Freddie Mac 2010 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2010 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Reducing Foreclosures and Keeping Families in Homes

During the current housing crisis, we are focused on reducing the number of foreclosures and helping to keep families

in their homes. In addition to our participation in HAMP, we introduced several new initiatives to help eligible borrowers

during this crisis, including our relief refinance mortgage initiative. In 2010, we helped more than 275,000 borrowers either

stay in their homes or sell their properties and avoid foreclosure through our various workout programs, including HAMP.

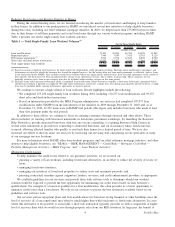

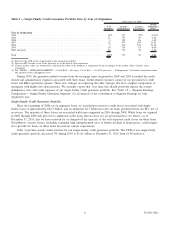

Table 1 presents our recent single-family loan workout activities.

Table 1 — Total Single-Family Loan Workout Volumes

(1)

12/31/2010 09/30/2010 06/30/2010 03/31/2010 12/31/2009

For the Three Months Ended

(number of loans)

Loan modifications . . . . ........................................ 37,203 39,284 49,562 44,228 15,805

Repayment plans . . . . . . ........................................ 7,964 7,030 7,455 8,761 8,129

Forbearance agreements

(2)

........................................ 5,945 6,976 12,815 8,858 8,780

Short sales and deed-in-lieu transactions . ............................. 12,097 10,472 9,542 7,064 6,533

Total single-family loan workouts .................................. 63,209 63,762 79,374 68,911 39,247

(1) Based on actions completed with borrowers for loans within our single-family credit guarantee portfolio. Excludes those modification, repayment, and

forbearance activities for which the borrower has started the required process, but the actions have not been made permanent, or effective, such as loans

in the trial period under HAMP. Also excludes certain loan workouts where our single-family seller/servicers have executed agreements in the currentor

prior periods, but these have not been incorporated into certain of our operational systems, due to delays in processing. These categories are not

mutually exclusive and a loan in one category may also be included within another category in the same period.

(2) Excludes loans with long-term forbearance under a completed loan modification. Many borrowers complete a short-term forbearance agreement before

another loan workout is pursued or completed. We only report forbearance activity for a single loan once during each quarterly period; however, a single

loan may be included under separate forbearance agreements in separate periods.

We continue to execute a high volume of loan workouts. Recent highlights include the following:

• We completed 275,256 single-family loan workouts during 2010, including 170,277 loan modifications and 39,175

short sales and deed-in-lieu transactions.

• Based on information provided by the MHA Program administrator, our servicers had completed 107,073 loan

modifications under HAMP from the introduction of the initiative in 2009 through December 31, 2010 and, as of

December 31, 2010, 22,352 loans were in HAMP trial periods (this figure only includes borrowers who made at least

their first payment under the trial period).

In addition to these efforts, we continue to focus on assisting consumers through outreach and other efforts. These

efforts included: (a) meeting with borrowers nationwide in foreclosure prevention workshops; (b) launching the Borrower

Help Network to provide distressed borrowers with free one-on-one counseling; (c) opening Borrower Help Centers in

several cities nationwide to provide free counseling to distressed borrowers; and (d) in instances where foreclosure has

occurred, allowing affected families who qualify to rent back their homes for a limited period of time. We have also

increased our efforts to directly assist our servicers by increasing our servicing staff and placing on-site specialists at many

of our mortgage servicer locations.

For more information about HAMP, other loan workout programs, and our relief refinance mortgage initiative, and other

options to help eligible borrowers, see “MD&A — RISK MANAGEMENT — Credit Risk — Mortgage Credit Risk —

Portfolio Management Activities — MHA Program” and “— Loan Workout Activities.”

Minimizing Credit Losses

To help minimize the credit losses related to our guarantee activities, we are focused on:

• pursuing a variety of loan workouts, including foreclosure alternatives, in an effort to reduce the severity of losses we

incur;

• managing foreclosure timelines;

• managing our inventory of foreclosed properties to reduce costs and maximize proceeds; and

• pursuing contractual remedies against originators, lenders, servicers, and credit enhancement providers, as appropriate.

We establish guidelines for our servicers and provide them with software tools to determine which loan workout

solution would be expected to provide the best opportunity for minimizing our credit losses based on each borrower’s

qualifications. For example, if a borrower qualifies for a loan modification, this often provides us a better opportunity to

minimize credit losses than a foreclosure. We rely on our servicers to pursue the best alternative available based on our

guidelines and software tools.

Our servicers pursue repayment plans and loan modifications for borrowers facing financial or other hardships since the

level of recovery (if a loan reperforms) may often be much higher than with foreclosure or foreclosure alternatives. In cases

where this alternative is not possible or successful, a short sale transaction typically provides us with a comparable or higher

level of recovery than what we would receive through property sales from our REO inventory. In large part, the benefit of

4Freddie Mac