Hyundai 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

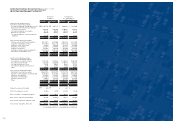

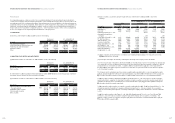

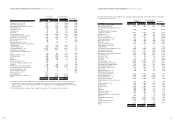

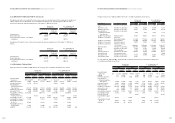

The changes in intangibles in 2002 are as follows:

Korean won

(in millions)

Industrial

Negative property Development

Goodwill goodwill rights costs Other Total Total

Beginning of the year 899,278 (118,225) 19,298 1,310,142 40,742 2,151,235

$

1,792,098

Addition:

Expenditures 19,758 (3,440) 6,082 996,742 46,449 1,065,591 887,697

Deduction:

Disposal - - - (16,645) - (16,645) (13,866)

Amortization (59,179) 8,996 (5,983) (710,723) (5,509) (772,398) (643,451)

Research - - - (308,187) - (308,187) (256,737)

Ordinary development - - - (383,157) - (383,157) (319,191)

Impairment loss - - - (58,329) - (58,329) (48,591)

End of the year 859,857 (112,669) 19,397 829,843 81,682 1,678,110

$

1,397,959

Amortization on intangible assets except negative goodwill is recorded in selling and administrative expenses and in

manufacturing cost and amortization on negative goodwill is recorded in other expenses. In addition, the Company

accounted for ordinary development expenses, research expenses and impairment loss as manufacturing cost, selling and

administrative expenses and other expenses, respectively.

As of December 31, 2002, goodwill consists of 340,288 million ($283,479 thousand) related to investments in

subsidiaries and 519,569 million ($432,830 thousand) related to mergers with non-subsidiary companies or business

divisions. As of December 31, 2001, goodwill consists of 343,704 million ($286,325 thousand) related to investments in

subsidiaries and 555,574 million ($462,824 thousand) related to mergers with non-subsidiary companies or business

divisions.

As of December 31, 2002, negative goodwill consists of 108,169 million ($90,111 thousand) related to investments in

subsidiaries and 4,500 million ($3,749 thousand) related to mergers with non-subsidiary companies or business

divisions. As of December 31, 2001, negative goodwill is 118,225 million ($98,488 thousand) related to investments in

subsidiaries.

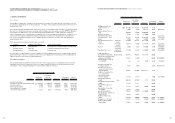

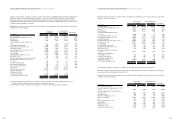

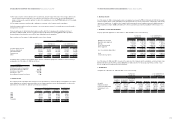

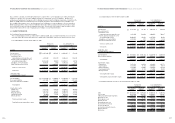

9. OTHER ASSETS

Other assets as of December 31, 2002 and 2001 consist of the following:

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

2002 2001 2002 2001

Long-term notes and accounts receivable, net of

allowance for doubtful accounts of 1,630

million in 2002 and nil in 2001 and

unamortized discount of 6,332 million

in 2002 and 10,486 million in 2001 31,203 34,053

$

25,994

$

28,368

Lease and rental deposits 322,505 313,715 268,664 261,342

Long-term deposits 36,186 202,702 30,145 168,862

Deferred gain on valuation of derivatives

(see Note 2) 51,622 168 43,004 140

Long-term loan, net of allowance for doubtful

accounts of 45 million in 2002 and

nil in 2001 and unamortized discount of

4,397 million in 2002 and 4,967 million

in 2001 138,719 122,643 115,561 102,168

Other 113,607 58,126 94,641 48,423

693,842 731,407 $578,009 $609,303

U. S. dollars

(Note 2)

(in thousands)

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

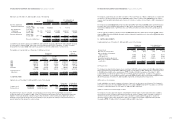

10. OTHER FINANCIAL BUSINESS ASSETS

Other financial business assets as of December 31, 2002 and 2001 consist of the following:

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

2002 2001 2002 2001

Finance receivables 8,059,742 4,926,439

$

6,714,213

$

4,103,998

Lease receivables 290,169 120,287 241,727 100,206

Other 17,930 21,687 14,937 18,066

8,367,841 5,068,413 $6,970,877 $4,222,270

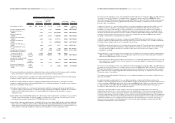

11. SHORT-TERM BORROWINGS

Short-term borrowings as of December 31, 2002 and 2001 amount to 7,526,948 million ($6,270,367 thousand) and

6,748,184 million ($5,621,613 thousand), respectively, and consist primarily of bank loans and export financing loans

with annual interest rates ranging from 0.48 percent to 10.50 percent.

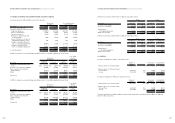

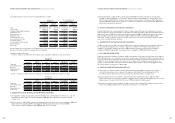

12. LONG-TERM DEBT

Long-term debt as of December 31, 2002 and 2001 consists of the following:

Korean won U.S. dollars(Note 2)

Interest rate (%) (in millions) (in thousands)

2002 2002 2001 2002 2001

Debentures 3.00 ~ 9.40 9,250,885 7,948,036 7,706,502 6,621,156

Won currency loans

Capital lease 8.10 ~ 14.31 62,490 55,241 52,058 46,019

Reorganization claims (*) 524,855 942,547 437,233 785,194

Composition obligation 0.00 ~ 5.50 5,812 225,396 4,842 187,767

General loans 1.00 ~ 14.30 475,597 440,881 396,199 367,279

1,068,754 1,664,065 890,332 1,386,259

Foreign currency loans

Capital lease 3.10 ~ 6.81 219,621 357,876 182,957 298,131

Reorganization claims (*) 148,611 223,563 123,801 186,240

Composition obligation - - 59,786 - 49,805

Other 2.23 ~ 7.73 372,241 774,099 310,097 644,868

740,473 1,415,324 616,855 1,179,044

11,060,112 11,027,425 9,213,689 9,186,459

Less: Current maturities (3,049,849) (2,768,331) (2,540,694) (2,306,174)

8,010,263 8,259,094 $6,672,995 $6,880,285

(*) 3 year non-guaranteed bond circulating earning rate on the end of every quarter

74 75