Freddie Mac 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

Commission File Number: 000-53330

Federal Home Loan Mortgage Corporation

(Exact name of registrant as specified in its charter)

Freddie Mac

Federally chartered corporation

(State or other jurisdiction of

incorporation or organization)

8200 Jones Branch Drive

McLean, Virginia 22102-3110

(Address of principal executive

offices, including zip code)

52-0904874

(I.R.S. Employer

Identification No.)

(703) 903-2000

(Registrant’s telephone number,

including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Voting Common Stock, no par value per share (OTC: FMCC)

Variable Rate, Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCCI)

5% Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCKK)

Variable Rate, Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCCG)

5.1% Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCCH)

5.79% Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCCK)

Variable Rate, Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCCL)

Variable Rate, Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCCM)

Variable Rate, Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCCN)

5.81% Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCCO)

6% Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCCP)

Variable Rate, Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCCJ)

5.7% Non-Cumulative Preferred Stock, par value $1.00 per share (OTC: FMCKP)

Variable Rate, Non-Cumulative Perpetual Preferred Stock, par value $1.00 per share (OTC: FMCCS)

6.42% Non-Cumulative Perpetual Preferred Stock, par value $1.00 per share (OTC: FMCCT)

5.9% Non-Cumulative Perpetual Preferred Stock, par value $1.00 per share (OTC: FMCKO)

5.57% Non-Cumulative Perpetual Preferred Stock, par value $1.00 per share (OTC: FMCKM)

5.66% Non-Cumulative Perpetual Preferred Stock, par value $1.00 per share (OTC: FMCKN)

6.02% Non-Cumulative Perpetual Preferred Stock, par value $1.00 per share (OTC: FMCKL)

6.55% Non-Cumulative Perpetual Preferred Stock, par value $1.00 per share (OTC: FMCKI)

Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, par value $1.00 per share (OTC: FMCKJ)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes nNo ≤

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes nNo ≤

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days. Yes ≤No n

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). nYe s nNo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. n

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. Large accelerated filer nAccelerated filer ≤

Non-accelerated filer (Do not check if a smaller reporting company) nSmaller reporting company n

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes nNo ≤

The aggregate market value of the common stock held by non-affiliates computed by reference to the price at which the common equity

was last sold on June 30, 2010 (the last business day of the registrant’s most recently completed second fiscal quarter) was $266.2 million.

As of February 11, 2011, there were 649,182,461 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

Table of contents

-

Page 1

...File Number: 000-53330 Federal Home Loan Mortgage Corporation (Exact name of registrant as specified in its charter) Federally chartered corporation (State or other jurisdiction of incorporation or organization) Freddie Mac 8200 Jones Branch Drive McLean, Virginia 22102-3110 (Address of principal... -

Page 2

... Financial Data ...Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations ...Mortgage Market and Economic Conditions, and Outlook...Consolidated Results of Operations ...Consolidated Balance Sheets Analysis ...Risk Management ...Liquidity and Capital Resources... -

Page 3

...(Deficit) ...Freddie Mac Consolidated Statements of Cash Flows ...Note 1: Summary of Significant Accounting Policies ...Note 2: Change in Accounting Principles ...Note 3: Conservatorship and Related Matters ...Note 4: Variable Interest Entities...Note 5: Mortgage Loans and Loan Loss Reserves ...Note... -

Page 4

... obligations. The report states the Obama Administration's belief that under the companies' senior preferred stock purchase agreements with Treasury, there is sufficient funding to ensure the orderly and deliberate wind down of Freddie Mac and Fannie Mae, as described in the Administration's plan... -

Page 5

... payments on our senior preferred stock, which exceeded total comprehensive income (loss) for the fourth quarter of 2010. To address our deficit in net worth, FHFA, as Conservator, will submit a draw request on our behalf to Treasury under the Purchase Agreement for $500 million. 2 Freddie Mac -

Page 6

... by Freddie Mac, Fannie Mae, or Ginnie Mae. Mortgage originators are generally able to offer homebuyers lower mortgage rates on conforming loan products, including ours, in part because of the value investors place on GSE-guaranteed mortgage-related securities. Prior to 2007, mortgage markets were... -

Page 7

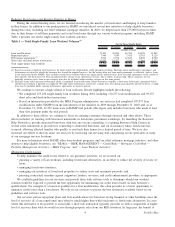

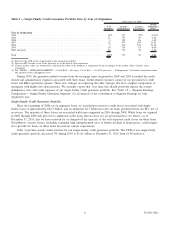

...Table 1 - Total Single-Family Loan Workout Volumes(1) 12/31/2010 For the Three Months Ended 09/30/2010 06/30/2010 03/31/2010 (number of loans) 12/31/2009 Loan modifications ...Repayment plans ...Forbearance agreements(2) ...Short sales and deed-in-lieu transactions Total single-family loan workouts... -

Page 8

... Credit Risk - Mortgage Seller/Servicers" for further information on our agreements with our seller/servicers. Historically, our credit loss exposure has also been partially mitigated by mortgage insurance, which is a form of credit enhancement. Primary mortgage insurance is required to be purchased... -

Page 9

...as of the date of loan origination. (3) Current market values are estimated by adjusting the value of the property at origination based on changes in the market value of homes since origination. (4) See "MD&A - RISK MANAGEMENT - Credit Risk - Mortgage Credit Risk - Credit Performance - Delinquencies... -

Page 10

... our allowance for loan losses on mortgage loans held for investment; and (b) our reserve for guarantee losses associated with non-consolidated single-family mortgage securitization trusts and other guarantee commitments. (4) Represents the number of completed modifications under agreement with the... -

Page 11

...or other obligations. For more information on the Purchase Agreement, see "Conservatorship and Related Matters." Long-Term Financial Sustainability and Future Status It is unlikely that we will generate net income or comprehensive income in excess of our annual dividends payable to Treasury over the... -

Page 12

...help bring private capital back to the mortgage market, including increasing guarantee fees, phasing in a 10% down payment requirement, reducing conforming loan limits, and winding down Freddie Mac and Fannie Mae's investment portfolios, consistent with the senior preferred stock purchase agreements... -

Page 13

... and housing revenue bonds held by third parties. Our charter limits our purchases of single-family loans to the conforming loan market. The conforming loan market is defined by loans originated with UPBs at or below limits determined annually based on changes in FHFA's housing price index, a method... -

Page 14

..., we purchase single-family mortgage loans originated by our seller/servicers in the primary mortgage market. In most instances, we use the mortgage securitization process to package the purchased mortgage loans into guaranteed mortgage-related securities. We guarantee the payment of principal and... -

Page 15

... could place Freddie Mac at a competitive disadvantage to Fannie Mae. Overview of the Mortgage Securitization Process Mortgage securitization is a process by which we purchase mortgage loans that lenders originate, and pool these loans into mortgage securities that are sold in global capital markets... -

Page 16

..., as it is generally easier to purchase and sell PCs than unsecuritized mortgage loans, and allows more cost effective interest-rate risk management. For our fixed-rate PCs, we guarantee the timely payment of principal and interest. For our ARM PCs, we guarantee the timely payment of the weighted... -

Page 17

...other fixed-income investors, including pension funds, insurance companies, securities dealers, money managers, commercial banks and foreign central banks, purchase our PCs. Treasury and the Federal Reserve have also purchased mortgage-related securities issued by us, Fannie Mae and Ginnie Mae under... -

Page 18

... in pools of PCs and/or certain other types of mortgage-related assets. We create these securities primarily by using PCs or previously issued REMICs and Other Structured Securities as the underlying collateral. Similar to our PCs, we guarantee the payment of principal and interest to the holders of... -

Page 19

...family and multifamily HFA bonds, which were Other Guarantee Transactions with significant credit enhancement provided by Treasury. The securities issued by us pursuant to the NIBP were purchased by Treasury. See "NOTE 3: CONSERVATORSHIP AND RELATED MATTERS" for further information. 16 Freddie Mac -

Page 20

... payments to security holders. See "Executive Summary - Changes in Accounting Standards Related to Accounting for Transfers of Financial Assets and Consolidation of VIEs" for additional information. In accordance with the terms of our PC trust documents, we are required to purchase a mortgage loan... -

Page 21

...or no payments are required during a defined period. They provide additional time for the borrower to return to compliance with the original terms of the mortgage or to implement another loan workout. • Short sales, in which the borrower, working with the servicer, sells the home and pays off part... -

Page 22

... business of investing in mortgage-related securities and mortgage loans. We compete for low-cost debt funding with Fannie Mae, the FHLBs and other institutions. Competition for debt funding from these entities can vary with changes in economic, financial market and regulatory environments. Assets... -

Page 23

... of the multifamily securitization business in 2011. We may also sell multifamily loans from time to time. The multifamily property market is affected by general economic factors, such as employment rates, construction cycles, and relative affordability of single-family home prices, all of which... -

Page 24

... the systemic risk that has contributed directly to the instability in the current market." These actions included the following: • placing us and Fannie Mae in conservatorship; • the execution of the Purchase Agreement, pursuant to which we issued to Treasury both senior preferred stock and... -

Page 25

...the Chairmen and Ranking Members of the Congressional Banking and Financial Services Committees dated February 2, 2010, the Acting Director of FHFA stated that the focus of the conservatorship is on conserving assets, minimizing corporate losses, ensuring Freddie Mac and Fannie Mae continue to serve... -

Page 26

... information on the impact of conservatorship and our current business objectives, see "NOTE 3: CONSERVATORSHIP AND RELATED MATTERS" and "Executive Summary - Our Primary Business Objectives." Limits on Mortgage-Related Investments Portfolio Under the Purchase Agreement and by FHFA Under the terms... -

Page 27

..., compensation and termination benefits of directors and officers at the executive vice president level and above (including, regardless of title, executive positions with the functions of Chief Operating Officer, Chief Financial Officer, General Counsel, Chief Business Officer, Chief Investment... -

Page 28

...of repudiating any guarantee obligation relating to Freddie Mac's mortgage-related securities because it views repudiation as incompatible with the goals of the conservatorship. We can, and have continued to, enter into, perform and enforce contracts with third parties. Limitations on Enforcement of... -

Page 29

... fee in cash or add the amount of the fee to the liquidation preference of the senior preferred stock. Treasury may waive the quarterly commitment fee for up to one year at a time, in its sole discretion, based on adverse conditions in the U.S. mortgage market. The fee was originally scheduled... -

Page 30

..., the holders of these debt securities or Freddie Mac mortgage guarantee obligations may file a claim in the United States Court of Federal Claims for relief requiring Treasury to fund to us the lesser of: (a) the amount necessary to cure the payment defaults on our debt and Freddie Mac mortgage... -

Page 31

...the senior preferred stock in limited circumstances. Treasury, as the holder of the senior preferred stock, is entitled to receive, when, as and if declared by our Board of Directors, cumulative quarterly cash dividends at the annual rate of 10% per year on the then-current liquidation preference of... -

Page 32

...the Chairmen and Ranking Members of the Congressional Banking and Financial Services Committees dated February 2, 2010, the Acting Director of FHFA stated that the focus of the conservatorship is on conserving assets, minimizing corporate losses, ensuring Freddie Mac and Fannie Mae continue to serve... -

Page 33

... Agency FHFA is an independent agency of the federal government responsible for oversight of the operations of Freddie Mac, Fannie Mae and the FHLBs. The Director of FHFA is appointed by the President and confirmed by the Senate for a five-year term, removable only for cause. In the discussion below... -

Page 34

... of financial assets and consolidation of VIEs. Specifically, upon adoption of these new accounting standards, FHFA directed us, for purposes of minimum capital, to continue reporting our PCs held by third parties and other aggregate off-balance sheet obligations using a 0.45% capital requirement... -

Page 35

... rental housing affordable to very low-income families. In addition, the rule states that Freddie Mac and Fannie Mae must continue to report on their acquisition of mortgages involving low-income units in small (5- to 50-unit) multifamily properties. Our housing goals for 2010 and 2011 are set forth... -

Page 36

... for Freddie Mac and Fannie Mae to serve three underserved markets (manufactured housing, affordable housing preservation and rural areas) by developing loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages for very low-, low- and moderate-income families... -

Page 37

... Treasury to purchase Freddie Mac debt obligations not exceeding $2.25 billion in aggregate principal amount at any time. The Reform Act granted the Secretary of the Treasury authority to purchase any obligations and securities issued by us and Fannie Mae until December 31, 2009 on such terms... -

Page 38

... may include risk-based capital and leverage requirements, liquidity requirements, resolution plan and credit exposure reporting requirements, concentration limits, contingent capital requirements, enhanced public disclosures, short-term debt limits, and overall risk management requirements, as well... -

Page 39

... the specific terms may vary, these laws generally treat the new energy assessments like property tax assessments, which generally create a new lien to secure the assessment that is senior to any existing first mortgage lien. These laws could have a negative impact on Freddie Mac's credit losses, to... -

Page 40

... programs to assist the U.S. residential mortgage market, future business plans, liquidity, capital management, economic and market conditions and trends, market share, the effect of legislative and regulatory developments, implementation of new accounting standards, credit losses, internal control... -

Page 41

... different types of mortgage servicing structures and servicing compensation; • preferences of originators in selling into the secondary mortgage market; • changes to our underwriting requirements or investment standards for mortgage-related products; • investor preferences for mortgage loans... -

Page 42

... in a 10% down payment requirement, reducing conforming loan limits, and winding down Freddie Mac and Fannie Mae's investment portfolios, consistent with the senior preferred stock purchase agreements. For more information, see "BUSINESS - Executive Summary - Long-Term Financial Sustainability and... -

Page 43

... losses recorded in earnings or AOCI; • limitations in our access to the public debt markets, or increases in our debt funding costs; • establishment of a valuation allowance for our remaining deferred tax asset; • limitations on our ability to develop new products; • changes in business... -

Page 44

... could place Freddie Mac at a competitive disadvantage to Fannie Mae. These changes and other factors could have material adverse effects on, among other things, our portfolio growth, net worth, credit losses, net interest income, guarantee fee income, net deferred tax assets, and loan loss reserves... -

Page 45

...the senior preferred stock in cash or if we do not pay the quarterly commitment fee to Treasury under the Purchase Agreement. We have a variety of different, and potentially competing, objectives that may adversely affect our financial results and our ability to maintain positive net worth. Based on... -

Page 46

...the Chairmen and Ranking Members of the Congressional Banking and Financial Services Committees dated February 2, 2010, the Acting Director of FHFA stated that the focus of the conservatorship is on conserving assets, minimizing corporate losses, ensuring Freddie Mac and Fannie Mae continue to serve... -

Page 47

... respect to multifamily loans because such loans generally have a balloon payment and typically have a shorter contractual term than single-family mortgages. Borrowers may be less able to refinance their obligations during periods of rising interest rates, which could lead to default if the borrower... -

Page 48

... seller/servicers. On July 12, 2010, FHFA, as Conservator of Freddie Mac and Fannie Mae, announced that it had issued subpoenas to various entities seeking loan files and other transaction documents related to non-agency mortgage-related securities in which the two enterprises invested. FHFA stated... -

Page 49

... achieve expected results, and new programs could be instituted that cause our credit losses to increase. For more information, see "MD&A - RISK MANAGEMENT - Credit Risk." Our business volumes are closely tied to the rate of growth in total outstanding U.S. residential mortgage debt and the size of... -

Page 50

... those representations and warranties, we have the contractual right to require the seller/servicer to repurchase those loans from us. In lieu of repurchase, we may agree to allow a seller/servicer to indemnify us against losses on such mortgages or otherwise compensate us for the risk of continuing... -

Page 51

... these entities will fail to reimburse us for claims under insurance policies. This risk could increase if home prices deteriorate further or if the economy worsens. As a guarantor, we remain responsible for the payment of principal and interest if a mortgage insurer fails to meet its obligations to... -

Page 52

... more information on the developments concerning FGIC and Ambac, see "MD&A - RISK MANAGEMENT - Credit Risk - Institutional Credit Risk - Bond Insurers." If mortgage insurers were to further tighten their standards or fall out of compliance with regulatory capital requirements, the volume of high LTV... -

Page 53

... of operations are significantly affected by general business and economic conditions, including conditions in the international markets for our investments or our mortgage-related and debt securities. These conditions include employment rates, fluctuations in both debt and equity capital markets... -

Page 54

... by mortgage loans that we purchased for cash. Our competitiveness in purchasing single-family mortgages from our seller/servicers, and thus the volume and profitability of new single-family business, can be directly affected by the relative price performance of our PCs and comparable Fannie Mae... -

Page 55

...aspect of our management of interest-rate risk, they generally increase the volatility of reported net income (loss), because, while fair value changes in derivatives affect net income, fair value changes in several of the types of assets and liabilities being hedged do not affect net 52 Freddie Mac -

Page 56

...the Purchase Agreement and FHFA regulation, the UPB of our mortgage-related investments portfolio is subject to a cap that declines by 10% per year beginning in 2010 until it reaches $250 billion. FHFA has stated its expectation in the Acting Director's February 2, 2010 letter that any net additions... -

Page 57

... actions taken by government regulators in response to our actual or alleged conduct. The MHA Program and other efforts to reduce foreclosures, modify loan terms and refinance mortgages may fail to mitigate our credit losses and may adversely affect our results of operations or financial condition... -

Page 58

... purchase loans from them in the future. We are the compliance agent for certain foreclosure avoidance activities under HAMP by mortgage holders other than Freddie Mac or Fannie Mae. In this role, we conduct examinations and review servicer compliance with the published requirements for the program... -

Page 59

... further complicate and delay the process of resolving these issues. These parties potentially include seller/servicers, Freddie Mac, Fannie Mae, FHFA, state or local authorities, mortgage insurers and title insurance companies. In many cases, the remedial actions will require court approval. It is... -

Page 60

...business activities and related GAAP requirements; significant management changes and internal reorganizations in 2010; uncertainty regarding the sustainability of newly established controls; data quality or servicing-related issues; and the uncertain impacts of the ongoing housing and credit market... -

Page 61

...that the valuations, risk metrics, amortization results, loan loss reserve estimations and security impairment charges produced by our internal models may be different from actual results, which could adversely affect our business results, cash flows, fair value of net assets, business prospects and... -

Page 62

... to inadequately designed or improperly executed systems. Servicing and loss mitigation processes are currently under considerable stress, which increases the risk that we may experience further operational problems in the future. Corporate reorganizations, inability to retain key staff members, and... -

Page 63

... reporting, our mortgage-related investment activity and mortgage loan underwriting. Any failures by those vendors could disrupt our business operations. We outsource certain key functions to external parties, including: (a) processing functions for trade capture, market risk management analytics... -

Page 64

... set for us by FHFA that may increase our losses. We may make adjustments to our mortgage loan sourcing and purchase strategies in an effort to meet our housing goals and subgoals, including changes to our underwriting guidelines and the expanded use of targeted initiatives to reach 61 Freddie Mac -

Page 65

... with the IRS related to our 1998 through 2005 federal income tax returns. We are also subject to investigations by the SEC and the U.S. Attorney's Office for the Eastern District of Virginia. In addition, certain of our current and former directors, officers and employees are involved in legal... -

Page 66

... or paying any dividends on Freddie Mac equity securities (other than the senior preferred stock) without the prior written consent of Treasury. Restrictions Under the GSE Act Under the GSE Act, FHFA has authority to prohibit capital distributions, including payment of dividends, if we fail to meet... -

Page 67

... capital requirements have been suspended during conservatorship. Restrictions Relating to Subordinated Debt During any period in which we defer payment of interest on qualifying subordinated debt, we may not declare or pay dividends on, or redeem, purchase or acquire, our common stock or preferred... -

Page 68

... share: Basic...Diluted ...Cash dividends per common share ...Weighted average common shares outstanding (in thousands)(2): Basic...Diluted ...Balance Sheets Data Mortgage loans held-for-investment, at amortized cost by consolidated trusts (net of allowance for loan losses) ...Total assets ...Debt... -

Page 69

...-family home prices by state, which are weighted using the property values underlying our single-family credit guarantee portfolio to obtain a national index. The depreciation rate for each year presented incorporates property value information on loans purchased by both Freddie Mac and Fannie Mae... -

Page 70

... loans during the last two years has been significantly worse than in any year since the 1930s. Based on data from the Federal Reserve's Flow of Funds Accounts, there was a sustained and significant increase in single-family mortgage debt outstanding from 2001 to 2006. This increase in mortgage debt... -

Page 71

... first-time buyers will be attracted to the housing market in 2011, which should translate into more home sales in 2011 than in 2010 and a slight increase in mortgage debt outstanding. • Lower mortgage origination volume - More home sales in 2011 would generally result in increased purchase-money... -

Page 72

... credit losses ...Non-interest income (loss): Gains (losses) on extinguishment of debt securities of consolidated trusts . Gains (losses) on retirement of other debt ...Gains (losses) on debt recorded at fair value ...Derivative gains (losses) ...Impairment of available-for-sale securities:(2) Total... -

Page 73

... ...Federal funds sold and securities purchased under agreements to Mortgage-related securities: Mortgage-related securities(3) ...Extinguishment of PCs held by Freddie Mac ...Total mortgage-related securities, net ...Non-mortgage-related securities(3) ...Mortgage loans held by consolidated trusts... -

Page 74

...-family trusts, comprised primarily of mortgage loans, restricted cash and cash equivalents and investments in securities purchased under agreements to resell (the average balance of such assets was $1.7 trillion for the year ended December 31, 2010); and (b) the interest expense related to the debt... -

Page 75

... of the replacement of some higher cost short- and long-term debt with new lower cost debt; and an increase in the average balance of our investments in mortgage loans and mortgage-related securities, including an increase in our holdings of fixed-rate assets. These items were partially offset by... -

Page 76

... documentation practices; (g) third-party mortgage insurance coverage and recoveries; and (h) the realized rate of seller/servicer repurchases. See "RISK MANAGEMENT - Credit Risk - Institutional Credit Risk" for additional information on seller/servicer repurchase obligations. Our loan loss reserves... -

Page 77

... are an important aspect of our management of interest-rate risk, they generally increase the volatility of reported net income (loss), because, while fair value changes in derivatives affect net income, fair value changes in several of the types of assets and liabilities being hedged do not... -

Page 78

... "LIQUIDITY AND CAPITAL RESOURCES - Liquidity - Other Debt Securities." During 2010, declining longer-term swap interest rates resulted in a loss on derivatives of $8.1 billion. Specifically, the decrease in longer-term swap interest rates resulted in fair value losses on our pay-fixed swaps of $17... -

Page 79

... obligation ...Gains (losses) on sale of mortgage loans ...Lower-of-cost-or-fair-value adjustments on held-for-sale mortgage loans . Gains (losses) on mortgage loans recorded at fair value ...Recoveries on loans impaired upon purchase ...Low-income housing tax credit partnerships ...Trust management... -

Page 80

... purchased prior to January 1, 2010. See "NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES" for further information about the impact of adoption of these amendments. Low-Income Housing Tax Credit Partnerships We wrote down the carrying value of our LIHTC investments to zero in the fourth quarter... -

Page 81

... acquisition, such as legal fees, insurance, taxes, cleaning and other maintenance charges. (2) Represents the difference between the disposition proceeds, net of selling expenses, and the fair value of the property on the date of the foreclosure transfer. Excludes holding period write-downs while... -

Page 82

...related to the amortization of net deferred losses on pre-2008 closed cash flow hedges. See "NOTE 14: INCOME TAXES" for additional information. Segment Earnings Our operations consist of three reportable segments, which are based on the type of business activities each performs - Investments, Single... -

Page 83

... returns on assets and funding costs, and all administrative expenses to our three reportable segments. As a result of these reclassifications and allocations, Segment Earnings for our reportable segments differs significantly from, and should not be used as a substitute for, net income (loss) as... -

Page 84

... loan workout. (4) Represents the UPB of mortgage-related assets held by third parties for which we provide our guarantee without our securitization of the related assets. (5) Freddie Mac single-family mortgage-related securities held by us are included in both our Investments segment's mortgage... -

Page 85

... (income) loss - noncontrolling interest ...Segment Earnings (loss), net of taxes ...Key metrics - Investments: Portfolio balances: Average balances of interest-earning assets:(3)(4)(5) Mortgage-related securities(6) ...Non-mortgage-related investments(7) ...Unsecuritized single-family loans...Total... -

Page 86

...Segment Earnings net interest income and Segment Earnings net interest yield were primarily due to decreased funding costs due to the replacement of higher cost short- and long-term debt with lower cost debt issuances, and increases in the average balance of interest-earning assets. 83 Freddie Mac -

Page 87

.... (8) Source: Federal Reserve Flow of Funds Accounts of the United States of America dated December 9, 2010. The outstanding amount for 2010 reflects the balance as of September 30, 2010, which is the latest available information. (9) Based on Freddie Mac's Primary Mortgage Market Survey rate for... -

Page 88

... maximum limits. We currently believe the increase in management and guarantee fee rates we implemented in 2009 and 2010, when coupled with the higher credit quality of the mortgages within our new PC issuances in 2009 and 2010, will provide management and guarantee fee income, over the long term... -

Page 89

... guaranteed loans, primarily those insured by FHA or guaranteed by VA. Ginnie Mae increased its share of the securitization market in 2010, in large part due to favorable pricing of loans insured by FHA, the increase in the FHA loan limit and the availability, through FHA, of a mortgage product for... -

Page 90

... certain bonds under the NIBP. (5) See "RISK MANAGEMENT - Credit Risk - Mortgage Credit Risk - Credit Performance - Delinquencies" for information on our reported multifamily delinquency rate. (6) Credit losses are equal to REO operations expenses plus charge-offs, net of recoveries, associated with... -

Page 91

... will make scheduled payments on its mortgage is based on the ability of the property to generate sufficient cash flow to make those payments, and is generally affected by rent levels, vacancy rates and property operating expenses. The multifamily market is affected by the balance between the... -

Page 92

... the mortgage market. We use these assets to help manage recurring cash flows and meet our other cash management needs. We consider federal funds sold to be overnight unsecured trades executed with commercial banks that are members of the Federal Reserve System. Securities purchased under agreements... -

Page 93

... Value Available-for-sale mortgage-related securities: Freddie Mac ...Subprime ...CMBS ...Option ARM ...Alt-A and other ...Fannie Mae ...Obligations of states and political subdivisions ...Manufactured housing ...Ginnie Mae ...Total available-for-sale mortgage-related securities Total investments... -

Page 94

...-hold investor in mortgage-related securities, which consist of securities issued by Fannie Mae, Ginnie Mae, and other financial institutions. We also invest in our own mortgage-related securities. However, upon our adoption of amendments to the accounting standards for transfers of financial assets... -

Page 95

...noted above, effective January 1, 2010, purchases of single-family PCs and certain Other Guarantee Transactions issued by trusts that we consolidated are recorded as an extinguishment of debt securities of consolidated trusts held by third parties on our consolidated balance sheets. 92 Freddie Mac -

Page 96

...Non-Freddie Mac mortgage-related securities purchased as investments in securities: Agency securities: Fannie Mae: Fixed-rate ...Variable-rate ...Total Fannie Mae ...Ginnie Mae fixed-rate ...Total agency securities ...Non-agency mortgage-related securities: Single-family variable-rate ...CMBS: Fixed... -

Page 97

...by the total UPB of all of the tranches of collateral pools from which credit support is drawn for the security that we own. Excludes credit enhancement provided by monoline bond insurance. Table 26 - Non-Agency Mortgage-Related Securities Backed by Subprime, Option ARM, Alt-A and Other Loans(1) 12... -

Page 98

... Credit Risk - Bond Insurers." The concerns about deficiencies in foreclosure documentation practices may also adversely affect the values of, and our losses on, non-agency mortgage-related securities we hold, including by causing further delays in foreclosure timelines. 95 Freddie Mac -

Page 99

...See "NOTE 19: CONCENTRATION OF CREDIT AND OTHER RISKS - Bond Insurers" for additional information. While it is reasonably possible that collateral losses on our available-for-sale mortgage-related securities where we have not recorded an impairment earnings charge could exceed our credit enhancement... -

Page 100

... foreclosure process, the subordinate classes of securities issued by the securitization trusts may continue to receive interest payments, rather than absorbing default losses. This may reduce the amount of funds available for the senior tranches we own. Given the extent of the housing and economic... -

Page 101

... using the lowest rating available for each security. Table 28 - Ratings of Available-For-Sale Non-Agency Mortgage-Related-Securities Backed by Subprime, Option ARM, Alt-A and Other Loans, and CMBS Credit Ratings as of December 31, 2010 UPB Percentage of UPB Gross Amortized Unrealized Cost Losses... -

Page 102

...% of Purchases Mortgage loan purchases and guarantee issuances: Single-family: 30-year or more amortizing fixed-rate ...20-year amortizing fixed-rate ...15-year amortizing fixed-rate ...Adjustable-rate(2) ...Interest-only(3) ...HFA bonds...FHA/VA and USDA Rural Development(4) ...Total single-family... -

Page 103

...another type of residential mortgage loan product with a higher risk of default; however, we do not purchase or hold significant amounts of these loans on our consolidated balance sheets. See "RISK MANAGEMENT - Credit Risk - Mortgage Credit Risk" and "NOTE 19: CONCENTRATION OF CREDIT AND OTHER RISKS... -

Page 104

... to fifteen years. (6) Primarily includes purchased interest rate caps and floors. (7) Commitments include: (a) our commitments to purchase and sell investments in securities; and (b) our commitments to purchase and extinguish or issue debt securities of our consolidated trusts. 101 Freddie Mac -

Page 105

...the foreclosure process, including delays related to concerns about deficiencies in foreclosure documentation practices. See "RISK MANAGEMENT - Credit Risk - Mortgage Credit Risk - Credit Performance - Non-Performing Assets" for additional information about our REO activity. Deferred Tax Assets, Net... -

Page 106

... reserves have been provided for settlement on reasonable terms. For additional information, see "NOTE 14: INCOME TAXES." Other Assets Other assets consist of the guarantee asset related to non-consolidated trusts, other guarantee commitments, accounts and other receivables, debt issuance costs, net... -

Page 107

...Year Weighted Average Effective Rate(4) Balance, Net(3) (dollars in millions) Maximum Balance, Net Outstanding at Any Month End Reference BillsË› securities and discount notes ...Medium-term notes ...Federal funds purchased and securities sold under agreements to repurchase ...Other short-term debt... -

Page 108

... by FHA/VA loans. (8) Represents the UPB of repurchased Freddie Mac mortgage-related securities that are consolidated on our balance sheets and includes certain remittance amounts associated with our security trust administration that are payable to third-party mortgage-related security holders as... -

Page 109

...consolidated trusts: Issuances based on underlying mortgage product type: 30-year or more, amortizing fixed-rate ...20-year amortizing fixed-rate ...15-year amortizing fixed-rate ...Adjustable-rate ...Interest-only ...FHA/VA ...Debt securities of consolidated trusts retained by us at issuance ...Net... -

Page 110

... related to our closed cash flow hedges as the originally forecasted transactions affected earnings. See "NOTE 2: CHANGE IN ACCOUNTING PRINCIPLES" for additional information on the cumulative effect of these changes in accounting principles. RISK MANAGEMENT Our investment and credit guarantee... -

Page 111

... billion, respectively, of UPB of loans associated with our repurchase requests, including amounts associated with one-time settlement agreements. Four of our larger single-family seller/servicers collectively had approximately 32% and 23% of their repurchase obligations outstanding more than four... -

Page 112

...., to resolve currently outstanding and future claims for repurchases arising from the breach of representations and warranties on certain loans purchased by us from Countrywide Home Loans, Inc. and Countrywide Bank FSB. Under the terms of the agreement, we received a $1.28 billion cash payment in... -

Page 113

... are based on our gross coverage without regard to netting of coverage that may exist to the extent an affected mortgage is covered under both types of insurance. (4) Beginning on June 1, 2009, Triad began paying valid claims 60% in cash and 40% in deferred payment obligations. 110 Freddie Mac -

Page 114

... loss limits on other pool insurance policies in the near term, which would further increase our credit losses. Our pool insurance policies generally have coverage periods that range from ten to twelve years. In many cases, we entered into these agreements to cover higher-risk mortgage product types... -

Page 115

... unpaid interest. (4) Represents the amount of gross unrealized losses at the respective reporting date on the securities with monoline insurance. (5) The majority of the Alt-A and other loans covered by monoline bond insurance are securities backed by home equity lines of credit. 112 Freddie Mac -

Page 116

... are investment grade at the time of purchase and primarily short-term in nature, which mitigates institutional credit risk for these instruments. To minimize counterparty risk of our on-balance-sheet assets, we access government programs and initiatives designed to support the economic environment... -

Page 117

...Excludes restricted cash balances as well as cash deposited with the Federal Reserve Bank and other federally-chartered institutions. (2) Represents the lower of S&P and Moody's short-term credit ratings as of each period end; however, in this table, the rating of the legal entity is stated in terms... -

Page 118

... meet our internal standards. We assign internal ratings, credit capital, and exposure limits to each counterparty based on quantitative and qualitative analysis, which we update and monitor on a regular basis. We conduct additional reviews when market conditions dictate or certain events affecting... -

Page 119

... posting threshold, as well as market movements during the time period between when a derivative was marked to fair value and the date we received the related collateral. Collateral is typically transferred within one business day based on the values of the related derivatives. 116 Freddie Mac -

Page 120

... critical risk characteristics, including but not limited to the borrower's credit score and credit history, the borrower's monthly income relative to debt payments, the original LTV ratio, the type of mortgage product and the occupancy type of the loan. See "BUSINESS - Our Business" for information... -

Page 121

... ARM, interest-only and Alt-A loans being originated. Conditions in the mortgage market continued to remain challenging during 2010. All types of single-family mortgage loans have been affected by the compounding pressures on household wealth caused by declines in home values that began in 2006... -

Page 122

... origination based on changes in the market value of homes since origination. Estimated current LTV ratio range is not applicable to purchase activity, includes the credit-enhanced portion of the loan and excludes any secondary financing by third parties. (6) The ending balances of relief refinance... -

Page 123

... refinance or sell the property for an amount at or above the balance of the outstanding mortgage loan. If a borrower has an estimated current LTV ratio greater than 100%, the borrower is "underwater" and is more likely to default than other borrowers. The serious delinquency rate for single-family... -

Page 124

... delinquent loans, based on UPB. Single-Family Mortgage Product Types Product mix affects the credit risk profile of our total mortgage portfolio. In general, 15-year amortizing fixed-rate mortgages exhibit the lowest default rate among the types of mortgage loans we securitize and purchase, due... -

Page 125

... single-family credit guarantee portfolio, excluding Other Guarantee Transactions, at December 31, 2010 that contain adjustable payment terms. The reported balances in the table are aggregated by adjustable-rate loan product type and categorized by year of the next scheduled contractual reset date... -

Page 126

... (for example, an interest-only loan may also have an original LTV ratio greater than 90%). Mortgage loans with higher LTV ratios have a higher risk of default, especially during housing and economic downturns, such as the one the U.S. has experienced over the past few years. 123 Freddie Mac -

Page 127

...property and excludes secondary financing by third parties, if applicable. For refinance mortgages, the original LTV ratios are based on third-party appraisals used in loan origination, whereas new purchase mortgages are based on the property sales price. (3) Represents the percentage of loans based... -

Page 128

... multifamily loans are generally for shorter terms than single-family loans, and most have balloon maturities ranging from five to ten years. Amortizing loans reduce our credit exposure over time because the UPB declines with each mortgage payment. Fixed-rate loans may also create less risk for us... -

Page 129

... income information for these properties and our assessments of market conditions. Our estimates of the current LTV ratios for multifamily loans are based on values we receive from a third-party service provider as well as our internal estimates of property value, for which we may use changes in tax... -

Page 130

... claims may exceed the maximum limit of loss allowed by the policy. In order to file a claim under a pool insurance policy, we generally must have finalized the primary mortgage claim, disposed of the foreclosed property, and quantified the net loss payable to us with respect to the insured loan... -

Page 131

... Some of the key initiatives of this program are: Home Affordable Modification Program. HAMP commits U.S. government, Freddie Mac and Fannie Mae funds to help eligible homeowners avoid foreclosures and keep their homes through mortgage modifications, where possible. Under this program, we offer loan... -

Page 132

... current market levels will have their payment gradually increase after the fifth year to a rate consistent with the market rate at the time of modification. Since we repurchase loans modified under HAMP from our PC pools, we bear the costs of these payment reductions. Although mortgage investors... -

Page 133

... or Fannie Mae an opportunity to refinance into loans with more affordable monthly payments and/or fixed-rate terms and is available until June 2011. Under the Home Affordable Refinance Program, we allow eligible borrowers who have mortgages with high current LTV ratios to refinance their mortgages... -

Page 134

...are the compliance agent for Treasury for certain foreclosure avoidance activities under HAMP by mortgage holders other than Freddie Mac and Fannie Mae. Among other duties, as the program compliance agent, we conduct examinations and review servicer compliance with the published requirements for the... -

Page 135

... Our single-family loss mitigation strategy emphasizes early intervention in seriously delinquent mortgages and provides alternatives to foreclosure. Other single-family loss mitigation activities include providing our singlefamily servicers with default management tools designed to help them manage... -

Page 136

... rate reduction, term extension and principal Total loan modifications(4) ...Repayment plans(5) ...Forbearance agreements(6) ...Total home retention actions: ...Foreclosure alternatives: Short sale(7) ...Deed-in-lieu transactions ...Total foreclosure alternatives ...Total single-family loan workouts... -

Page 137

... of foreclosures, our credit losses could increase. In order to allow our mortgage servicers time to implement our more recent modification programs and provide additional relief to troubled borrowers, we implemented several temporary suspensions of all foreclosure transfers of occupied homes during... -

Page 138

... noted, we report single-family serious delinquency rate information based on the number of loans that are three monthly payments or more past due or in the process of foreclosure, as reported by our seller/servicers. For multifamily loans, we report delinquency rates based on UPB of mortgage loans... -

Page 139

... Current LTV Modified(2) Total UPB Ratio(1) Serious Delinquency Rate 2010 Credit Losses Alt-A Non Alt-A (in billions) Geographical distribution: Arizona, California, Florida, and Nevada All other states ...Year of origination: 2010 ...2009 ...2008 ...2007 ...2006 ...2005 ...All other years... -

Page 140

...Rate Current LTV Ratio(1) All Loans Serious Percentage Delinquency Percentage of Portfolio(2) Rate Modified(3) Table 52 - Single-Family Credit Guarantee Portfolio by Attribute Combinations By Product Type FICO scores Ͻ 620: 20 and 30- year or more amortizing 15- year amortizing fixed rate ...ARMs... -

Page 141

.... See endnote (2) to "Table 51 - Credit Concentrations in the Single-Family Credit Guarantee Portfolio." Includes balloon/resets and option ARM mortgage loans. Includes both fixed rate and adjustable rate loans. Consist of FHA/VA and USDA Rural Development product types. The total of all FICO scores... -

Page 142

... of credit terms under which loans were underwritten during these years; (b) an increase in the origination and our purchase of interest-only and Alt-A mortgage products in 2006 through 2008; and (c) an environment of decreasing home sales and broadly declining home prices in the period shortly... -

Page 143

...as a percentage of the total mortgage portfolio, excluding non-Freddie Mac securities ... (1) Mortgage loan amounts are based on UPB and REO, net is based on carrying values. (2) Represents loans recognized by us on our consolidated balance sheets, including loans purchased from PC trusts due to the... -

Page 144

... length of time for foreclosure of a Freddie Mac loan significantly increased in recent years. The nationwide average for completion of a foreclosure (as measured from the date of the last scheduled payment made by the borrower) on our single-family delinquent loans, excluding those underlying... -

Page 145

... within losses on loans purchased on our consolidated statements of operations. Recoveries of charge-offs primarily result from foreclosure alternatives and REO acquisitions on loans where a share of default risk has been assumed by mortgage insurers, servicers or other third parties through credit... -

Page 146

...-offs primarily result from foreclosure transfers and short sales on loans where a share of default risk has been assumed by mortgage insurers, servicers, or other third parties through credit enhancements. (3) Equal to REO operations expense plus charge-offs, net. Excludes foregone interest on non... -

Page 147

... and foreclosure transfers on loans where a share of default risk has been assumed by mortgage insurers, servicers or other third parties through credit enhancements. Recoveries of charge-offs through credit enhancements are limited in many instances to amounts less than the full amount of the loss... -

Page 148

... in the conduct of that process. For further information about foreclosure documentation deficiencies and our other operational risks, see "RISK FACTORS - Operational Risks." Management, including the company's Chief Executive Officer and Chief Financial Officer, conducted an evaluation of the... -

Page 149

... in our business activities. The Federal Reserve requires that we fully fund our account in the Fedwire system to the extent necessary to cover cash payments on our debt and mortgage-related securities each day, before the Federal Reserve Bank of New York, acting as our fiscal agent, will initiate... -

Page 150

... maturities of one year or less; or (b) as uninvested cash at the Federal Reserve Bank of New York; • maintain a portfolio of liquid, high quality marketable non-mortgage-related securities with a market value of at least $10 billion, exclusive of the 35-day cash requirement discussed above. The... -

Page 151

... the Purchase Agreement. Continued cash payment of senior preferred dividends will have an adverse impact on our future financial condition and net worth and will increasingly drive future draws. In addition, we are required under the Purchase Agreement to pay a quarterly commitment fee to Treasury... -

Page 152

... paying only principal at maturity. Our Reference BillsË› securities program consists of large issues of short-term debt that we auction to dealers on a regular schedule. We issue discount notes with maturities ranging from one day to one year in response to investor demand and our cash needs. Short... -

Page 153

... pay-fixed swaps. From time to time, we may also enter into transactions in which we exchange newly issued debt securities for similar outstanding debt securities held by investors. These transactions are accounted for as debt exchanges. Table 61 provides the par value, based on settlement dates... -

Page 154

...fund our business operations. For additional information on these assets, see "CONSOLIDATED BALANCE SHEETS ANALYSIS - Cash and Cash Equivalents, Federal Funds Sold and Securities Purchased Under Agreements to Resell" and "- Investments in Securities - Non-Mortgage-Related Securities." Mortgage Loans... -

Page 155

... of our investment activities; quarterly commitment fees payable to Treasury; our inability to access the public debt markets on terms sufficient for our needs, absent continued support from Treasury; establishment of additional valuation allowances for our remaining net deferred tax asset; changes... -

Page 156

... the Purchase Agreement with Treasury. For more information on the Purchase Agreement, its effect on our business and capital management activities, and the potential impact of making additional draws, see "Liquidity - Dividend Obligation on the Senior Preferred Stock," "BUSINESS - Executive Summary... -

Page 157

... to improve our fair value estimates, to accommodate market developments or to compensate for changes in data availability and reliability or other operational constraints. We review a range of market quotes from pricing services or dealers and perform analysis of internal valuations on a monthly... -

Page 158

... of our trading and investing function, execute, validate, and review the valuation process. Additionally, the Valuation & Finance Model Committee (Valuation Committee), which includes senior representation from business areas, and our Enterprise Risk Management and Finance divisions, participates... -

Page 159

...the fair value of net assets resulting from net exposures related to the market risks we actively manage. We do not hedge all of the interest-rate risk that exists at the time a mortgage is purchased or that arises over its life. The market risks to which we are exposed as a result of our investment... -

Page 160

... rate exposure related to net buy-ups (up front payments we make that increase the management and guarantee fee that we will receive over the life of the pool) and float (expected gains or losses resulting from our mortgage security program remittance cycles). These value changes are excluded... -

Page 161

... with Fannie Mae, provide liquidity guarantees for certain variable-rate single-family and multifamily housing revenue bonds, under which Freddie Mac generally is obligated to purchase 50% of any tendered bonds that cannot be remarketed within five business days. Our exposure to losses on the... -

Page 162

...We also purchase mortgages from pools underlying our PCs in certain circumstances, including when loans are 120 days or more delinquent; • any future cash payments associated with the liquidation preference of the senior preferred stock, as well as the quarterly commitment fee and the dividends on... -

Page 163

... executive deferred compensation plan are included in the Total and 2011 columns. However, the timing of payments due under these obligations is uncertain. See "NOTE 15: EMPLOYEE BENEFITS" for additional information. (5) As of December 31, 2010, we have recorded tax liabilities for unrecognized tax... -

Page 164

...-for-investment on our consolidated balance sheets, whereas the reserve for guarantee losses relates to single-family and multifamily loans underlying our non-consolidated Freddie Mac mortgage-related securities and other guarantee commitments. We use the same methodology to determine our allowance... -

Page 165

...impact on the loan loss reserves and provision for credit losses. For example, the inability to realize the benefits of our loss mitigation plans, a lower realized rate of seller/servicer repurchases, further declines in home prices, deterioration in the financial condition of our mortgage insurance... -

Page 166

... of time our available-for-sale securities have been in an unrealized loss position. Also see "NOTE 8: INVESTMENTS IN SECURITIES - Table 8.3 - Significant Modeled Attributes for Certain Non-Agency Mortgage-Related Securities" for the modeled default rates and severities that were used to determine... -

Page 167

... related disclosures are provided in our Monthly Volume Summary reports, which are available on our website, www.freddiemac.com/investors/volsum and in current reports on Form 8-K we file with the SEC. For disclosures concerning credit risk sensitivity, see "RISK MANAGEMENT - Credit Risk - Mortgage... -

Page 168

...the limits set by our Board of Directors. Sources of Interest-Rate Risk and Other Market Risks Our investments in mortgage loans and mortgage-related securities expose us to interest-rate risk and other market risks arising primarily from the uncertainty as to when borrowers will pay the outstanding... -

Page 169

...Risk Basis risk is the risk that interest rates in different market sectors will not move in tandem and will adversely affect GAAP total equity (deficit). This risk arises principally because we generally hedge mortgage-related investments with debt securities. As principally a buy-and-hold investor... -

Page 170

... asset and liability management process, we seek to mitigate interest-rate risk by issuing a wide variety of callable and non-callable debt products. The prepayment option held by mortgage borrowers drives the fair value of our mortgage assets such that the combined fair value of our mortgage assets... -

Page 171

... to manage interest rate risk. As such, these analyses are not intended to provide precise forecasts of the effect a change in market interest rates would have on the estimated fair value of our net assets. PMVS Results Table 66 provides duration gap, estimated point-in-time and minimum and maximum... -

Page 172

... Risk.") The derivatives we use to hedge interest-rate and foreign-currency risk are common in the financial markets. We principally use the following types of derivatives: • LIBOR- and Euribor-based interest-rate swaps; • LIBOR- and Treasury-based options (including swaptions); 169 Freddie Mac -

Page 173

... asset securitization activities, callable debt, and short-term debt to rebalance our portfolio. On an ongoing basis, we review the credit fundamentals of all of our OTC derivative counterparties to confirm that they continue to meet our internal standards. We assign internal ratings, credit capital... -

Page 174

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA 171 Freddie Mac -

Page 175

... on the Company's internal control over financial reporting based on our audits (which were integrated audits in 2010 and 2009). We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform... -

Page 176

... of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. /s/ PricewaterhouseCoopers LLP McLean, Virginia February 24, 2011 173 Freddie Mac -

Page 177

...owned operations expense ...Other expenses (Note 23) ...Non-interest expense ...Loss before income tax benefit (expense) ...Income tax benefit (expense) ...Net loss ...Less: Net (income) loss attributable to noncontrolling interest ...Net loss attributable to Freddie Mac ...Preferred stock dividends... -

Page 178

...sale securities (includes $10,740 and $15,947, respectively, net of taxes, of other-than-temporary impairments) ...Cash flow hedge relationships ...Defined benefit plans ...Total AOCI, net of taxes ...Treasury stock, at cost, 76,684,097 shares and 77,494,218 shares, respectively ...Total Freddie Mac... -

Page 179

...change in accounting principle ...Net loss attributable to Freddie Mac ...Senior preferred stock dividends declared ...Preferred stock dividends declared ...Common stock dividends declared ...Dividends equivalent payments on expired stock options ...Transfer to additional paid-in capital ...Retained... -

Page 180

... preferred stock ...Repurchase of REIT preferred stock ...Payment of cash dividends on senior preferred stock, preferred stock, and common stock ...Excess tax benefits associated with stock-based awards ...Payments of low-income housing tax credit partnerships notes payable ...Other, net ...Net cash... -

Page 181

... secondary mortgage market includes providing our credit guarantee for mortgages originated by mortgage lenders in the primary mortgage market and investing in mortgage loans and mortgage-related securities. Our operations consist of three reportable segments, which are based on the type of business... -

Page 182

... majority of our securitization trusts, as well as certain of our investment securities issued by third parties, because they had been designed to meet the definition of a QSPE. Upon the effective date of the amendments to the accounting standards for transfers of financial assets and consolidation... -

Page 183

... average coupon interest rate for the underlying mortgage loans. We do not guarantee the timely payment of principal for ARM PCs; however, we do guarantee the full and final payment of principal. Various types of fixed income investors purchase our PCs, including pension funds, insurance companies... -

Page 184

...guarantee asset, to the extent a management and guarantee fee is charged, and we recognize a guarantee obligation at fair value. We do not receive transaction fees, apart from our management and guarantee fee, for these transactions. Purchases and Sales of Freddie Mac Mortgage-Related Securities PCs... -

Page 185

... portion of the outstanding debt securities of the related PC trust on our consolidated balance sheets. When we sell single-class REMICs and Other Structured Securities, we recognize a liability to the third-party beneficial interest holders of the related consolidated PC trust as debt securities of... -

Page 186

... homogeneous pools of single-family mortgage loans are determined based on common underlying characteristics, including current LTV ratios and trends in home prices, loan product type and geographic region. In determining the loan loss reserves for single-family loans at the balance sheet date, we... -

Page 187

...loans by sellers under their obligations to repurchase loans that are inconsistent with certain representations and warranties made at the time of sale; • counterparty credit of mortgage insurers and seller/servicers; • pre-foreclosure real estate taxes and insurance; • estimated selling costs... -

Page 188

... rate, subject to our non-accrual policy as discussed in the Non-Performing Loans section above, with all other changes in the present value of expected future cash flows being recognized as a component of the provision for credit losses in our consolidated statement of operations. 185 Freddie Mac -

Page 189

... interest income on the securities and interest expense on the debt we issued. See "Securitization Activities through Issuances of Freddie Mac Mortgage-Related Securities - Purchases and Sales of Freddie Mac Mortgage-Related Securities" for additional information on accounting for purchases of PCs... -

Page 190

... at any time. Other debt represents short-term and long-term debt securities that we issue to third parties to fund our general business activities. Both debt of our consolidated trusts and other debt, except for certain debt for which we elected the fair value option, are reported at amortized cost... -

Page 191

... third-party insurance or other credit enhancements are recorded as receivables when REO is acquired. The receivable is adjusted when the actual claim is filed and is reported as a component of other assets on our consolidated balance sheets. Material development and improvement costs relating to... -

Page 192

... settlement. See "NOTE 14: INCOME TAXES" for additional information. Income tax benefit (expense) includes: (a) deferred tax benefit (expense), which represents the net change in the deferred tax asset or liability balance during the year plus any change in a valuation allowance; and (b) current tax... -

Page 193

..., representing the difference between the UPB of the loans underlying the PC trusts and the fair value of the PCs, including premiums, discounts, and other basis adjustments; (b) the elimination of the guarantee asset and guarantee obligation established for guarantees issued to 190 Freddie Mac -

Page 194

securitization trusts we consolidated; and (c) the application of our non-accrual policy to single-family seriously delinquent mortgage loans consolidated as of January 1, 2010. 191 Freddie Mac -

Page 195

...Federal funds sold and securities purchased under agreements to resell(3) Investments in securities:(4) Available-for-sale, at fair value ...Trading, at fair value ...Total investments in securities ...Mortgage loans: Held-for-investment, at amortized cost: By consolidated trusts, net of allowance... -

Page 196

... entities and the corresponding gains (losses) on guarantee asset and income on guarantee obligation, which are recorded in other income; • Losses on loans purchased - we no longer recognize the acquisition of loans from PC trusts that we have consolidated as a purchase with an associated loss... -

Page 197

... carrying value, adjusted for any related purchase commitments accounted for as derivatives. As discussed in "NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES," REMICs and Other Structured Securities that are single-class securities pass through all of the cash flows of the underlying PCs directly... -

Page 198

... regarding Freddie Mac and Fannie Mae. These actions included the execution of the Purchase Agreement, pursuant to which we issued to Treasury both senior preferred stock and a warrant to purchase common stock. Business Objectives We continue to operate under the conservatorship that commenced... -

Page 199

...Conservator have placed on Freddie Mac in addressing housing and mortgage market conditions and our public mission, we may be required to take additional actions that could have a negative impact on our business, operating results, or financial condition. The Acting Director of FHFA stated that FHFA... -

Page 200

...help bring private capital back to the mortgage market, including increasing guarantee fees, phasing in a 10% down payment requirement, reducing conforming loan limits, and winding down Freddie Mac and Fannie Mae's investment portfolios, consistent with the senior preferred stock purchase agreements... -

Page 201

... in positive net worth, draws under the Purchase Agreement effectively fund the cash payment of senior preferred dividends to Treasury. It is unlikely that, over the long-term, we will generate net income or comprehensive income in excess of our annual dividends payable to Treasury, although we... -

Page 202

... executive officer (as such terms are defined by SEC rules) without the consent of the Director of FHFA, in consultation with the Secretary of the Treasury. We are required under the Purchase Agreement to provide annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form... -

Page 203

..., the holders of these debt securities or Freddie Mac mortgage guarantee obligations may file a claim in the United States Court of Federal Claims for relief requiring Treasury to fund to us the lesser of: (a) the amount necessary to cure the payment defaults on our debt and Freddie Mac mortgage... -

Page 204

... housing bond credit enhancement products, Freddie Mac is providing a guarantee of new housing bonds issued by HFAs, which Treasury purchased from the HFAs. Treasury will not be responsible for a share of any losses incurred by us in this initiative. Related Parties as a Result of Conservatorship... -

Page 205

..., we have the ability to purchase defaulted mortgage loans out of the PC trust to help manage credit losses. See "NOTE 5: MORTGAGE LOANS AND LOAN LOSS RESERVES" for further information regarding our purchase of mortgage loans out of PC trusts. These powers allow us to direct the activities of... -

Page 206

... and cash equivalents ...Federal funds sold and securities purchased under agreements to resell Mortgage loans held-for-investment by consolidated trusts ...Accrued interest receivable ...Real estate owned, net ...Other assets ...Total assets of consolidated VIEs ...Accrued interest payable ...Debt... -

Page 207

...potential loss from the credit risk and interest-rate risk of the underlying pool. The originators of the financial assets or the underwriters of the deal create the trusts and typically own the residual interest in the trust assets. See "NOTE 8: INVESTMENTS IN SECURITIES" for additional information... -

Page 208

... risk and interest-rate risk of the underlying pool. The originators of the financial assets or the underwriters of the deal create the trusts and typically own the residual interest in the trust assets. See "NOTE 8: INVESTMENTS IN SECURITIES" for additional information regarding our non-Freddie Mac... -

Page 209

... VIEs related to mortgage-related guarantees and short-term default and other guarantee commitments discussed above. NOTE 5: MORTGAGE LOANS AND LOAN LOSS RESERVES We own both single-family mortgage loans, which are secured by one to four family residential properties, and multifamily mortgage loans... -

Page 210

... of cost or fair value adjustments on loans held-for-sale(2) ...Allowance for loan losses on mortgage loans held-for-investment . . Total mortgage loans, net ... Mortgage loans, net: Held-for-investment ...Held-for-sale ...Total mortgage loans, net ... (1) Based on principal balances and excluding... -

Page 211

... area since that time. The value of a property at origination is based on the sales price for purchase mortgages and third-party appraisal for refinance mortgages. Estimates of the current LTV ratio include the credit-enhanced portion of the loan and exclude any secondary financing by third... -

Page 212

...on loans where a share of default risk has been assumed by mortgage insurers, servicers or other third parties through credit enhancements. (4) In February 2010, we announced that we would purchase substantially all single-family mortgage loans that are 120 days or more delinquent from our PC trusts... -

Page 213

.... Pool insurance contracts generally provide insurance on a group, or pool, of mortgage loans up to a stated aggregate loss limit. As shown in the table above, the UPB of single-family loans covered by pool insurance declined during 2010, primarily due to loan payoffs and other liquidation events... -

Page 214

... all singlefamily classes, see "NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES." Total loan loss reserves consists of a specific valuation allowance related to individually impaired mortgage loans, and a general reserve for other probable incurred losses. Our recorded investment in individually... -

Page 215

...that we would purchase substantially all single-family mortgage loans that are 120 days or more delinquent from our PC trusts. This change in practice was made based on a determination that the cost of guarantee, or debt payments to the security holders, will exceed the cost of holding nonperforming... -

Page 216

... is considered for a loan modification, our seller/servicers obtain information on income, assets, and other borrower obligations to determine new loan terms. Under HAMP, the goal of a single-family loan modification is to reduce the borrowers' monthly mortgage payments to a specified percentage... -

Page 217

...market rate (determined at the time of modification) and remains fixed at that new rate for the remaining term. NOTE 7: REAL ESTATE OWNED We obtain REO properties when we are the highest bidder at foreclosure sales of properties that collateralize nonperforming single-family and multifamily mortgage... -

Page 218

... Unrealized Unrealized Gains Losses(1) (in millions) Fair Value Mortgage-related securities: Freddie Mac ...Subprime ...CMBS ...Option ARM ...Alt-A and other ...Fannie Mae ...Obligations of states and political subdivisions Manufactured housing ...Ginnie Mae ...Total mortgage-related securities... -

Page 219

...Mortgage-related securities: Freddie Mac ...Subprime ...CMBS ...Option ARM ...Alt-A and other ...Fannie Mae ...Obligations of states and political subdivisions . Manufactured housing . . Ginnie Mae ...Total mortgage-related securities ...Total available-for-sale securities in a gross unrealized loss... -

Page 220

... investments in securities or extinguishment of debt securities of consolidated trusts depending on the nature of the mortgage-related security that we purchase. See "NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Securitization Activities through Issuances of Freddie Mac Mortgage-Related... -

Page 221

...the availability of capital, generation of new business, pending regulatory action, credit ratings, security prices, and credit default swap levels traded on the insurers. We consider loan level information including estimated current LTV ratios, FICO scores, and other loan level characteristics. We... -

Page 222

... required to sell such securities before a recovery of the unrealized losses. We believe that any credit risk related to these securities is minimal because of the issuer guarantees provided on these securities. Monoline Bond Insurance We rely on monoline bond insurance, including secondary coverage... -

Page 223

...See "NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Investments in Securities" for information regarding our policy on accretion of impairments. Table 8.5 presents a roll-forward of the credit-related other-than-temporary impairment component of the amortized cost related to available-for-sale... -

Page 224

... lot yield consists of the sum of: (a) the year-end interest coupon rate multiplied by the year-end UPB; and (b) the annualized amortization income or expense calculated for December 2010 (excluding the accretion of non-credit-related other-than-temporary impairments and any adjustments recorded for... -

Page 225

...: Freddie Mac ...Fannie Mae ...Ginnie Mae ...Other ...Total mortgage-related securities ...Non-mortgage-related securities: Asset-backed securities ...Treasury bills ...Treasury notes ...FDIC-guaranteed corporate medium-term notes . Total non-mortgage-related securities ...Total fair value of... -

Page 226

... as either debt securities of consolidated trusts held by third parties or other debt that we issue to fund our operations. Commencing with our adoption of two new accounting standards on January 1, 2010, the mortgage loans that are held by the consolidated securitization trusts are 223 Freddie Mac -

Page 227

... debt securities of consolidated trusts held by third parties on our consolidated balance sheets. See "NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Securitization Activities through Issuances of Freddie Mac Mortgage-Related Securities" for additional information. Under the Purchase Agreement... -

Page 228

... transactions. Federal funds purchased are unsecuritized borrowings from commercial banks that are members of the Federal Reserve System. At both December 31, 2010 and 2009, we had no balances in federal funds purchased and securities sold under agreements to repurchase. Other Long-Term Debt Table... -

Page 229