Hyundai 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

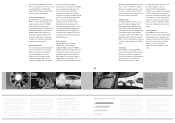

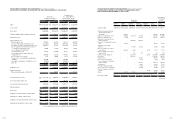

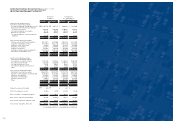

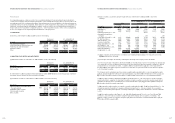

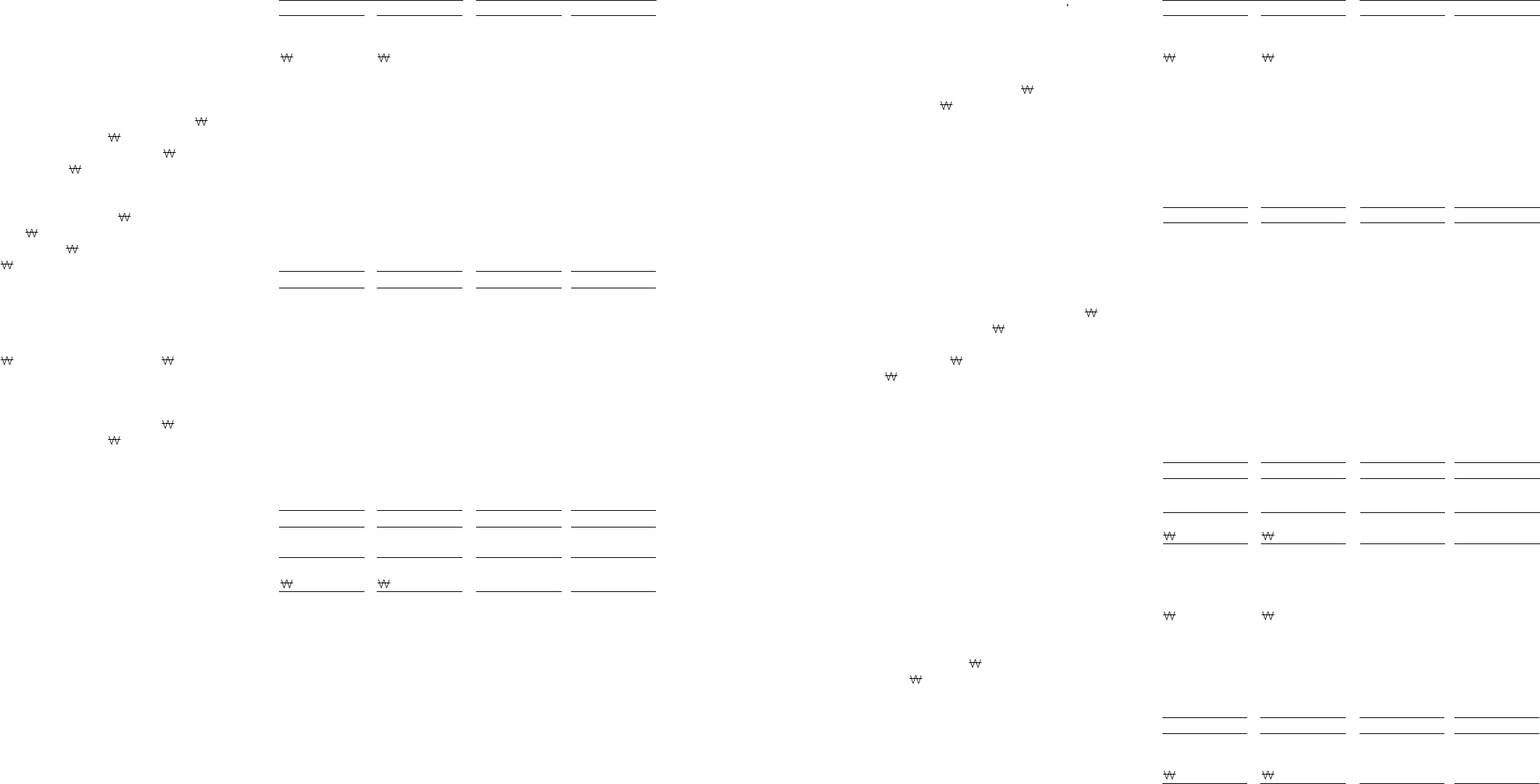

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

CONSOLIDATED BALANCE SHEETS (CONTINUED) AS OF DECEMBER 31, 2002 AND 2001

Korean won Translation into

(in millions) U. S. dollars (Note 2)

(in thousands)

LIABILITIES AND SHAREHOLDERS EQUITY 2002 2001 2002 2001

Current liabilities:

Short-term borrowings (Note 11) 7,526,948 6,748,184 $ 6,270,367 $ 5,621,613

Current maturities of long-term debt, net of

unamortized discount of 657 million in

2002 and 5,877 million in 2001 (Note 12) 3,049,849 2,768,331 2,540,694 2,306,174

Trade notes and accounts payable 4,695,480 3,775,059 3,911,596 3,144,834

Accrued warranties and product liabilities 901,254 725,040 750,795 603,999

Accounts payable-other 2,741,462 1,488,025 2,283,790 1,239,607

Accrued expenses 314,674 621,008 262,141 517,334

Income tax payable 585,447 415,405 487,710 346,055

Other current liabilities 1,016,682 1,116,014 846,952 929,702

Total current liabilities 20,831,796 17,657,066 17,354,045 14,709,318

Long-term liabilities:

Long-term debt, net of current maturities

(Note 12) 8,010,263 8,259,094 6,672,995 6,880,285

Accrued severance benefits, net of National

Pension payments for employees of 123,960

million in 2002 and 141,674 million in

2001 and individual severance insurance

deposits of 1,513,268 million in 2002 and

1,250,037 million in 2001 (Note 2) 955,281 752,244 795,802 626,661

Accrued loss on valuation of derivatives

(Note 2) 17,053 62,382 14,206 51,968

Accrued warranties and product liabilities 2,401,220 1,171,058 2,000,350 975,556

Deferred income tax liabilities (Note 18) 124,295 84,891 103,545 70,719

Other long-term liabilities 334,966 181,433 279,045 151,144

Total long-term liabilities 11,843,078 10,511,102 9,865,943 8,756,333

Other financial business liabilities 12,732 - 10,607 -

Total liabilities 32,687,606 28,168,168 $ 27,230,595 $ 23,465,651

Commitments and contingencies (Note 22)

Shareholders’ equity:

Capital stock (Note 13) 1,476,454 1,476,454 $ 1,229,968 $ 1,229,968

Capital surplus 5,286,061 5,306,332 4,403,583 4,420,470

Retained earnings

(Net income of 1,434,395 million in 2002

and 1,152,136 million in 2001) 3,677,983 2,473,940 3,063,964 2,060,930

Capital adjustments (Note 14) (106,417) (65,435) (88,651) (54,511)

Minority interests 3,104,001 2,512,837 2,585,806 2,093,333

Total shareholders’ equity 13,438,082 11,704,128 11,194,670 9,750,190

Total liabilities

and shareholders’ equity 46,125,688 39,872,296 $38,425,265 $33,215,841

See accompanying notes to consolidated financial statements

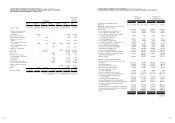

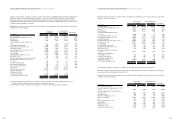

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

CONSOLIDATED BALANCE SHEETS AS OF DECEMBER 31, 2002 AND 2001

Korean won Translation into

(in millions) U. S. dollars (Note 2)

(in thousands)

ASSETS 2002 2001 2002 2001

Current assets:

Cash and cash equivalents (Note 15) 2,765,872 2,304,424 $ 2,304,125 $ 1,919,713

Short-term financial instruments (Note 15) 3,610,223 1,634,060 3,007,517 1,361,263

Marketable securities (Notes 4 and 15) 710,474 866,521 591,864 721,860

Trade notes and accounts receivable, less

allowance for doubtful accounts of 289,549

million in 2002 and 297,372 million in 2001

and unamortized discount of 2,820 million

in 2002 and 4,215 million in 2001 2,198,905 1,848,372 1,831,810 1,539,797

Inventories (Note 3) 3,819,999 3,787,927 3,182,272 3,155,554

Advances and other, net of allowance for

doubtful accounts of 165,122 million in 2002

and 210,420 million in 2001 and unamortized

discount of 9,639 million in 2002 and

14,540 million in 2001 2,005,079 1,597,411 1,670,343 1,330,732

Total current assets 15,110,552 12,038,715 12,587,931 10,028,919

Non-current assets:

Long-term financial instruments (Note 15) 102,195 99,735 85,134 83,085

Investment, net of unamortized discount of

23,341 million in 2002 and 25,545 million

in 2001 (Notes 4 and 15) 2,061,273 1,743,242 1,717,155 1,452,218

Property, plant and equipment, net of

accumulated depreciation of 6,415,241

million in 2002 and 5,317,325 million in

2001 (Notes 5, 6, 7 and 15) 16,745,238 16,905,497 13,949,715 14,083,220

Intangibles (Note 8) 1,678,110 2,151,235 1,397,959 1,792,098

Other assets (Note 9) 693,842 731,407 578,009 609,303

Deferred income tax assets (Note 18) 1,366,637 1,134,052 1,138,485 944,728

Total non-current assets 22,647,295 22,765,168 18,866,457 18,964,652

Other financial business assets (Note 10) 8,367,841 5,068,413 6,970,877 4,222,270

Total assets 46,125,688 39,872,296 $38,425,265 $33,215,841

(continued)

48 49