Hyundai 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

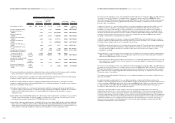

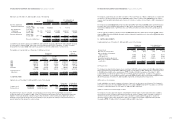

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Consolidated Financial Statement Presentation

The Company maintains its official accounting records in Korean won and prepares statutory consolidated financial

statements in the Korean language (Hangul) in conformity with the accounting principles generally accepted in the

Republic of Korea. Certain accounting principles applied by the Company that conform with financial accounting

standards and accounting principles in the Republic of Korea may not conform with generally accepted accounting

principles in other countries. Accordingly, these financial statements are intended for use by those who are informed about

Korean accounting principles and practices. The accompanying financial statements have been condensed, restructured,

and translated into English from the Korean language financial statements. Certain information included in the Korean

language financial statements, but not required for a fair presentation of the Company and its subsidiaries’ financial

position, results of operations or cash flows, is not presented in the accompanying financial statements.

The U.S. dollar amounts presented in these financial statements were computed by translating the Korean won into U.S.

dollars based on the Bank of Korea Basic Rate of 1,200.40 to US$1.00 at December 31, 2002, solely for the convenience

of the reader. This convenience translation into US dollars should not be construed as a representation that the Korean

won amounts have been, could have been, or could in the future be, converted at this or any other rate of exchange.

The significant accounting policies followed by the Company in the preparation of its consolidated financial statements are

summarized below.

Principles of Consolidation

The consolidated financial statements include the individual accounts of the Company and its domestic and foreign

subsidiaries over which the Company has control, is the largest shareholder and owns more than 30 percent of the voting

shares, except for companies with total assets of less than 7,000 million ($5,831 thousand) at the end of the preceding

fiscal year. Investments in affiliates in which a consolidated entity is able to exercise significant influence over theoperating

and financial policies of a non-consolidated company are accounted for using the equity method. Significant influence is

deemed to exist when the investor owns more than twenty percent of the investee’s voting shares unless there is evidence

to the contrary. If the changes in the investment value due to the changes in the net assets of affiliates, whose individual

beginning balance of total assets or paid-in capital at the date of its establishment is less than 7,000 million ($5,831

thousand), are not material, investments in affiliates can be excluded from using the equity method.

The investment account of the Company and corresponding equity accounts of subsidiaries are eliminated at the dates the

Company obtained control over the subsidiaries. The difference between the investment cost and the fair value of the

Company's portion of assets acquired less liabilities assumed of a subsidiary is accounted for as goodwill or negative

goodwill. Goodwill is amortized on a straight-line basis over its useful life, not exceeding twenty years. The amount of

negative goodwill not exceeding the total fair value of acquired identifiable non-monetary assets is recognized as income

on a straight-line basis over the remaining weighted average useful life of the identifiable acquired depreciable assets and

the amount of negative goodwill in excess of the total fair value of the acquired identifiable non-monetary assets is

recognized as extraordinary gain at the date of acquisition.

When the Company acquires additional interests in a subsidiary after obtaining control over the subsidiary, the difference

between incremental price paid by the Company and the amount of incremental interest in the stockholders' equity of the

subsidiary is reflected in the consolidated capital surplus. In case a subsidiary still belongs to a consolidated economic

entity after the Company disposes a portion of the stocks of subsidiaries to [I4]non-subsidiary parties , gain or loss on

disposal of the subsidiary`s stocks is accounted for as consolidated capital surplus.

When consolidated companies are merged together during a fiscal year, for purposes of consolidation, the merger is

regarded as additional acquisition of ownership. The net income for the acquiree as of the merger date is reflected in the

consolidated income statement.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

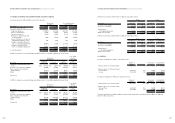

Intercompany receivables and payable and revenues and expenses arising from transactions between the Company and

its subsidiaries or among subsidiaries are eliminated against each other in the consolidated financial statements. On sales

from the Company to its subsidiaries (downstream sales), the full amounts of unrealized gains or loss are eliminated in the

consolidated income and charged (credited) to the majority interest. On sales from a subsidiary to the Company (upstream

sales), unrealized gains and losses are eliminated entirely and allocated proportionately between majority and minority

interests.

The accounting methods adopted by the Company and its subsidiaries for similar transactions and circumstances is

generally the same. However, if the differences resulting from applying different accounting methods are not significant,

such difference methods are applied. Financial statements of a subsidiary as of the same closing date of the Company are

used in preparing the consolidation.

Revenue Recognition

Revenue, including long-term installment sales, is recognized upon shipment of goods. Interest income arising from long-

term installment sales is recognized using the level yield method. In the case of subsidiaries in financial business, interest

revenues earned on financial assets are recognized as time passes and fees and commissions in return for services

rendered are recognized as services are provided.

Valuation of Marketable Securities

Marketable securities are stated at fair value. The difference between book value and fair value is recognized in current

operations.

Allowance for Doubtful Accounts

The Company provides an allowance for doubtful accounts based on management’s estimated loss on uncollectible

accounts.

Inventories

Inventories are stated at the lower of cost or net realizable value, cost being determined by the moving average cost

method.

Valuation of Investments Securities

Equity securities held for investment (excluding those accounted for using the equity method discussed in the next

paragraph) that are not actively traded (unlisted security) are stated at acquisition cost, as determined by the moving

average method. Actively quoted (listed) securities, including those traded over-the-counter, are stated at fair value, with

the resulting valuation gain or loss reported as a capital adjustment within shareholders’ equity. If the fair value of a listed

equity security or the net equity value of an unlisted security held for investment declines compared to acquisition cost and

is not expected to recover (impaired investment security), the carrying value of the equity security is adjusted to fair value

or net equity value, with the resulting valuation loss charged to current operations. If the net equity value or fair value

subsequently recovers, in the case of an unlisted security, the increase in value is recorded in current operations, up to the

amount of the previously recognized impairment loss, and in the case of a listed security, the increase in value is recorded

in capital adjustments.

Equity securities held for investment in companies in which the Company is able to exercise significant influence over the

operating and financial policies of the investees are accounted for using the equity method. The Company’s share in the

net income or net loss of investees is reflected in current operations. Changes in the retained earnings, capital surplus or

capital adjustments of investees are accounted for as an adjustment to consolidated retained earnings, consolidated

capital surplus or consolidated capital adjustments.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES: Financial Statements 2002

60 61