477)

Loss on valuation of investment

equity securities - - - 194,237 - 194,237 161,810

Stock options - - - 6,693 - 6,693 5,576

Cumulative translation debits - - 14,188 - 14,188 11,819

Loss on transaction of derivatives - - - 45,300 - 45,300 37,737

Effect of change in the minority

interest - - - - 49,388 49,388 41,143

Others - 61,672 11,936 - - 73,608 61,320

December 31, 2001 1,476,454 5,306,332 2,473,940 (65,435) 2,512,837 11,704,128 $9,750,190

(continued)

Translation into

U.S. dollars

(Note 2)

(in thousands)

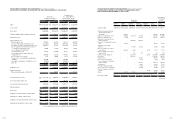

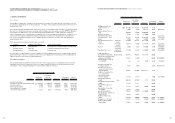

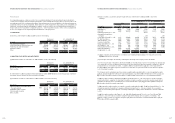

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

CONSOLIDATED STATEMENTS OF INCOME FOR THE YEARS ENDED DECEMBER 31, 2002 AND 2001

Korean won

(in millions, except per

share amounts)

2002 2001 2002 2001

Sales 48,122,919 39,851,575 $ 40,089,069 $ 33,198,580

Cost of sales 35,462,821 29,307,330 29,542,503 24,414,637

Gross profit 12,660,098 10,544,245 10,546,566 8,783,943

Selling and administrative expenses (Note 16) 9,529,256 7,426,130 7,938,401 6,186,380

Operating income 3,130,842 3,118,115 2,608,165 2,597,563

Other expenses, net:

Interest expense, net 210,619 562,326 175,457 468,449

Loss on foreign currency translations, net (132,258) 101,732 (110,178) 84,748

Loss (gain) on foreign currency transaction, net (209,587) 113,543 (174,598) 94,588

Loss on valuation of investments accounted

for using the equity method, net 70,065 27,599 58,368 22,991

Loss on disposal of investments

and other assets, net 63,971 219,694 53,291 183,017

Loss on disposal of property, plant and

equipment, net 206,424 83,472 171,963 69,537

Loss on valuation of inventory 5,331 30,603 4,441 25,494

Provision for accrued warranties and product

liabilities 291,708 - 243,009 -

Loss (gain) on redemption of debentures, net (37,022) 95 (30,841) 79

Other, net (81,206) 80,689 (67,650) 67,219

388,045 1,219,753 323,262 1,016,122

Ordinary income 2,742,797 1,898,362 2,284,903 1,581,441

Extraordinary items:

Other extraordinary gain, net (Note 17) - 190,650 - 158,822

Translation into

U. S. dollars (Note 2)

(in thousands, except

per share amounts)

50 51

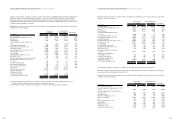

Income before income tax 2,742,797 2,089,012 $ 2,284,903 $ 1,740,263

Income tax expense (Note 18) 844,344 671,164 703,386 559,117

Income before minority interests 1,898,453 1,417,848 1,581,517 1,181,146

Minority interests (464,058) (265,712) (386,586) (221,353)

Net income 1,434,395 1,152,136 $1,194,931 $959,793

Ordinary income per ordinary common share 6,313 5,713 $5.26 $4.76

Earnings per ordinary common share 6,313 5,103 $5.26 $4.25

Ordinary income per fully diluted common share 6,290 - $5.24 $-

Earnings per fully diluted common share 6,290 - $5.24 $-

See accompanying notes to consolidated financial statements